As the markets opened on Monday 13th of February, 2023, the focus of investors was squarely on the incoming CPI numbers on Tuesday. With the forecast of a rise in the CPI numbers, dollar bulls may be expecting a Valentine’s day gift from the FED in form of likely hikes. The actual announcement, whether it surprises the market, or not will determine a lot about the direction of the dollar, which is poised to go higher when you consider its current technical structure.

CPI m/m: Previous -01%, Forecast 0.5%

CPI y/y: Previous 6.5%, Forecast 6.2%

Core CPI m/m: Previous 0.3%, Forecast 0.4%

The only projected decrease is in the year on year numbers while the month on month number are expected to increase.

The dollar index dropped by 0.27% as the close of the US session on Monday. However it is worth noting that the real yields are climbing, as shown in the chart below.

With the dollar poised for a possible 2% increase, we may see a drop in the equities market and a rally in the US treasury bond markets.

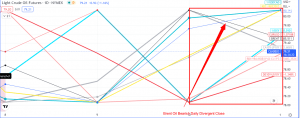

Oil

WTI (CL1!) closed at $81.14 per barrel at the end of the trading session. The correlational event of note in the oil market was the divergent close on BRENT (BR1!) relative to WTI, the refiner’s margin, the crack spread and the US dollar. The non US benchmark is currently trading at $85.80 per barrel and it is likely to close above $87 today as it catches up with the pricing of the rest of the energy basket.

After the CPI announcement, the direction of the dollar will have an effect on the price of oil. A positive dollar should bring the price of oil down, while a negative dollar should add fuel to the already existing oil price rally.

As traders and investors, at their various stations across the world, assess and make decisions this week, the key data points they will be basing their decisions on will be the flow of ‘credit’ as determined by the FED. This will then determine the domino effect across the other asset classes.

Premier League

Premier League