The market held it’s breath for the CPI announcement earlier today and the release was not too far off the expectations of the consensus.

CPI m/m came out as anticipated at 0.5%, the Core CPI also held no surprise at 0.4% although that meant it had risen for 32 consecutive months. It was the CPI y/y that held a slight surprise coming out at 6.2% against a forecast of 6.2%, so it dropped, just not by as much as expected. The release led to a whipsaw in price action across most asset classes with the US dollar spiking up by as much as 0.37% on the day.

After a rise of 0.1 MoM last month (up from the initial -0.1% print), consensus forecast was for an acceleration to +0.5% MoM in January and that is what it printed, triggering a hotter than expected +6.4% YoY CPI print (+6.2% exp). Analysts singled out the rising cost of shelter as the single most important catalyst for this acceleration.

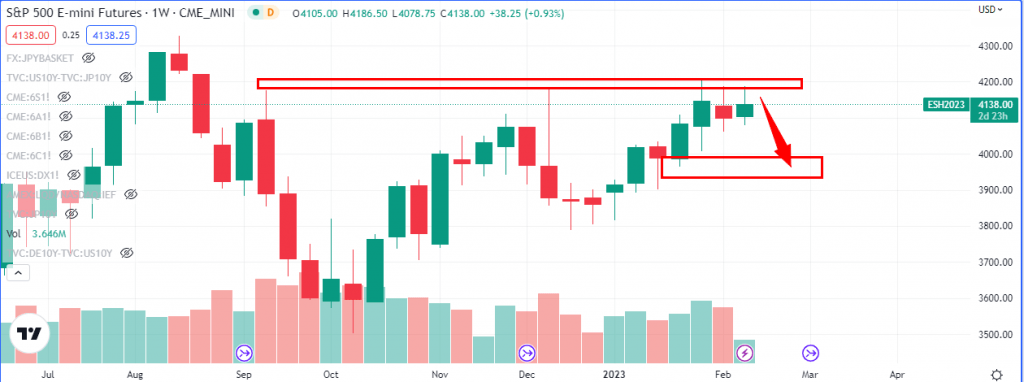

The equity markets and the finance stocks in particular closed lower relative to risk-on assets like the high beta currencies, hence we will look to see if the spread narrows in tomorrow’s trading session. However should the US dollar strength continue, the narrative would be inline with the current momentum off the weekly liquidity retest at 4175.00 that occurred last week on the S&P500. This bearish continuation could drop price to 4007.50 as indicated in the chart below.

Oil whipsawed between $77.5/barrel and $79.6/barrel on the WTI benchmark and followed BRENT’s example from yesterday by closing lower on the day despite strong underlying demand. We will be watching the Inventory numbers for crude oil and natural gas tomorrow for supply-demand clues.

Premier League

Premier League