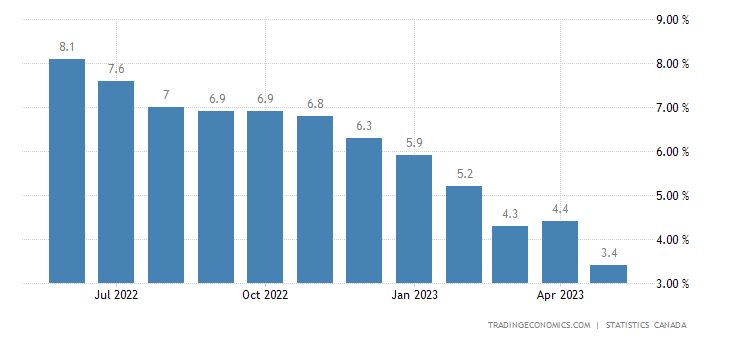

Canadian inflation ebbed to its weakest pace in two years and core measures edged lower, reducing pressure on the central bank of Canada for another interest-rate hike next month.

The consumer price index rose 3.4% in May from a year ago, the smallest increase since June 2021, Statistics Canada reported Tuesday in Ottawa. That matched the median estimate in a Bloomberg survey of economists and was down a full percentage point from 4.4% in April. On a monthly basis, the index rose 0.4%, also matching expectations.

Two key yearly metrics tracked by the BOC— the trim and median core rates — also dropped sharply, averaging 3.85% from an upwardly revised 4.25% a month earlier, slightly slower than the 3.95% expected by economists. Service inflation slowed to 4.6%, from 4.8% a month earlier.

According to Bloomberg calculations, three-month moving average of the measures that policymakers have flagged as key to their thinking fell to an annualized pace of 3.72%, from 3.83% previously.

“Some signs of tamer core price pressures could provide a bit of breathing space for the Bank of Canada as it decides if, or when, to raise interest rates again,” Andrew Grantham, an economist at Canadian Imperial Bank of Commerce, said in a report to investors.

Bonds got a lift on the news, with the yield on benchmark 2-year Canadian government notes falling around 4 basis points to 4.576% at 9.02 a.m. in Toronto. The Loonie was little changed.

The large deceleration in May was driven by lower year-over-year prices for gasoline resulting from a base-year effect. Gasoline prices fell 18.3% that month, from a year ago.

Energy prices fell 12.4% in May compared with the same month a year earlier, when supply uncertainty following Russia’s invasion of Ukraine led to surging prices. The first year-over-year decline in natural gas prices since August 2020 also contributed to the deceleration.

Premier League

Premier League