Equities

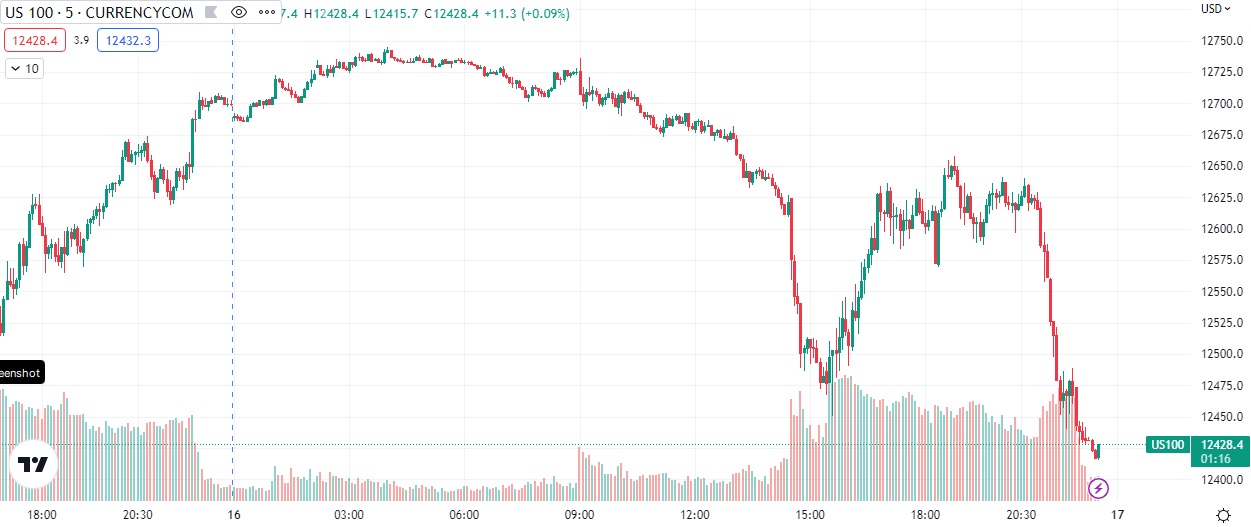

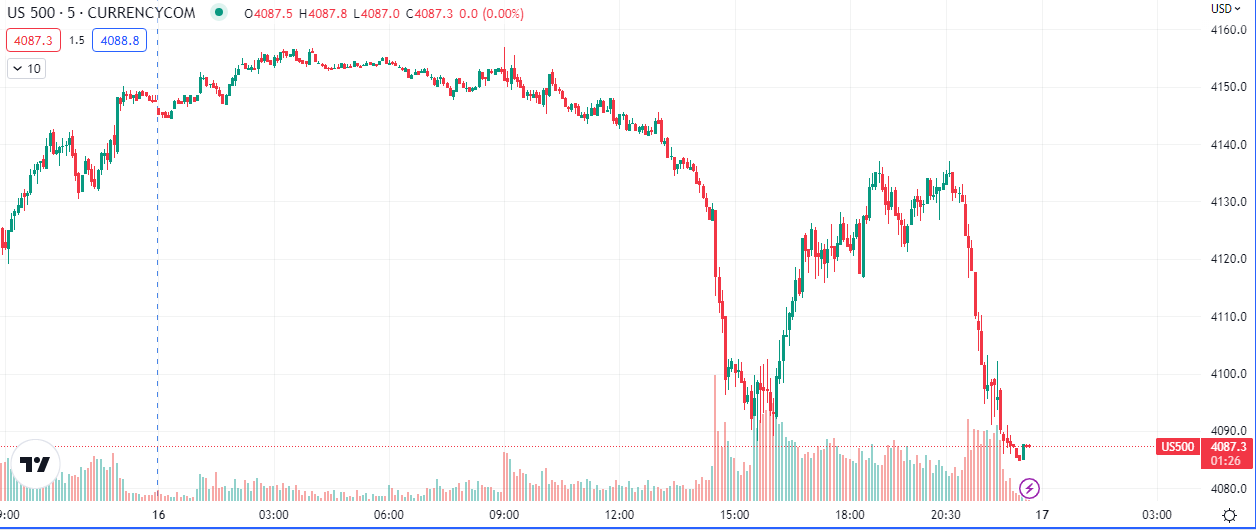

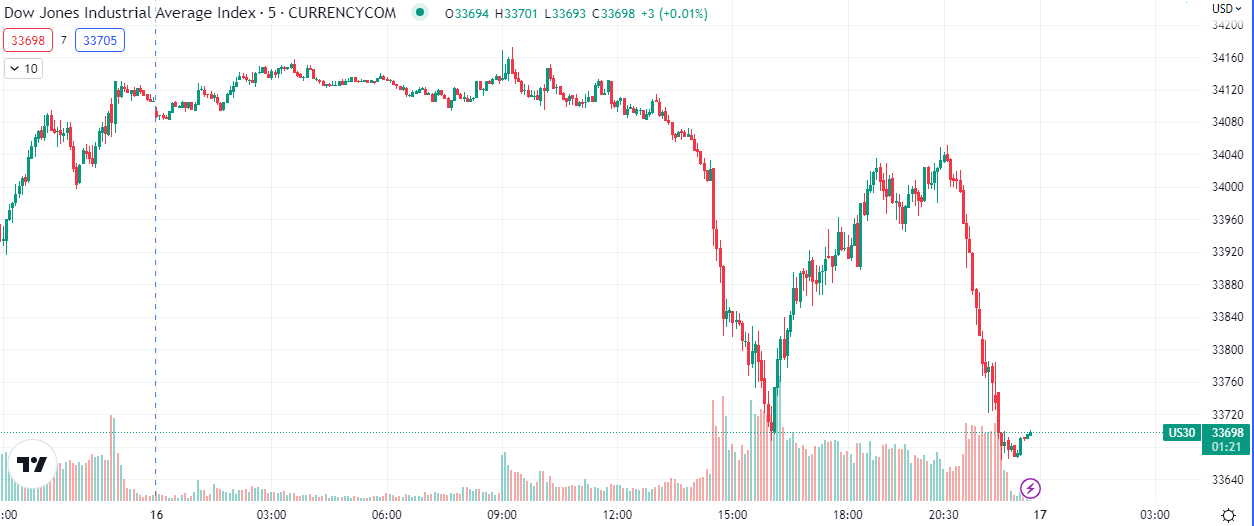

It was a volatile day for US equities as the day saw the major indices routed on positive US data. The S&P500 (SPX) closed -1.49% lower, the Nasdaq (NDAQ) closed -2.21% and the Dow Jones (DJI) closed -1.27%.

As stipulated in our market review on Tuesday, the slew of positive US data, including the CPI, was putting a spring in the step of the dollar bulls. Other key factors such as market structure and institutional rotations were also inline with the narrative.

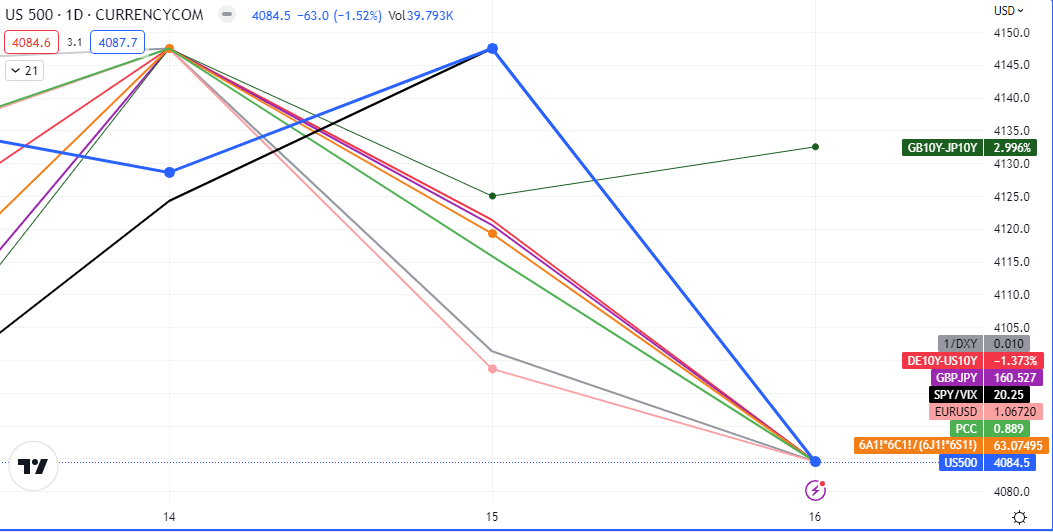

The good news is that the bullish trend is still in place and the Daily premium to value, relative to risk assets, is now at fair value. The bad news, for the bulls at least, is that the weekly still has another potential 2% drop in store before it gets to fair value.

The US PPI and Core PPI came out higher than the forecasts by 0.3% and 0.2% respectively. The Non-Farm Payrolls and CPI also came out positive earlier in the month, painting a dire picture for dollar bears.

Currencies

The high beta currencies, AUD, CAD and GBP all closed lower today and so did the Euro. The Japanese Yen ended the day as one of the strongest currencies of the day and this added to the clues hinting at a Risk OFF sentiment in the market, albeit a temporary one.

With price possible in an oversold region, short sellers may come in again after a rally to seek liquidity for a lower drop in line with the weekly bearish structure. Next week’s FOMC meeting and the US GDP numbers will shed more light on how the US economy is faring and what the FED might do next.

Oil

WTI extended its losses after a massive build in Inventory on Wednesday. Crude oil inventories came out at 16.3M versus a forecast of 1.5M, Distillate Inventories came out at -1.3M versus the forecast of 0.8M and Gasoline Inventories came out at 2.3M versus 1.4M.

Analysts expect a rise in demand off the back of China’s easing of Covid restrictions, but other geopolitical issues like Iran and the war in Ukraine may still act as bogymen in the oil market. The next OPEC meeting is scheduled for 3rd of April, 2023 and it will be interesting to see whether supply will be added to or cut from the market.

A notable spike in the front month contract of April to the tune of +14,054 was recorded on the CME group records. This contango showed up in the price as BRENT oil closed -0.65% on the day.

Tradable Spreads

Going into Friday the are possible opportunities in the following instruments;

USDJPY

This currency pair closed the day slightly lower at -0.15% despite a highly resilient US dollar. The Yen was also strong but we can expect USDJPY to close above yesterday’s high.

WTI

The US oil benchmark managed to close the day higher at +0.19%. This can be read as a premium to value since the rest of the assets classes in the energy market closed lower on the day.

Premier League

Premier League