Nigeria’s banking index fell the most in a month after the central bank tightened monetary policy by increasing reserve requirements, damping the outlook for lenders’ margins.

The Nigerian SE Banking Index, which tracks the West African nation’s 10 largest lenders by market value, declined 3.9 percent to 404.84 by 1:14 p.m. in Lagos, the steepest drop since June 28.

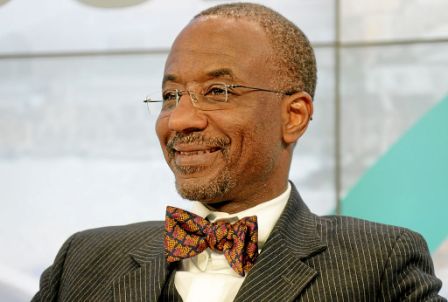

The Central Bank of Nigeria’s Monetary Policy Committee led by Governor Lamido Sanusi introduced a 50 percent cash reserve requirement on public sector funds yesterday after warning about the risk of excess liquidity in the system. The regulator in the capital Abuja left itsbenchmark interest rate at a record 12 percent for an 11th consecutive meeting to protect the currency of Africa’s second-biggest economy.

The decision is expected to have a “negative impact on the banking sector,” Muyiwa Oni and Rele Adesina, analysts at SGB Securities Ltd. in Lagos, wrote in a report today.

The move may result in 45 billion naira ($281 million) of lost interest income for Nigeria’s banking industry, according to the report. In the first quarter, “public sector funds in the banking sector stood at 2.5 trillion naira, which was 17 percent of the banking sector’s deposits,” the analysts said.

Zenith Bank Plc (ZENITHBA), Nigeria’s second-largest lender by market capitalization, tumbled 5.1 percent to 20.1 naira, the most since June 25. Guaranty Trust Bank Plc (GUARANTY), the biggest, dropped 3.5 percent to 25.39 naira.

“The CBN was concerned about the build-up in excess liquidity in the financial system and a vicious cycle where banks sourced large amounts of public sector funds and subsequently lent them to the government by purchasing T-bills and Open Market Operations,” Samir Gadio, a London-based emerging-markets strategist at Standard Bank Group Ltd., said in an e-mailed note yesterday.

The newly-introduced reserve requirements “could also result in a sharp increase in Nigeria’s interbank rates,” which may impact some lenders’ net interest margins negatively because of the higher cost of funding, the analysts at SGB said.