As Christmas season is already taking shape in most places across the world, Nigerians are still feeling the recession aches. However one class of people that may be enjoying the Buhari administration from a general economic perspective are stock market investors.

The Nigerian Stock Exchange is booming in 2017. Easily one of the best performing stock markets in the world, at 38.12% year to date performance.

Most average Nigerians are still shy of investing in the market after the global crash of 2008 coupled with local banking sector malpractices. For many there is just not enough disposable income to invest, due to the recession. However these are the same types that bundled their life savings into scams like MMM.

Foreign investors are likely the architects of this boom, with hundreds of millions of dollars to pour into the market. Their enthusiasm buoyed by the lifting of FX controls and liberalization of capital gains repatriation rules.

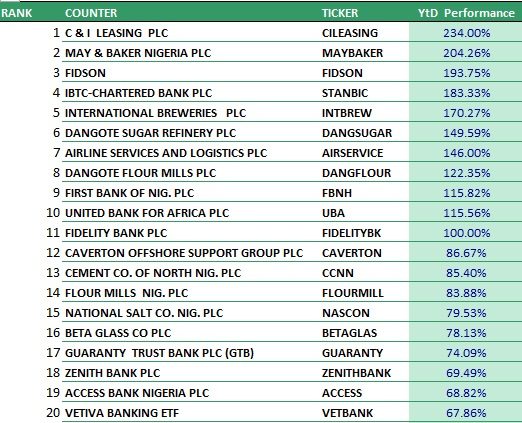

So before you call your broker, here are a few notable stocks that are performing well in 2017.

Leading the market is C & I Leasing with +234% gains from January till date, May & Baker (+204%) and Fidson (+193%) are first and second runners up respectively.

Stanbic IBTC (+183%) comes in at fourth and leads the banking sector.

International Breweries (+170%) is a notable fifth and could be said to be leading the Fast Moving Consumer Goods sector. With the outcome of Buharinomics on other sectors of the economy eg. FX, it is no wonder Nigerians are drinking away their sorrows.

First Bank (+116% and UBA (116%) are almost tied.

The remaining top-tier banks are all featured in the top twenty GTBank (+74%), Zenith Bank (+69%) and Access (+68%).