The highly anticipated FOMC release is scheduled for tomorrow, and it is an important piece of news for the US dollar and Inflation. The CPI m/m has a previous number of 0.4% and forecasts expect it to drop to 0.2%. CPI y/y has a previous number of 4.9% and a forecast of 4.1% while Core CPI m/m is expected to remain unchanged at 0.4%

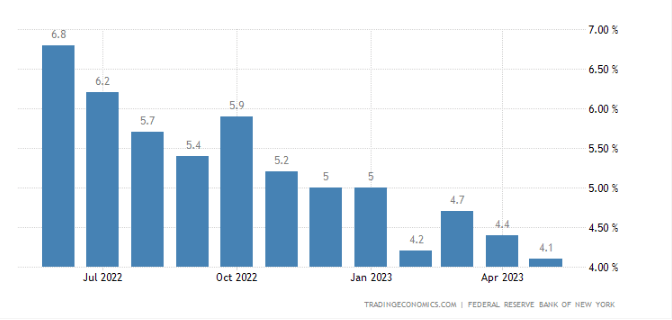

US consumer inflation expectations for the year ahead fell to 4.1% in May 2023, the lowest since March 2021. The median inflation for the next 12 months is expected to moderate further for college education (down by 0.7 pp to 7.1%), food (down by 0.4 pp to 5.4%), medical care (down by 0.1 pp to 9.2%), and rent (down by 0.1 pp to 9.1%) and to remain unchanged for gas (at 5.1%). Meanwhile, inflation expectations for the three- and five-year horizons increased by 0.1 percentage points to 3% and 2.7%, respectively.

In the US, inflation expectations refer to median one year ahead expected inflation rate and are part of the Survey of Consumer Expectations. The expectations are based on the nationally representative, internet-based survey of a rotating panel of approximately 1,300 heads of households.

The money markets are expecting the Fed to pause its rate hiking program, due to the improvements in inflation expectations, however there may be room for a surprise in tomorrow’s release.

Premier League

Premier League