On a site four times the size of Manhattan along the banks of the Niger river, the Ajaokuta steel plant was supposed to symbolize Nigeria’s modernity and prosperity rather than its failure.

Russian contractors first started building it in 1979 and estimates on how much has been spent range from $4 billion to $10 billion. The state-owned company that owns the facility calls it “the bedrock of Nigeria’s industrialization.” It’s yet to produce any steel.

“It’s not about resuscitating it, it’s about developing it,” Frank Jacobs, who runs a company making wine from pineapples and heads Nigeria’s main manufacturing association, said at his office in Lagos. “If you say resuscitating, it means it was working before. It hasn’t worked. There’s nowhere a country can industrialize without steel.”

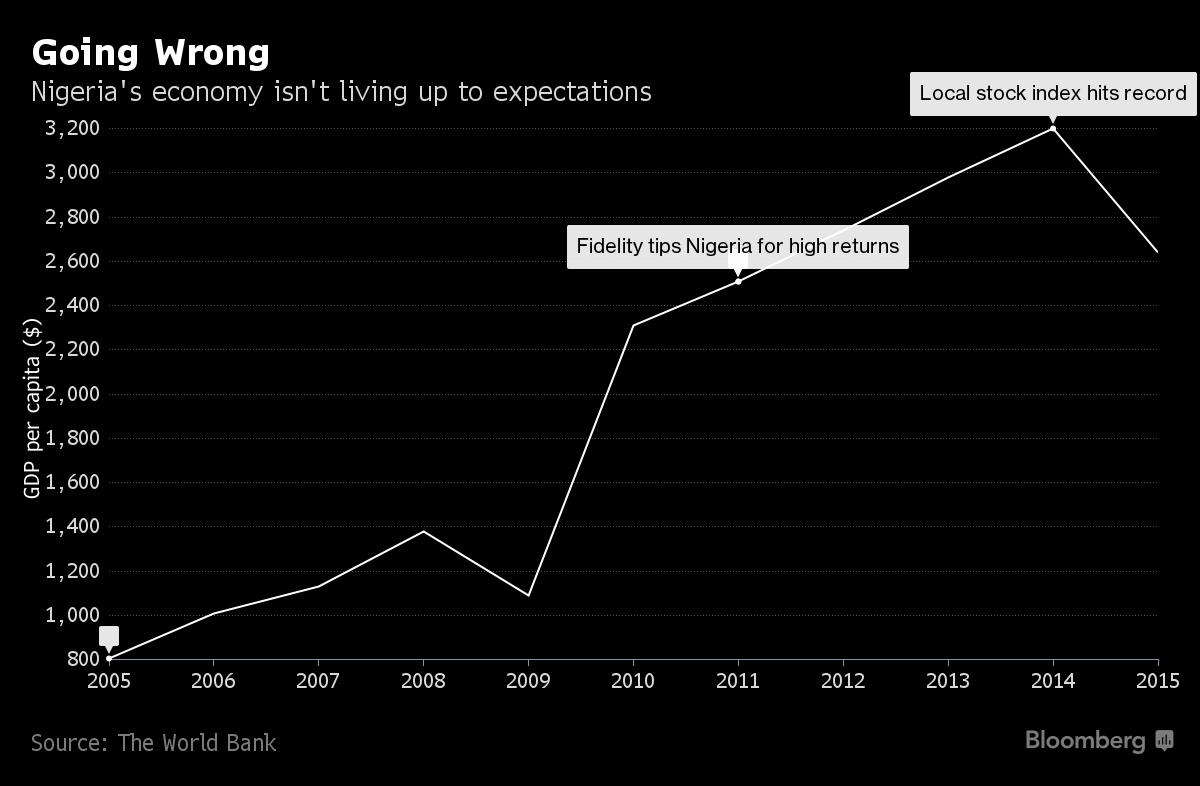

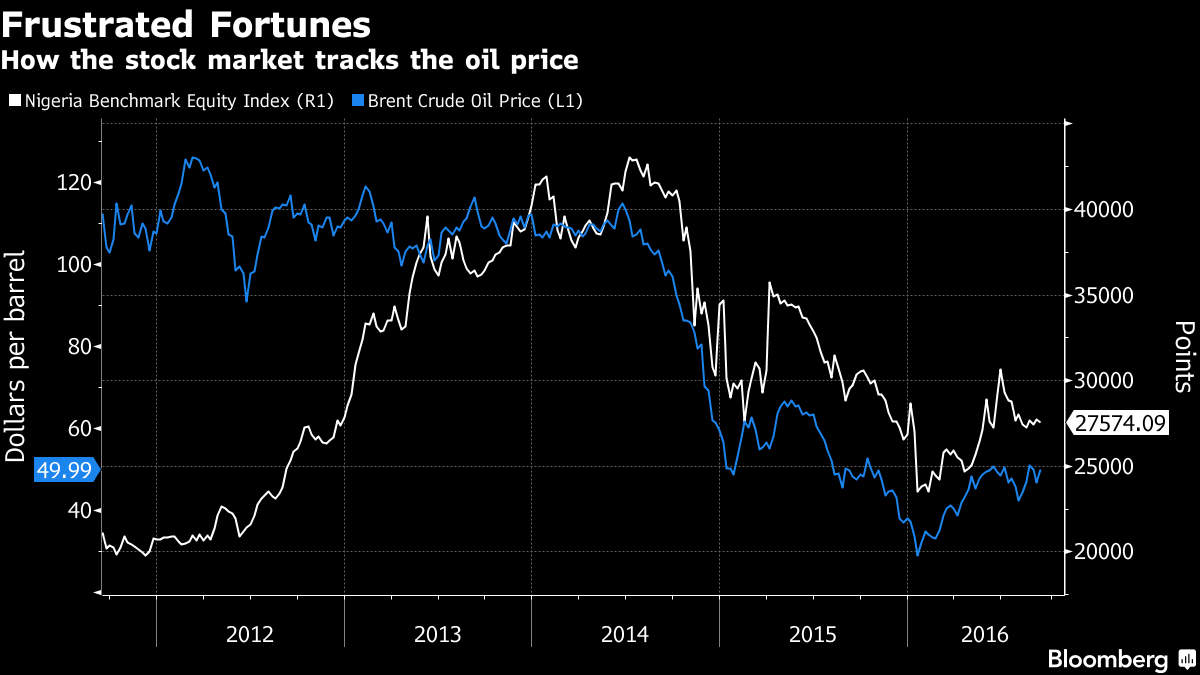

Africa’s most populous country has gone from a promised land for Nigerians and foreign investors alike to one of frustrated fortunes. The decline looked complete last month when Nigeria’s vice president said the country was in the worst economic crisis it had ever faced. The currency has collapsed and output is set to shrink this year for the first time since 1991 after 8 percent-plus growth through the 2000s.

Creaking Country

The nation remains blighted by the mismanagement and corruption that were rife during the oil-led boom years and its dysfunction has been more exposed since the collapse of energy prices. Transport links are in tatters and blackouts are common because the country produces just 10 percent of the electricity of South Africa, which has one-third of Nigeria’s 180 million population.

Islamist militant group Boko Haram has wreaked havoc in the northeast, killing tens of thousands of people and leaving 250,000 children needing food aid. Other groups blew up oil pipelines and export terminals in the southern Niger River delta, sending crude production to an almost three-decade low.

Nigeria’s 36 states are so cash-strapped that many teachers, pensioners and civil servants have gone months without pay. The governor of Imo, home to about 4 million people in the southeast, announced a three-day working week, telling bureaucrats to farm on the other two. Nigerians are even scrimping on protein in their diets, according to the head of Nestle SA’s local business.

‘A Mess’

French construction company Bouygues SA has halted some projects and plans to do less work for the government because of the risk of not getting paid.

“The last two years have been terrible,” said Andre Guillou, Bouygues’s vice chairman in Nigeria. “It’s a mess.”

At the 92 square-mile (240 square-kilometer) Ajaokuta site, a three-hour drive south from the capital Abuja, cows graze on grounds that were meant to store iron ore, coal and lime, and thousands of houses for workers lie empty and windowless. A railway bridge across the river has never been used because there’s no line linking it to ports or manufacturing hubs. It has produced rods, wires and machine parts — on and off — and banks, hospitals and schools are open for the local community.

“I did some work at the plant, but there is not much to do there yet,” said Sulaiman Abubakar, a 56-year-old father of nine who lives near Ajaokuta and studied metallurgy in his youth so he could get a job there. Instead, he drives a keke, a Nigerian version of a motorized rickshaw, and wants his children to become engineers. “They will get jobs once this plant starts working,” he said. “We still hope it does, because it’s all we have.”

Crash Landing

It’s hard to imagine in Ajaokuta that investors once drooled over Nigeria’s prospects.

Fidelity Investments promoted “MINTs” in April 2011, saying Nigeria, Mexico, Indonesia and Turkey were the emerging markets of the future, an opinion reinforced by Jim O’Neill, the former Goldman Sachs economist. Consulting firm McKinsey said Nigeria had the potential to grow 7 percent a year through 2030, ultimately making its economy larger than the Netherlands, Malaysia or Thailand.

Then came the 2014 oil crash. Foreign investors fled and the economy tanked. Though Nigeria was always going to suffer from a drop in oil prices, it was the government’s bungled response that made it worse, according to Martina Bozadzhieva, an analyst at Frontier Strategy Group.

President Muhammadu Buhari, a military ruler in the 1980s, came to power again last year, this time via the ballot box and on a wave of optimism that he would fight corruption and revive the economy. He took almost six months to form a cabinet and only approved the 2016 budget in May.

He also leaned on central bank Governor Godwin Emefiele to peg the naira, ostensibly to stop prices of food and transport rising. Instead, inflation soared to an 11-year high of 18 percent as businesses struggle to pay foreign suppliers for the machinery and raw materials that aren’t available locally. Since June, when Emefiele gave up trying to support the currency, the naira has plunged 40 percent against the dollar. S&P Global Ratings downgraded Nigeria five levels into junk territory on Sept. 16, saying the economy had performed worse than it expected because of the attacks on oil facilities and Buhari’s foreign-exchange policies.

“The confidence in Buhari is very quickly evaporating,” said Bozadzhieva, whose company advises multinationals like Coca-Cola Co. and General Electric Co. “Firms are close to that point where they say: ‘You know what, this is a disaster.’ It’s okay to have an oil price drop. But there are countries that have managed it much better.”