Chinese state-owned metals trader Sinosteel is in talks to take over a state-owned steel mill in Nigeria and expand its capacity to 5.6 millions tonnes from 1.3 million, Nigeria’s mining minister said on Thursday during a visit to Beijing.

The steel mill sale and upgrade would mean investment into Nigeria of around $6 billion, Minister of Mines and Steel Development Musa Mohammed Sada told Reuters.

Sinosteel did not confirm or deny the talks when contacted.

Nigeria, Africa’s largest crude oil producer, is looking to China for cheap funding to help it move up the value chain from exports of raw materials, a goal that has been hampered by woeful infrastructure.

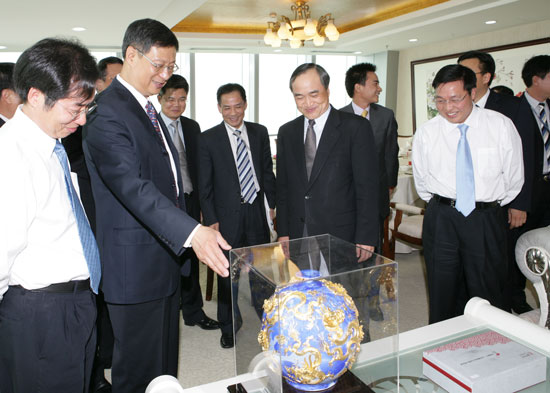

A delegation of over a dozen ministers led by President Goodluck Jonathan is visiting China this week soliciting loans for infrastructure that Finance Minister Ngozi Okonjo-Iweala said last week could amount to $3 billion.

“We have had discussions with Sinosteel… We would hope they will be able to reach some agreement and transfer the management to them,” he said. The government holds 80 percent of the mill, with the remainder held by employees and the local community.

Nigeria is delineating its iron ore deposits with a view to opening bids by the end of the year, he added.

“We have a steel programme to produce steel within the country, but the size of the deposits we have of iron ore is more than what we can consume locally, so there is also (a need for) infrastructure development,” Sada said.

During the visit, China Ex-Im Bank agreed to lend $500 million to Nigeria to build airport terminals in Lagos, Abuja, Port Harcourt and Kano. The 20-year loan is at a 2 percent interest rate with a 30 percent local content provision, Aviation Minister Stella Oduah said.

“It’s free money, so we’re happy,” she said.

MAINTAINING GROWTH

China, the world’s most populous country and second-largest economy, has made several cheap loans to African nations in the past few years as it competes with Western powers like the United States for access to the continent’s abundant natural resources and growing market for imported goods.

Nigeria is seeking Chinese help to develop petrochemicals, metals smelting, roads and port infrastructure and even add cold-storage capacity at airports for exports of fresh agricultural products, to maintain economic growth that has averaged 7 percent a year for the past five years – but which economists say has been too dependent on crude oil.

China and Nigeria signed a framework agreement between the China Development Bank and Nigeria’s First Bank, details of which were not provided, as well as accords covering visas, cultural exchange and economic and technical cooperation.

The lending is part of a $7.9 billion external borrowing plan approved by Nigeria’s national assembly last year as the government seeks to increase cheaper external borrowing and limit domestic debt.

Chinese firms are already active in road-building, mining and construction in Nigeria, all of which require more steel.

But a glut of steel capacity in China may make it more economic to sell steel to Africa than to build new mills there.

[Reuters]