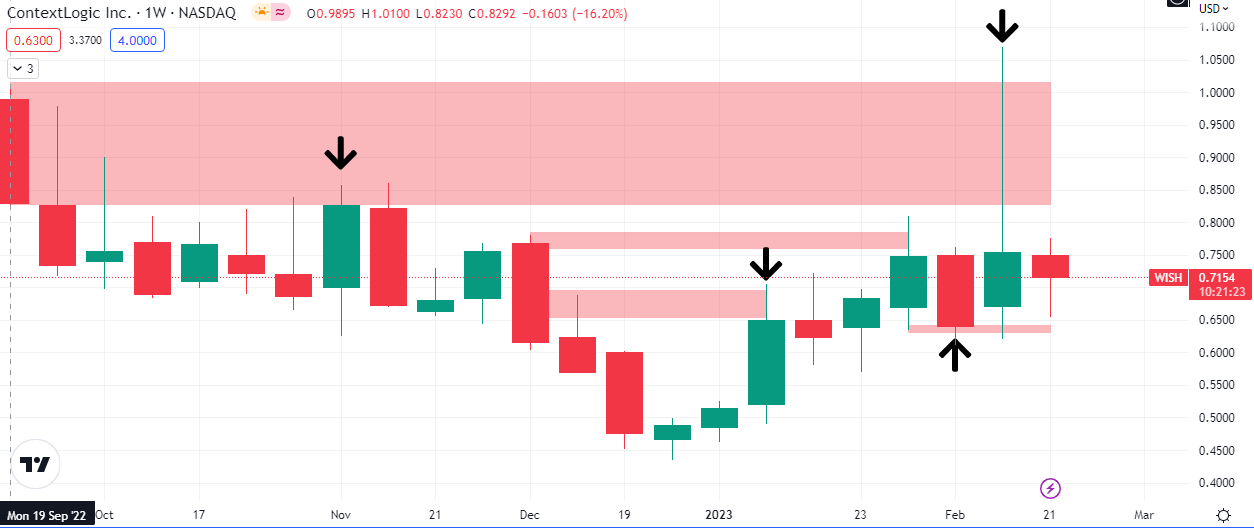

ContextLogic $WISH has so far erased most of the 17.88% rally it had last week. The ecommerce company dropped 5.14% this week in addition to the erased gains from the massive +30% spike it encountered on the 13th of February, 2023.

$WISH reported a Q4 net loss, on Thursday, of $0.16 per diluted share, compared with a loss of $0.09 per share a year ago.

In a poll of Analysts carried out by Capital IQ, an expected a loss of $0.18 per share was the average expectation. Q4 revenue in 2022 was $123 million, down from $289 million a year ago. Analysts expected $152 million.

For Q1 2023, the company stated that it expects adjusted earnings before interest, taxes, depreciation and amortization to be a loss of $70 million to $80 million.

In a separate development, Jo Yan was appointed as the permanent chief executive of the mobile e-commerce company, effective Feb. 21. Yan was serving as the interim CEO from as far back as September 2022.

Jerry Louis, the company’s interim Chief Technology Officer, will now hold the position on a permanent basis, effective immediately. The chief merchant officer, Mauricio Monico, was also appointed as chief product officer.

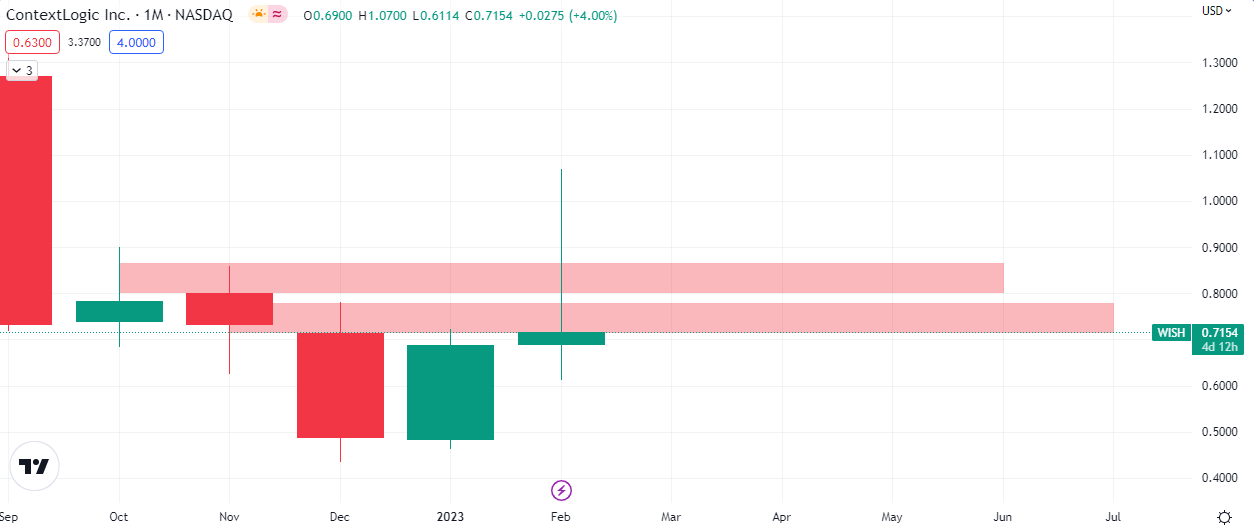

Price Action

At the end of this month it will be important to note if the share price of $WISH closes above $0.86. A close below the aforementioned price could send the price tumbling back to $0.44, while a close above would likely be support towards $1.33.

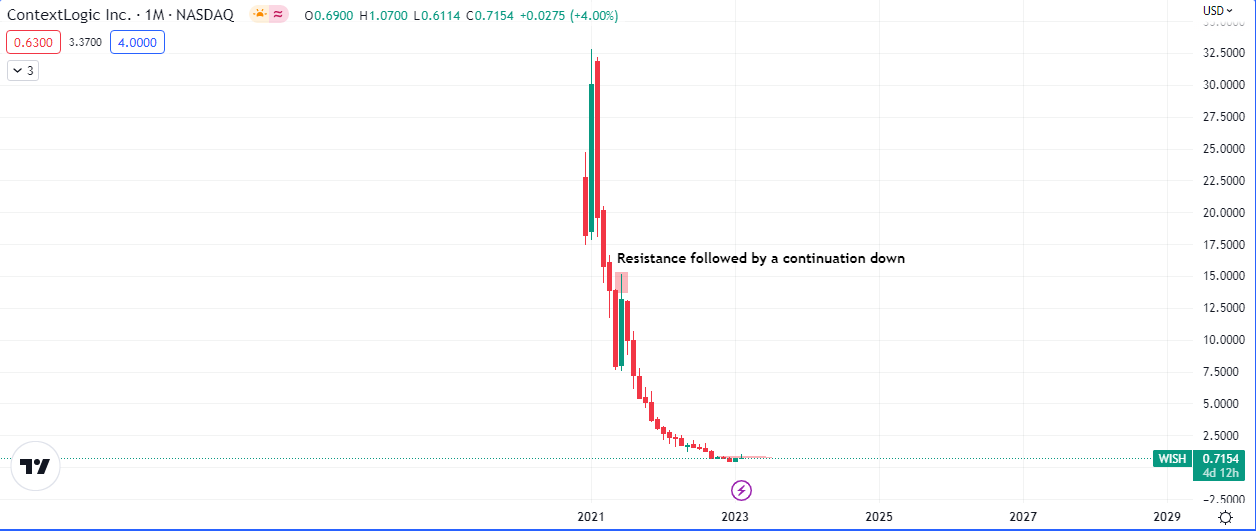

The last time we had a similar scenario, a resistance and a continuation down, was in June, 2021, as seen in the chart below.

Price could not close above the high of $13.9 reached in May and subsequently tumbled below $7 and eventually to the current price of $0.7. The company which went public in December 2020, on the tailwinds of the pandemic, has been on a downward spiral since January 2021.

The most important price action decision, for now, is whether price closes above or below $0.75 on the week and if it closes above $0.78 or/and $0.86, at the end of the month. A bearish weekly likely takes price down to $0.44 and also turns the monthly bearish.

It would be pertinent to consider the broader macro economic factors in tandem with the stock’s internals before making investment and trading decision.

Please find further information on $WISH earnings release, presentation and remarks on their investor relations page.

Premier League

Premier League