Mohamadu Buhari’s Administration will be handing over $103bn debt to the next administration on May 29th. The roughly N50 trillion debt is the highest in the history of Nigeria.

According to information from the Debt Management Office of Nigeria, the current debt is actually N75 trillion, when you consider the time elapsing on these debts that were raised via government bonds to international commercial entities and individuals.

Unlike the $18 billion Paris Club debt that the Obasanjo administration inherited, these debts were raised via bonds to commercial entities and individuals. To service these liens, Nigeria will have to find innovative and effective ways to generate more revenue.

In an interview on Arise Television, Paul Alaje, a senior economist at at SPM Professionals, pointed out some sectors in the Nigerian economy that could remit more of their revenue to the government. “You need to look at the books released by the Economic Bureau of Statistics on the economic performance (of sectors) on a quarterly basis. And look at which sector of the economy is growing. Are they paying revenue to government in the right proportion? I can tell you about three or four of them.” He chose not to mention them so as not to cause any ‘fear’ on the program.

Revenue generation has to however go hand in hand with investments in education, infrastructure and human capital development.

Alaje states that “State governments must become innovative. They are losing revenue worth N20 trillion a year due to incompetence in collection and poor leadership.” He went further to allude that many states in Nigeria are not aware of some businesses extracting billions in revenue from within their various jurisdictions.

There was a good chance that Nigeria’s total public debt could rise to 77 trillion naira ($172 billion) from 44 trillion naira as of last September, after a loan-to-bond swap and new borrowings to fund the 2023 budget, the Debt Management Office chief said.

The president requested to convert $53 billion worth of temporary loans to the government from the central bank into 40-year bonds although some lawmakers questioned the plan and attempts were made to block it.

“If that is approved sometime this year …, it means you will be seeing that figure included in the public debt,” debt management chief Patience Oniha said

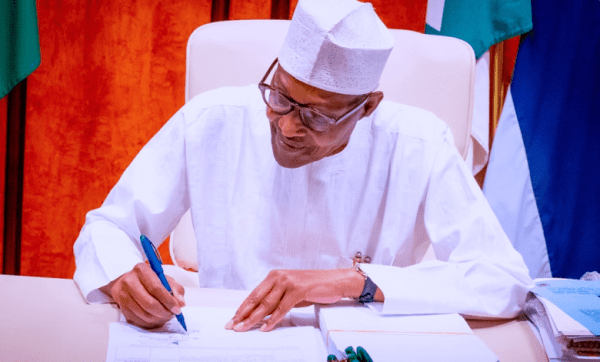

Earlier in the year President Muhammadu Buhari signed the 2023 budget of 21.83 trillion naira into law and said the country would pay 1.8 trillion naira ($4 billion) in extra interest this year if parliament rejects the loan-to-bond swap request.

Premier League

Premier League