The Central Bank of Nigeria (CBN) on Monday announced a reduction of the Monetary Policy Rate (MPR) from 12.5 percent to 11.5 percent.

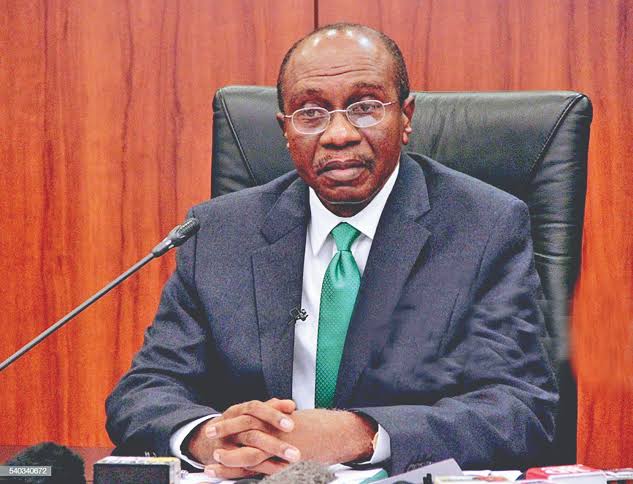

Mr. Godwin Emefiele, the CBN Governor made the announcement while presenting the communiqué the 275th Monetary Policy Committee (MPC) meeting on Tuesday.

Emefiele said that the decision to reduce the MPR was made to sustain economic recovery efforts and to arrest rising inflation.

He projected that the country could enter into a recession in the third quarter, while there would be growth in the fourth quarter of 2020 or the first quarter of 2021.

READ ALSO: Trade Union Congress Postpones Sept. 23 Planned Protest

The CBN governor said that the committee also retained Cash Reserve Ratio (CRR) at 27.5 percent.

He said that recent inflationary pressures were not driven by monetary policies rather as a result of structural policies.

He called on commercial banks to respond to the reduction of deposit rate by also reducing interest rates on borrowing to encourage borrowing for investments.

He said air and road transportation, accommodation, food services were worst hit by the lockdown occasioned by the COVID-19 pandemic.

He called for more aggressive funding of those sectors to engender economic growth.

“Management was directed to ensure that deposit money banks respond to lowering of interest on deposit rate by aggressively lowering the cost of credit to borrowers.

“Sectors like air and road transportation, entertainment and accommodation, food services, and education were most adversely affected by the lockdown.

“Committee suggested that more effort be put in place to continue to provide relief and funding to those sub-sectors to catalyze growth,’’ he said.