The exchange-traded funds run by Cathie Wood’s ARK Investment dumped more shares of Tesla Inc. (TSLA) Wednesday, ARK’s disclosures show. The ARK Autonomous Technology & Robotics ETF (ARKQ) sold 17,967 shares of Tesla on the day, while the ARK Next Generation Internet ETF (ARKW) shed 10,401 shares, according to the daily trade notifications that ARK publicizes.

Together that amounts to $7.3 million in Tesla stock, based on Wednesday’s closing price of $256.24. ARK funds have dumped more than 500,000 shares of Tesla this month. Meanwhile, the ARK Autonomous Technology & Robotics ETF added 4,576 shares of Advanced Micro Devices Inc. (AMD) Wednesday, worth just over $500,000 based on the day’s $110.17 closing price.

That fund also bought up 6,542 shares of Taiwan Semiconductor Manufacturing Co. Ltd. (2330.TW) , while the Next Generation Internet ETF scooped up 20,114 shares. That comes out to just shy of $2.7 million in stock, based on Wednesday’s $100.92 close.

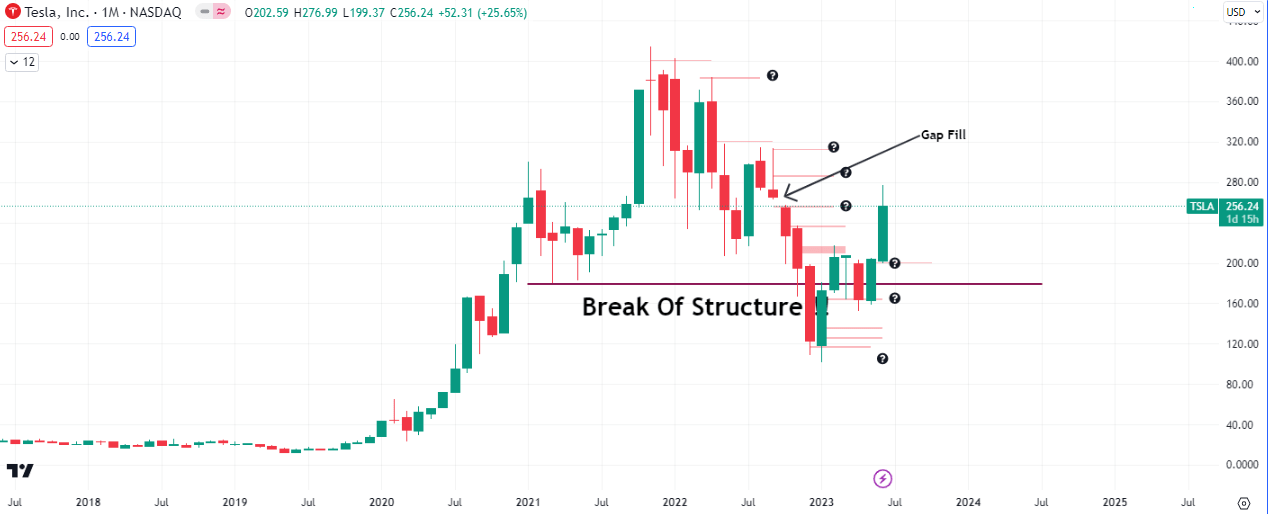

The close of the month and quarter is an important one in the $TSLA chart above. As we showed here if the monthly close is lower than the key price of $257.50, we may witness a $50 retracement to $200. However there is still a gap above price that stops at $265.25 and the probability of it getting filled is very high, hence even if price were to drop back to $100, it should rise above $265 first to retest higher resistances.

There are 24 hours left to find out.