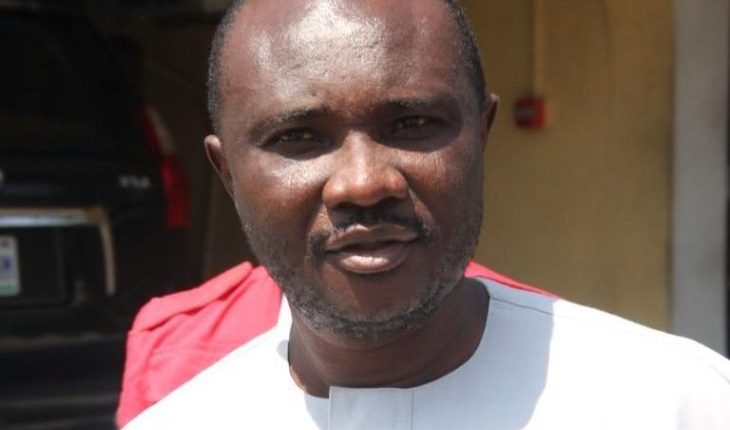

The Economic and Financial Crimes Commission (EFCC), on Wednesday in a Federal High Court opened its case in the trial of a former Director, Niger Delta Development Commission (NDDC), Tuoyo Omatsuli, over alleged N3.6 billion fraud.

The anti-graft agency on Nov. 8, 2018, arraigned Omatsuli alongside Don Parker Properties Ltd., Francis Momoh, and Building Associates Ltd. before Justice Saliu Saidu on a 45-count charge bordering on the alleged offence.

They each pleaded not guilty to the charge and were granted bail.

On Wednesday, EFCC Counsel, Mr Ekene Iheanacho, called the first witness for the prosecution, Mr Eyo Bassey, a software developer and contractor.

Being led in evidence by Basset, the witness said that he executed contracts for the commission as well as for the Akwa Ibom, Imo and Abia state governments.

He also narrated how huge sums of money was transferred to the account of two of his companies by Omatsuli in 2014.

He said: “In 2014, while a contractor with the commission, I came in contact with Mr. Tuoyo Omatsuli.

“In the course of our interaction, I told him that I run an online platform and I do a lot of imports.

‘’I also told him that because of my engagement in import, I was able to source for foreign currencies.

“He later called me on phone and told me that some money will be transferred into my account.

‘’I got an initial sum of N80 million transferred into the Heritage Bank account of one of my companies, Asiladrrin Global Consulting Ltd, and I converted the money into dollars as directed by Mr Tuoyo. ”

The witness also said that he had an inflow of N340 million in two tranches of N160 million and N180 million, into the company’s account within the same period.

He said that he also converted the money into dollars and handed it over to Tuoyo, the NDDC’s Executive Director of Finance and Administration as well as the NDDC’s MD.

The witness further said that sometime in January 2015, he also got a call from the first defendant (Tuoyo) telling him that he will be getting a payment from a company known as Building Associate.

He said that he later got an inflow of N349 million into the Heritage Bank account of his company, College-Pro Synergy Ltd.

“I was furnished with an account of a firm, Greenhouse Investment, owned by the Special Assistant on Finance to the then NDDC’s MD to which I transferred N100 million.

‘’And the balance was converted to dollars as directed by Mr Tuoyo,’’ he said.

When asked by the EFCC counsel whether he executed any contract for Building Associate Ltd. to warrant the transfer of the fund to his company’s account, he said: “I did not execute any contract for Building Associate.”

Under cross-examination by defence counsel Prof. Amuda Kehinde (SAN), the witness said he did not transfer any money to the first defendant’s account.

He maintained that his oral testimony was part of the statement he wrote on Aug. 14, 2017 for the EFCC.

Continuation of trial will resume on April 14.

In the charge, Omatsuli was said to have procured the third and fourth accused (Momoh and Building Associates), to utilise total sum of N3.6 billion paid by Starline Consultancy Services Ltd. into an account operated by fourth defendant

The prosecution said that they ought to have known that the said sums, formed part of the proceeds of their unlawful activities which includes corruption and gratification.

EFCC alleged that the defendants committed the offence between August 2014 and September 2015.

The antigraft agency said the offence contravened the provisions of t 15(1), 15(2), 15(3) and 18 of the Money Laundering Prohibition Act 2011.

(NAN)