Oliver Renick sat down 1-on-1 with Ark Invest’s $ARKK Cathy Wood in Market Overtime to discuss the surge in Bitcoin’s price and the Bitcoin ETF launch that recently saw the cryptocurrency’s market cap surge by hundreds of billions of dollars.

Cathie Wood, born Catherine Duddy Wood in 1955, is widely regarded as one of the capital market’s industry’s most prominent individuals. She is a renowned American investor and the founder, CEO and chief investment officer of ARK Investment Management. Wood has distinguished herself with her innovative approaches and forward-thinking tactics

In theinterview she granted to the Market Overtime show at the CBOE floor side, she associated the detention of Binance Executives in Nigeria to a “flight to safety”, an urgent Risk Off flow from the Naira that was recently floated.

“In Nigeria, in June of last year, the government let the Naira float. It’s a new administration, its an oil rich country, we [the government] can support it. Guess what! It’s lost two-thirds of its value and the government is now detaining two people from Binance and is insisting that they need to learn who has been manipulating the Naira with Bitcoin. We don’t believe that’s what’s going on. What we believe is there is a flight to safety.”

At 09:54 in the prerecorded interview, the billionaire money manager associated the rise in the demand for Bitcoin to it’s store-of-value and privacy preservative features, as the root cause of investors liquidating fiat to purchase the open ledger based money.

You may recall that the Federal Government of Nigeria, via the office of the Nation Security Adviser, arrested and seized the passports of 3 Binance executives. Tigran Gambaryan, Binance’s head of investigations, and Nadeem Anjarwalla, a British lawyer and Kenya-based manager for the crypto exchange for Africa, were the individuals arrested.

Cathy Wood also reaffirmed her view that the cryptocurrency and blockchain technology is a natural evolution of the internet itself that was overlooked by its developers in the late 80’s and early 90’s. She also emphasized that regulatory clarity is important and encourages more of it.

From 13:30, Oliver and Cathy got more technical and discussed the confluences that point to what the true underlying nature of Bitcoin is. Is it a risk on asset or is it risk off asset? One factor Oliver pointed out is the correlation of Bitcoin to high beta risk assets. Cathy, who holds a portion of her portfolio in Bitcoin, affirmed that it acts as both.

“Is it a risk on asset that acts like everything else? During some markets, Yes, it is right up there with stocks and bonds in some cases. But the important thing we’ve learned in the past year, and this is where the low correlation comes into view, is that during the regional bank crises it was a risk off asset…”

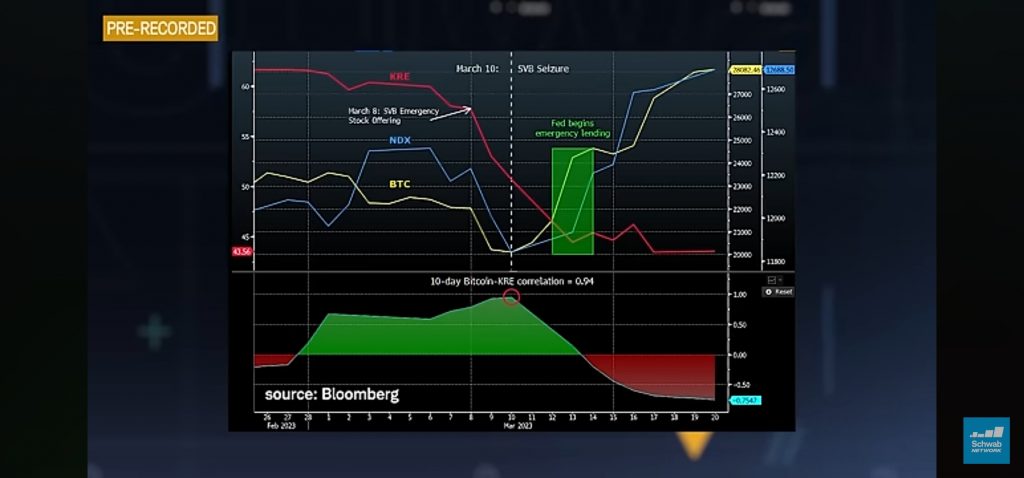

Oliver interrupted her at this point to disagree with her. At this point the host pulled up the chart below.

The chart above shows the correlation between Bitcoin, Nasdaq $NDAQ and Fed lending policy.

Cathy stood her ground on Bitcoin being a store of value, pointing out the safe heaven flows she noticed in Bitcoin during the Regional banking crises.

“We first gained exposure to Bitcoin at $250, versus the 73, 74, 75 thousand dollars now” , Cathy reminded the host of the much lower prices ARK Invest had started investing in Bitcoin.

“We were on edge every day, trying to figure out how will this behave? When Greece threatened to leave the European Union and we got fear again in the Euro, of reverberation on the European sovereign debt crisis, Bitcoin went up.”

Oliver pushed back immediately pointing out the fact that “stocks were also rallying back then”, pointing out the gap in her risk off-safe haven narrative on Bitcoin. Cathy however was unflustered reminding Oliver that it went from $250 to over $70,000, and she caught the ride.

“In 2000 and…no I don’t think is what that clear-cut back then, no, no, it was not. So, you’re talking about a store of value, a gold? I just told you Bitcoin has gone from $250, from when we first got in, to $73-$74,000 dollars.” Cathy retorted.

Olive hit back, “Sounds like a great speculative trade.” To which Cathy retorted, “No it also sounds like a great store of value doesn’t it!”

She went on further to point out the fact that regional banks stock index (correlated to risk on), has gone “nowhere” since the regional bank crises but Bitcoin has gone straight up,” she said pointing up. Store of Value.”

The University of Southern California (USC) Alumni’s narrative compared gold to Bitcoin in some interesting ways.

“The value of gold in the market place today is 14 trillion dollars, the value of Bitcoin in the world today is 1.4 trillion dollars. 10% of gold. Digital gold is much more convenient than tradition gold, especially if you need, if you want it in cold storage.”

“By definition, the price for any commodity is determined at the margin. If at the margin, supply growth is going to be cut in half, for a commodity that’s huge.”

The discussion turned to the Bitcoin miners and how they fit into the big picture.

“They need to be making money, right. We do have in our Bitcoin Monthly (publication), which we put out every month, a metric, is the average miner making money here? And when they are not, miners drop out of the system and they can only be invited back in by a higher price.”

The successful money manager also explained that she has “pulled away” from NVDIA $NVDA because it may be extended and early to the full potential of the AI sector, much like Cisco in the 90’s.

“We have pulled away from it for that reason, but we don’t think this is a bubble.”

You may watch video below.

Premier League

Premier League