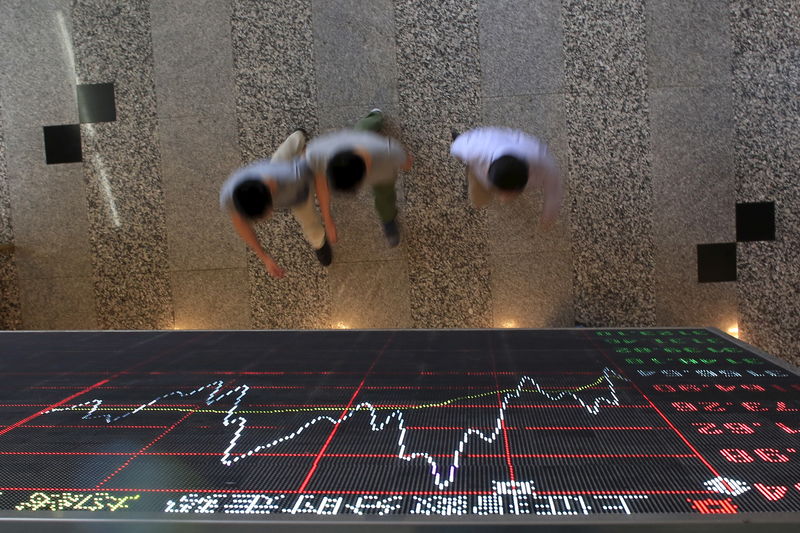

MSCI’s broadest index of Asian Pacific shares outside Japan.MIAPJ0000PUS jumped 1.08 per cent, touching its highest level since July 24, and on track for its biggest one-day gain since Oct. 11.

Equity markets in Europe were set to follow Asian higher, with pan-region Euro Stoxx 50 futures STXEc1 up 0.53 per cent, German DAX futures FDXc1 0.49 per cent, higher and FTSE futures FFIc1 rising 0.41 per cent, in early trading.

In Asia, Hong Kong’s Hang Seng rose 1.36 per cent, and Seoul’s Kospi added 1.43 per cent.

In mainland China, blue chips were up 0.72 per cent, and Australian shares were 0.27 per cent higher.

Markets in Japan were closed for a holiday.

The United States and China both said on Friday that they had made progress in talks aimed at defusing their protracted trade war, and U.S. officials said a deal could be signed this month.

But in a note to clients, analysts at National Australia Bank sounded a note of caution.

“As much as the U.S.-China trade updates continue to point to a Phase 1 deal looking like a certainty, the contentious issues on whether the U.S. will cancel the planned December tariffs and remove some of the current tariffs in line with China’s demands remains an unknown and if the issue is not resolved then a deal could easily collapse,” they said.

In comments on Friday, White House economic adviser Larry Kudlow said tariffs set to kick in on Dec. 15, which would cover Chinese imports such as laptops, toys and electronics, would remain on the table, and the decision whether to cancel them would be made by U.S. President Donald Trump.

Any lingering uncertainty over the outlook for trade talks was not enough to keep the S&P 500 from gaining 0.97 per cent and the Nasdaq rising 1.13 per cent to fresh record closing highs on Friday.

The Dow Jones Industrial Average rose 1.11 per cent.

On Monday, U.S. S&P 500 e-mini stock futures ESc1 were up 0.2 per cent at 3,067.8.

U.S. job growth slowed less than expected in October and hiring in the prior two months was stronger than previously estimated, data from the Labor Department showed on Friday.

Those numbers followed a private survey of manufacturers in China that showed better-than-expected factory activity in October.

Rob Carnell, an Asian -Pacific chief economist at ING in Singapore, said some market optimism was “probably justified” in the wake of the positive data.

“Everybody had been looking for a much worse number and it didn’t materialise, so some bounce from that was entirely plausible and reasonable.”

But he added that continued uncertainty over trade talks and less room for monetary easing by global central banks made for a murky outlook.

“It’s difficult to see why you wouldn’t be at least thinking, there is a ‘good profit-taking opportunity right now’ and positioning for a slightly worse outcome,” he said.

While cash treasuries were not trading due to the Japanese market holiday, U.S. 10-year Treasury futures TYc1 were down 0.11 per cent amid the broadly bullish market mood.

The implied yield on the 10-year Treasury futures contract expiring in December TYZ9 was 1.65 per cent.

Oil prices, which had surged on hopes for a U.S.-China trade deal, pulled back on Monday.

Global benchmark Brent crude LCOc1 was off 0.57 per cent at 61.34 dollars per barrel and U.S. West Texas Intermediate crude CLc1 was 0.55 per cent lower at 55.89 dollars.

In the currency market, the dollar was up 0.06 per cent against the yen at 108.23 JPY=, and the euro was up 0.02 per cent to buy 1.116 dollars.

The dollar index .DXY, which tracks the greenback against a basket of six major rivals, was down 0.02 per cent at 97.222.

Those small moves contrasted with a 1.42 per cent jump in the South African rand ZAR= against the dollar.

The currency rallied on relief that Moody’s maintained South Africa’s investment-grade rating on Friday, though the agency cut its outlook on the rating to “negative”.

China’s yuan also strengthened, with the positive market tone around trade talks helping it to rise to a 2-1/2 month high against the dollar. It was last up 0.15 per cent at 7.0267 per dollar.

Gold was slightly lower as investors moved into riskier assets. Spot gold XAU= was trading at 1,511.52 dollars per ounce, down 0.13 per cent.