Equities and Currencies

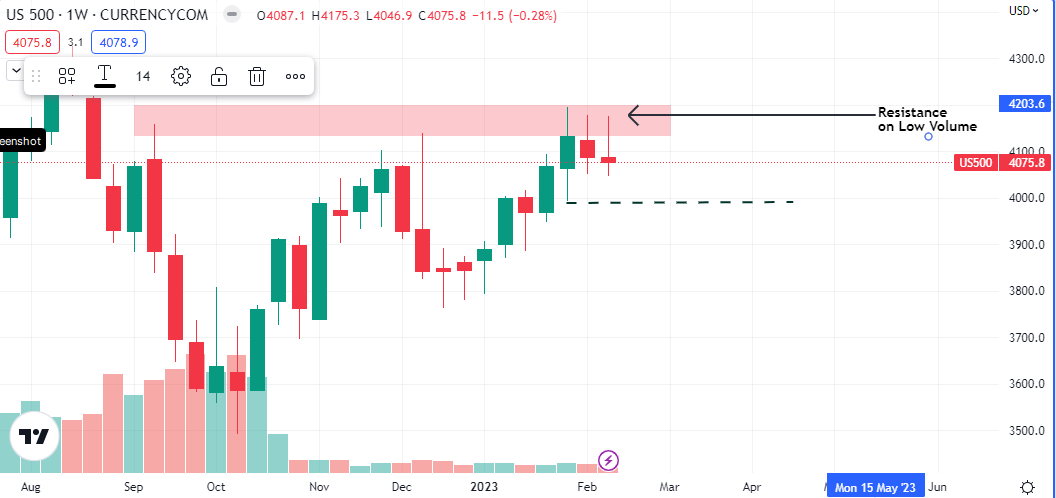

The US dollar has had a lot of positive data this month, so far. The CPI and Non-Farm Payrolls were both positive, adding fuel to the hawkish Federal Reserve narrative and driving the price of the main US stock index down by -0.28% on the back of a failed auction at the retest of October 2022’s high.

The current momentum is suggesting a likely 0.5% drop further to test the lows of 2 weeks ago (3992.8). The bearish sentiment will have to be reassessed there.

The rise in volatility and the strengthening of the dollar has been able to slow down the multi-week rally temporarily. Our interest in buys may have to resume at lower prices.

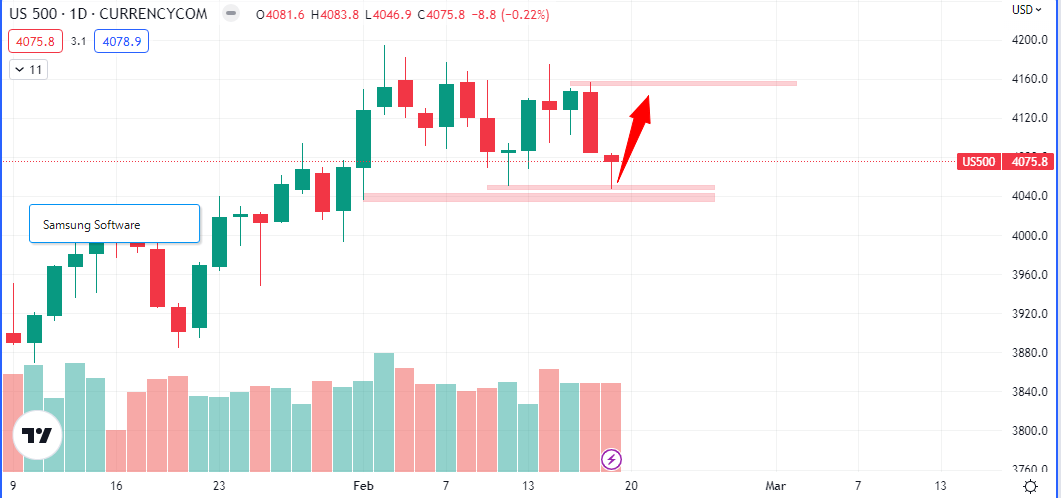

The daily chart bares the hallmarks of a temporary rally, but Monday’s close will determine if that happen and also the directional bias for the week.

Upcoming US dollar news

Flash Services PMI: Previous 46.8 Forecast 47.3

FOMC Meeting Minutes

Prelim GDP: Previous 2.9% Forecast 2.9%

Core PCE Price Index m/m: Previous 0.3% Forecast 0.2%

New Home Sales: Previous 616K Forecast 620K

Oil

This week, the Calendar spread, the Crack spread, the German spread, WTI and Brent all closed lower. The possibility for next week to be bearish persists

The inventory numbers coming up next week Wednesday will also tell us more about the state of supply and demand.

Spreads to watch

EURUSD

The EURUSD closed slightly higher, +0.17%, on the week, while the energy and equity markets closed lower almost across board. If the spread were to close there would be a good short selling opportunity on the pair.