BUA Foods Plc, one of Sub-Saharan Africa’s most valuable companies based on market capitalization and a leading manufacturer of high-quality foods, held its 1st Annual General Meeting in Abuja at the Transcorp Hilton Hotel.

The company declared a dividend with a total value of ₦63 billion for the fiscal year 2021 following approvals by the shareholders translating to ₦3.50 per one ordinary share of 50 Kobo- subject to the deduction of withholding tax- for all shareholders on the Company’s register at the close of business on 13 July 2022. This was driven by the positive growth recorded in the financial year ended 31 December 2021, making BUA Foods a listed company on the NGX, with the highest dividend payout in Nigeria’s Food and FMCG industry.

The period under review showed impressive results across the Company’s three revenue-generating divisions- Sugar, Flour and Pasta. Operating profits grew by 56% to ₦79.9 billion, while Profit Before Tax (PBT) increased by 63.96% to ₦77.5 billion. The total profit at the end of the year was N69.8 billion (+97% y-o-y).

Read Also: Petroleum subsidy removal: The short-run costs, long-run payoffs and in-betweens – By Iniobong Usen

Payment of dividends will commence on 4 August 2022, upon shareholders’ approval at the meeting.

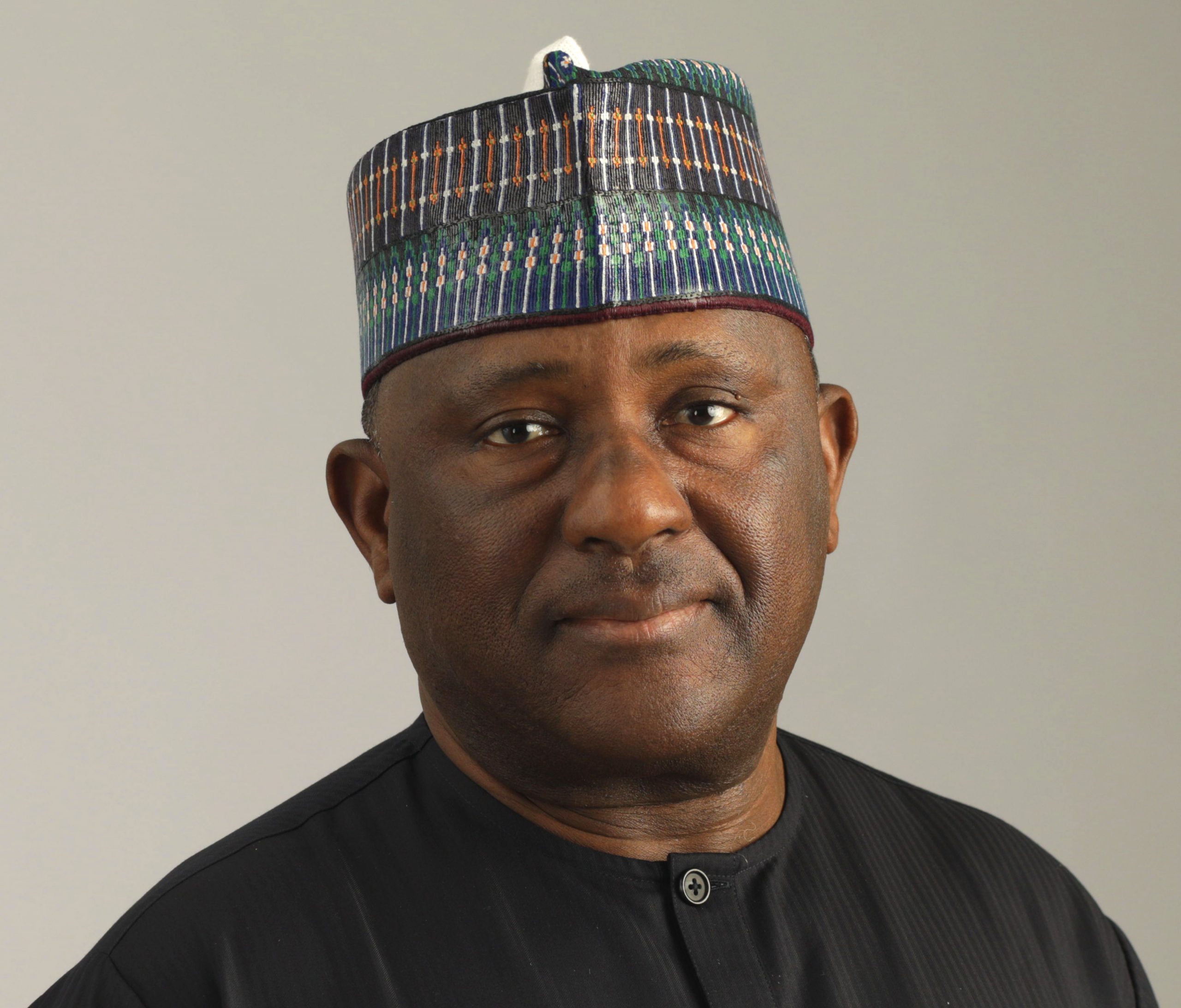

Addressing shareholders at the meeting, the Chairman of BUA Foods, Abdulsamad Rabiu, said: “2021 was a pivotal year in our corporate history. It charted a new path for us to fulfil our vision to meet Africa’s growing demand for food by promoting food security and nourishing lives. Our bold decision to consolidate and restructure our business strengthened our productivity and improved our efficiency as a food value chain company.

“Our business has remained resilient despite global economic challenges and plays a significant role in the FMCG industry. This was evidenced by the positive financial results recorded for the fiscal year ended 31 December 2021.”

Speaking further on growth ambitions, Rabiu said, “Our expansion plans have positioned us to provide a more diversified revenue stream in the years ahead, with a positive and demonstrable impact to create value for the business and shareholders. We are expanding our plant capacities across the entire business and investing in a backward integration program for sugar with farmers in host communities. We plan to recommence our rice division by the end of 2022 and edible oils in 2024 to further accelerate revenue generation. Also, our ongoing investments in export infrastructure, supported by strategically located ultramodern plants, will improve our capacity to serve Africa and other markets.”

“We will continue to invest in the future with a clarity of purpose for shareholders and make a difference through our sustainable business model driven by a committed team executing well-thought strategies for growth and value creation as we continue to lead with purpose.”

Also commenting, the Managing Director BUA Foods, Engr. Ayodele Abioye said: “2021 was an exciting year for us at BUA Foods. The restructuring of our business improved our position as a leading player producing and distributing high-quality, accessible, competitively priced and innovative food products. It strengthened our vision to lead confidently even as we expand our footprint across West Africa and provide end-to-end supply chain efficiency while leveraging the strategic location of our ultramodern plants.”

“Our focus is on driving sustainable growth from our strong portfolio to create good investment returns for shareholders. This aligns with our plan to create liquidity, enhance visibility, and expand access to capital for future growth. We worked with some of the best advisers in the industry to achieve these milestones, and I thank them all for their support.”

Also speaking, the National President of Starlite Shareholders Association of Nigeria, Mr Tunji Bamidele, who represented professional investors, commended the company on its exceptional performance for the fiscal year 2021. He added that despite global security challenges, the company grew profits from 39 billion in the previous year to 69 billion in 2021, indicating a strong commitment to alleviating food security challenges.