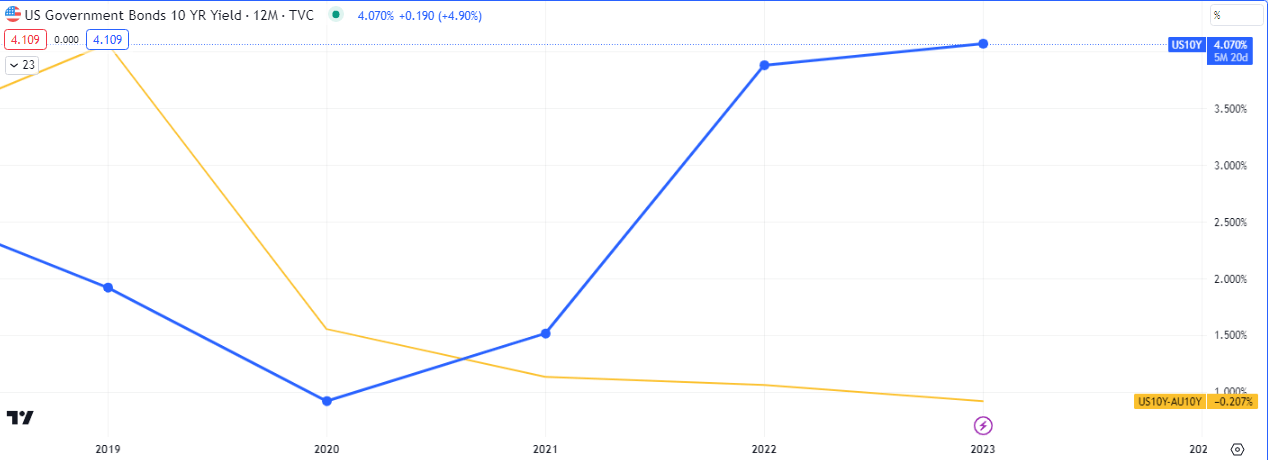

At the end of 2022 the US10Y treasury yield closed up, having accumulated a massive 156.27%. This rise in yield was good news for USD bulls but was not good for investors who typically seek a lower yield so they can make more profit on interest.

There was however a laggard in the Australian AU10Y treasury which managed to close positively against the dollar, dragging the greenback down by over -10%. This set up a spread which in all likelihood will close. The current narrative is for the AU10Y lose some ground against the US10Y, conversely weakening the Aussie and probably strengthening its equity market.

The direction for the AU10Y looks likely to be bearish with this spread close. The annual inflation rate in Australia dropped to 7.0% in Q1 of 2023 from an over-30-year high of 7.8% in the previous period, compared with market forecasts of 6.9%. It was the lowest print since Q2 of 2022, further declines would but some supply pressure on the Aussie.

DE10Y (German bonds) and GB10Y (UK bonds) are also in the same divergent position as AU, so we can expect a similar narrative to play out.