Oil is set to close the week in the green as Chinese demand continues to increase. China’s Caxin Services PMI came out strong with an actual number of 55.0, with the forecast of 54.3. The upward surprise showed an increase in economic activity, which would spur more demand for energy.

Chinese factory activity rose after been flat for seven months and manufacturing activities expanded at the fastest rate since 2012. Despite massive inventory builds at the US facility in Cushion, Chinese demand has been the current driver for a recovery in oil prices despite other bearish factors lingering in the market.

Bearish

- Ten week streak of inventory additions in the United States, lifting the storage trend to above 9% of a 5 year average

- Climbing inflation data from Europe (8.5% in February), which could cause a slowdown and subsequently a drop in the demand for oil in that region

- Recent increase in output by OPEC member, Nigeria, to the tune of 1.44 million (+120,000bpd)

Bullish

- Signs from the FED that they may stop increasing interest rates, at least temporarily, much later in the year

- China demand coming back online, with the country’s GDP forecasted to increase by +5% year-on-year

Price Action

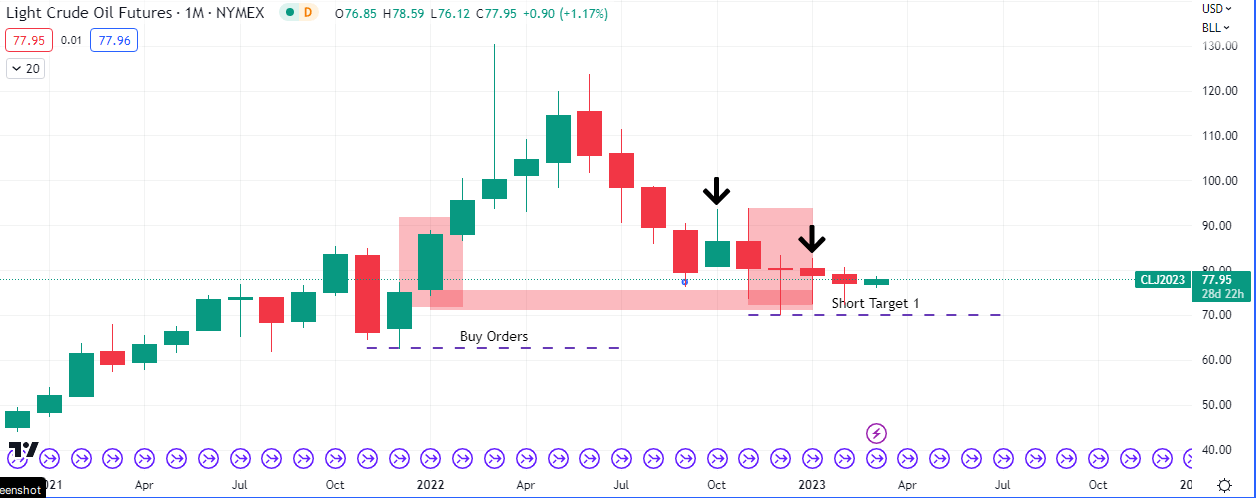

The monthly time frame of crude oil futures paints a bearish picture, depicting a scenario in which oil drops to $62.

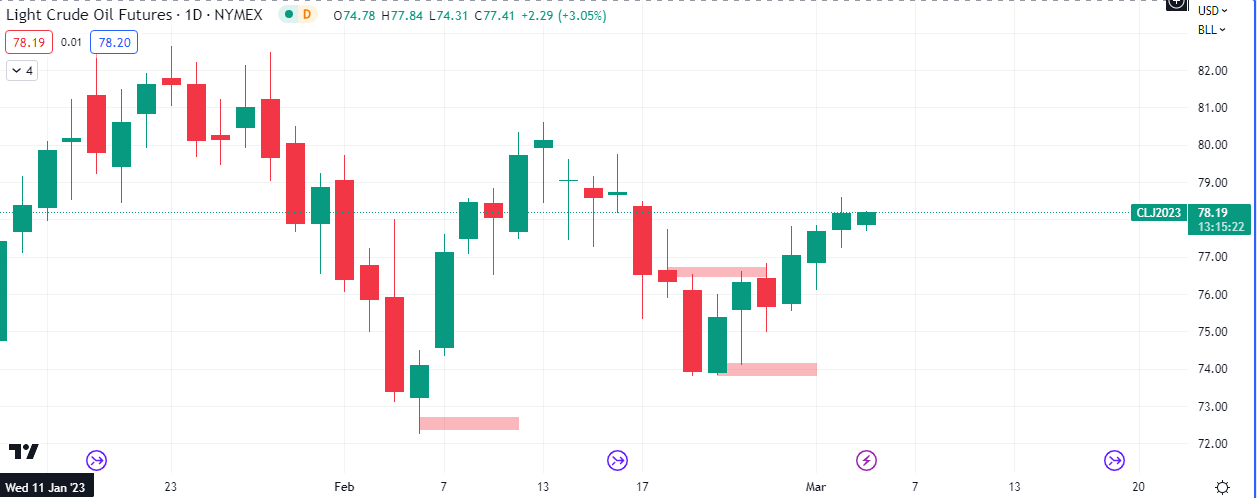

The daily chart remains bullish, especially if today’s close is above $77.89, we should see price test $80. However a close below $77.89 today should keep price depressed and in the 70s a bit longer, at the least.

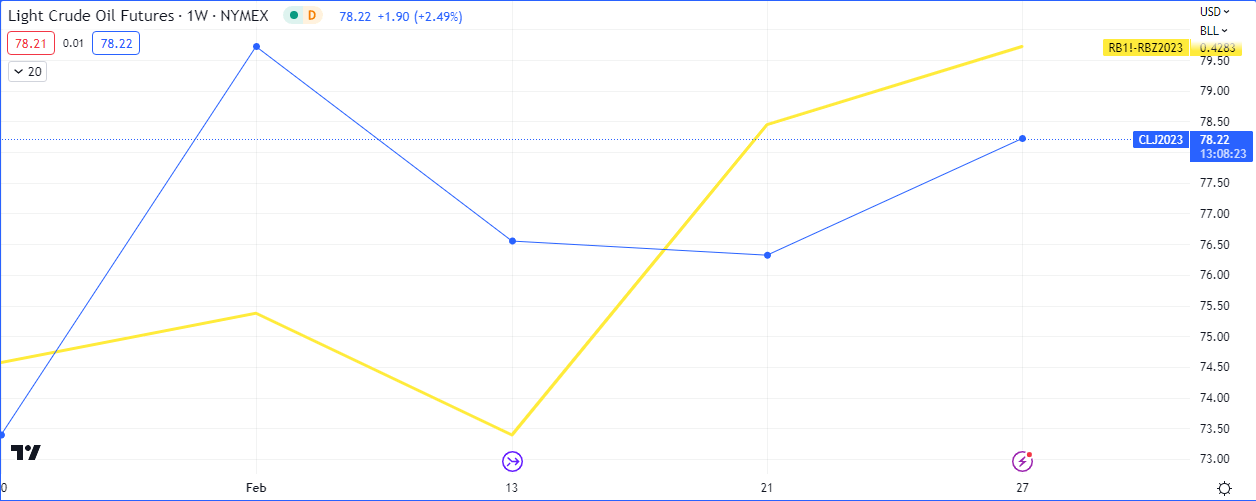

Gasoline futures are in a state of backwardation (demand) as we can see that the back contract is in more demand than the front months (December contract)

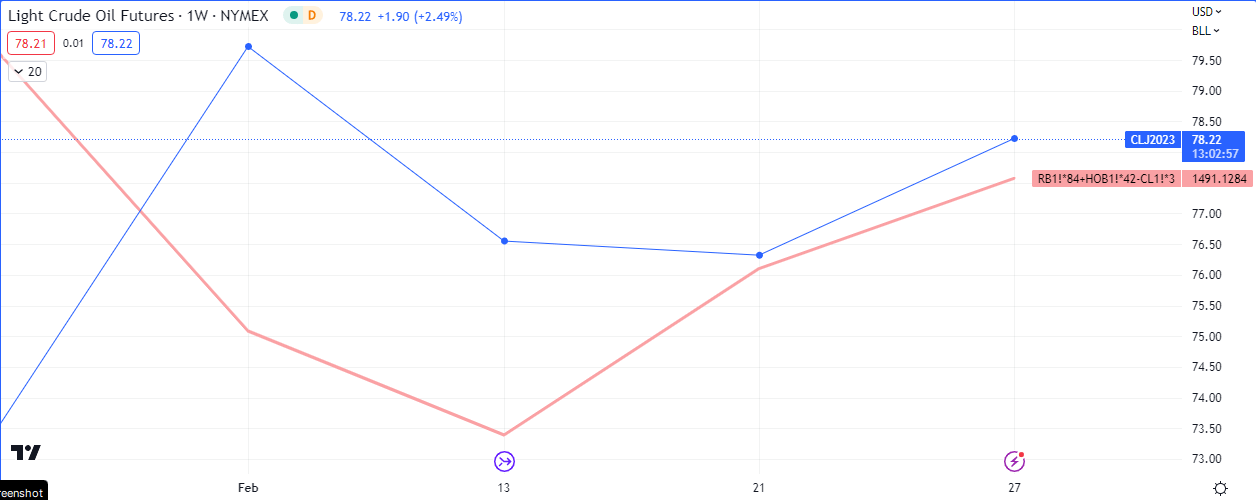

There has been an improvement in the refiner’s margin for about two weeks.

These factors coupled with the possibility of some softness in the dollar could add ‘fuel’ to the rally on oil.

Premier League

Premier League