“There are so many people in Africa that are outside the banking system”, said Segun Agbaje, Managing Director and CEO of Guaranty Trust Bank (GTBank), one of the continent’s leading financial institutions. “For you to be part of organised society, financial inclusion is a must.”

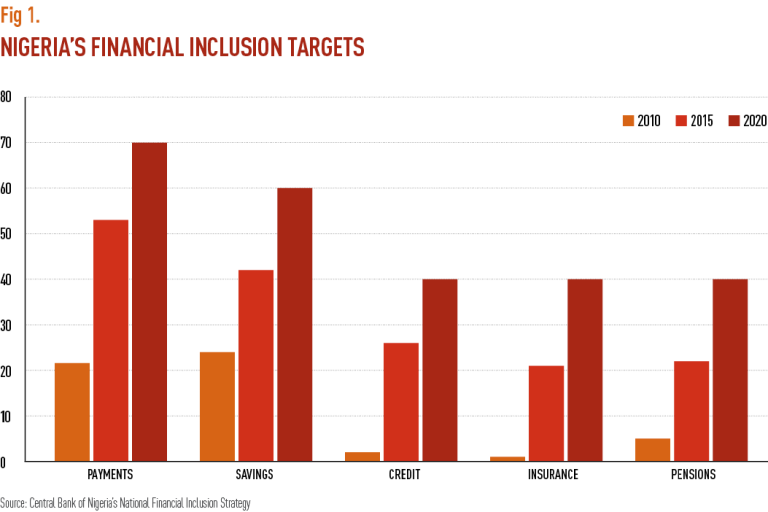

Slowly but surely, financial inclusion in Africa is improving. In fact, the Central Bank of Nigeria predicts that, by 2020, the number of adult Nigerians with access to payment services will increase to around 70 percent (see Fig 1). “It’s not as superfast as we would like it to be, but there are marked improvements, and this is steadily increasing”, said Agbaje, speaking to World Finance. “Just 10 years ago, data on financial inclusion was hard to come by. Now we know just how much better we must do in order to expand access to financial services.”

Access to savings, credit, insurance and pensions is also growing rapidly. “Encouraging as these projections are, we know that there’s a lot more to be done. This is why, at GTBank, we are keen to leverage digital technology to expand the reach of our products and services. Mobile has become very, very big and we have begun to see people doing a lot using their mobile phones.”

Agbaje points to the example of Kenya’s M-Pesa, a mobile-based money transfer and finance platform that is now used by more than two thirds of the country’s adult population. The mobile app serves as a channel for approximately 25 percent of Kenya’s GNP. “When I look at our mobile technology compared to a lot of developed economies, I think we’re a lot further ahead. You know, I actually think that the African banking sector is very much ahead in terms of mobile banking. And I think African banks are probably embracing disruptive technologies a lot quicker, because we don’t have as many legacies.”

Making banking more mobile

This readiness to embrace new technologies has helped a large proportion of the African population skip whole stages of traditional digital development altogether. Indeed, for many, a smartphone is their first computer. Agbaje said: “From experience, we know that the major reasons for financial exclusion include the lack of physical access to financial institutions, inadequate understanding of financial institutions and their products, general distrust in the system, and the affordability of products as a result of minimum opening balance requirements.”

Despite these hurdles, technology is helping forward-thinking institutions tackle such challenges head on, prompting financial inclusion to leap forward on the African continent. Agbaje explained: “The world is changing around us and the future of banking is digital. To protect our traditional business and maintain our social relevance, we are incorporating another model, which involves mobile phones, use of data, partnerships and collaborations. Simply put, we are creating a platform to support our traditional business model by leveraging digital solutions.”

GTBank’s Bank 737 provides banking services to millions of Nigerian mobile phone owners, and does not require internet access to perform basic banking services. Anyone with a phone registered in Nigeria can open an account, transfer money, buy airtime or check their balance by dialling *737#. The convenience of Bank 737 lies in the fact that all of its services can be accessed through a customer’s mobile phone, at the dial of *737#. And because stable internet access is still not ubiquitous in Africa, Bank 737, being USSD-powered, side steps the need for an internet connection.

“Through this service, which makes banking simpler, cheaper and faster, we continue to pull into the banking stream many of those who have long been excluded from the country’s financial framework”, said Agbaje. “Since its introduction, we have recorded an uptake of over three million customers and over NGN 1trn [$3.1bn] in transactions via the platform.

The reception of Bank 737 has been phenomenal, with it gaining recognition as Product of the Year in Africa from The Asian Banker and Best Digital Bank in Africa from Euromoney. The bank was also the recipient of six awards at the 2017 Electronic Payment Incentive Scheme Awards, which was organised by the Central Bank of Nigeria in conjunction with the Nigeria Interbank Settlement System to recognise financial institutions, merchants and other stakeholders at the forefront of driving electronic payments in Nigeria.”

Digitally minded

“Core to our digital strategy is both our understanding that the future of banking is digital, and our determination to lead that future”, Agbaje said. “We know, because digital technologies have dissolved the boundaries between industry sectors, that our competition is no longer just banks. It now includes fintechs, telcos and tech companies that can provide speed and flexibility to customers as we can. This creates tough challenges for the banking sector, but it also creates ample opportunities to extend our footprint.”

example, the bank’s SME MarketHub is an e-commerce platform that allows business owners to create online stores. Agbaje told World Finance: “Our strategy is to take advantage of the new opportunities born from the digital revolution by moving beyond our traditional role as enablers of financial transactions and providers of financial products, to playing a deeper role in the digital and commercial lives of our customers. In pursuit of this strategy we have created our own in-house fintech division, while also actively seeking partnerships and collaborations with other fintechs.

“Our immediate focus is three-pronged; to digitalise our key processes, build a robust data-gathering infrastructure, and create a well designed, segmented and integrated customer experience, rather than a one-size-fits-all distribution. In the long run, our goal is to build a digital bank that consistently delivers faster, cheaper and better solutions for the constantly evolving needs of our customers.”

The lack of digital and electrical infrastructure, as well as lower levels of wealth than those found in more developed markets, means that there are some barriers to the full adoption of digital banking that are particular to Africa. “Another obvious challenge is the little focus given to innovation in the banking industry.

For African banks, like most banks across the world, tend to innovate in bite sizes, and generally around products, rather than service delivery. It was almost as though banks believed that ownership of the customer was their right, as long as they had the branch network to support customer footfall. Now, facing the real threat of losing relevance, banks are waking up to this need to innovate – not just out of dire necessity, but as a strategic objective.”

Agbaje also pointed out that, while GTBank has made significant gains in getting customers to accept digital banking as a viable alternative to traditional forms, there is still more to be done. That said, he is hopeful that the Central Bank of Nigeria’s ‘Cash-less Nigeria’ policy, which discourages the use of cash, will drive greater migration to e-banking platforms.

“We are also tackling the innovation challenge. We now operate an open innovation policy, through which we invest significantly in building our in-house digital capabilities. At the same time, we are seeking effective partnerships and alliances to drive operational efficiency and boost our competitive advantage.

“We want to become a fully digital bank that offers everyday banking services outside of traditional bank walls, but more than that, we want to create digital touch points that ensure we are constantly interacting and playing a deep role in the lives our customers. This of course requires a sustained commitment, and we have repositioned our business structures in such a way that makes us very confident in our continued leadership of Africa’s digital frontier.”

Gaining interest

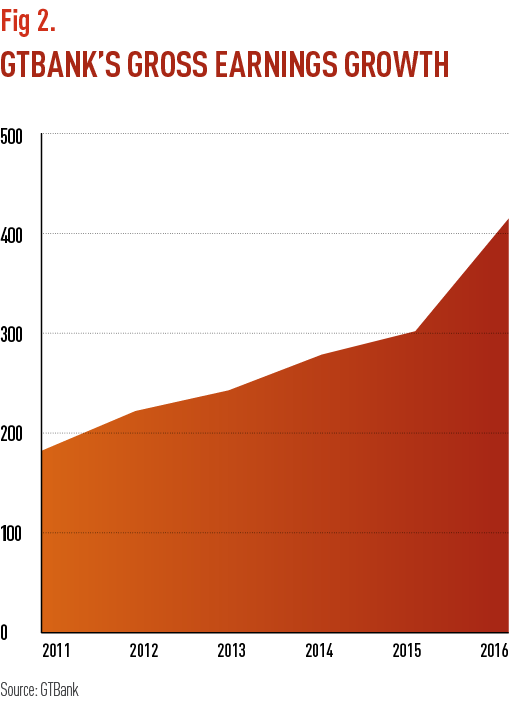

Despite the difficult business environment in 2016, GTBank enjoyed “a fairly decent year”, according to Agbaje. The bank overcame these challenges by growing its retail business and leveraging technology to deliver superior payment solutions to make banking simpler, faster and better. Gross earnings for the period grew by 37 percent to NGN 414.62bn ($1.3bn), from NGN 301.85bn ($959m) in December 2015 (see Fig 2).

This was driven primarily by growth in interest income, as well as foreign exchange income. Profit before tax stood at NGN 165.14bn ($524.7m), representing a growth of 37 percent since December 2015. The bank’s loan book also grew 16 percent, from the NGN 1.37trn ($4.4bn) recorded in December 2015 to NGN 1.59trn ($5.1bn) in December 2016, with corresponding growth in total deposits increasing 29 percent, to NGN 2.11trn ($6.7bn).

Likewise, the bank’s balance sheet remained strong with a 19.7 percent growth in total assets and contingents, reaching NGN 3.70trn ($11.8bn) at the end of December 2016, while shareholders’ funds reached NGN 504.9bn ($1.6bn). The bank’s non-performing loans remained low at 3.29 percent – below the regulatory threshold of 3.66 percent, with adequate coverage of 131.79 percent. Against the backdrop of this result, return on equity (ROE) and return on assets closed at 35.96 percent and 5.85 percent respectively.

According to Agbaje: “The vision of the bank is to build an oasis in a country that was not necessarily known for doing things properly, so we focused on ethics and integrity. And once you build anything on that type of foundation – because even though things change, values never change – and bring in very young people who imbibe this culture along with a healthy attitude towards work, you have a workforce that’s very young and dynamic, possessing all the right values to enable you to build a successful organisation.”

Pan-African

GTBank is building on its successes both at home and abroad through its ‘Pan-African’ growth strategy. Apart from its home market in Nigeria, the bank enjoys a presence in three countries in east Africa (Kenya, Rwanda and Uganda), five in the west (Ivory Coast, Gambia, Ghana, Liberia and Sierra Leone) and has plans to have another in Tanzania by the end of the year.“Our strategy has always been to go into a country and take the high end of the middle market, and then as we grow, enter into the corporate markets.

“We are building a high-end type retail business because the middle class is emerging in most countries in Africa, and where you have an emerging middle class, you have a lot of banking opportunities. So far, we have been fairly successful, delivering an ROE after tax of over 25 percent.”

The bank’s expansion strategy has enjoyed remarkable success, with businesses outside Nigeria now accounting for 15 percent of total deposits, 11 percent of its loans and around 8.2 percent of its profit. Over the next three years, Agbaje expects subsidiary contribution to grow further, to approximately 20 percent.

He told World Finance: “I’m pretty excited about the fact that the profit of the bank has grown by over 300 percent in the last five years. Our customer base has grown from around two million to over 10 million, and we have built a very strong e-business as well.

“We are driven by a vision to create a great African institution; an institution that can compete anywhere in the world in terms of good corporate governance culture and performance. We are driven by the desire to be, in terms of best practices, as good as any institution in the world. As a bank, we always want to do better than 25 percent ROE, and if we have the corporate governance that you’d find anywhere else in the world, then we’ll always be an attractive destination for discerning international investors”

Growing the SME sector

According to Agbaje: “At GTBank, we have been enriching lives since 1990. We do this by giving people a source of livelihood, growing businesses and offering them scale and infrastructure that might not have been available to them otherwise. We are doing things that people never thought possible, and doing most of it for free. Our aim is to continuously transform our organisation into a business enterprise that is all about creating value for our customers, shareholders and the communities in which we operate.”

A key area of focus for GTBank has been widening financial access and building capacity for SMEs. “What we have found with a lot of SMEs is that the financial capacity to borrow isn’t there yet”, said Agbaje. “This is why we created the MarketHub, so that our customers can have an e-commerce platform in addition to their traditional market places so they can grow their revenues.”

Building this online economy is important for both customers and the host economy as a whole, as well as for GTBank. “If we can help increase your sales, then we increase your cash flow and we increase your ability to repay loans. We give loans, but what people must remember is that we have no money of our own, so whatever loans we give must come back.”

As part of the bank’s long-term growth strategy, it has developed a rapidly growing SME franchise that is radically positioning the bank as the apt financial institution for small and medium-size enterprises. This is built on the bank’s understanding of the crucial role of small businesses when it comes to the sustenance of economic growth and development.

As a foremost financial institution, we have a huge obligation to our host communities: not only must we never fail, we have to remain consistent in delivering superior performance and creating value for our stakeholders. We are constantly innovating how we give back to our host communities by going beyond traditional corporate philanthropies. We intervene in key economic sectors to strengthen small businesses through non-profit, consumer-focused fairs and capacity building initiatives that serve to boost their expertise, exposure and business growth.”

In May 2016, the bank held the first of its consumer-focused initiatives: the GTBank Food and Drink Fair. The aim was to promote enterprise within the Nigerian food industry by connecting small businesses involved in the production and sale of food and food-related items to a large audience of consumers and food enthusiasts. The event hosted more than 90 exhibitors from the food sector and attracted around 25,000 guests over its two-day period.

This event was shortly followed by the GTBank Fashion Weekend in November 2016, which targeted the country’s fast-growing fashion industry. The event was a huge success, becoming a meeting point for all stakeholders in the industry and providing a space for retail exhibitions, masterclasses and runway shows.

“We plan to continue such initiatives across viable sectors where we can help small businesses boost their growth potential and productivity. These initiatives are driven by our ambition to play a deeper role in people’s social and commercial lives, thus positioning ourselves at the centre of an extended ecosystem that serves both their banking and non-banking needs, while allowing for frequent interaction between them and our organisation.”