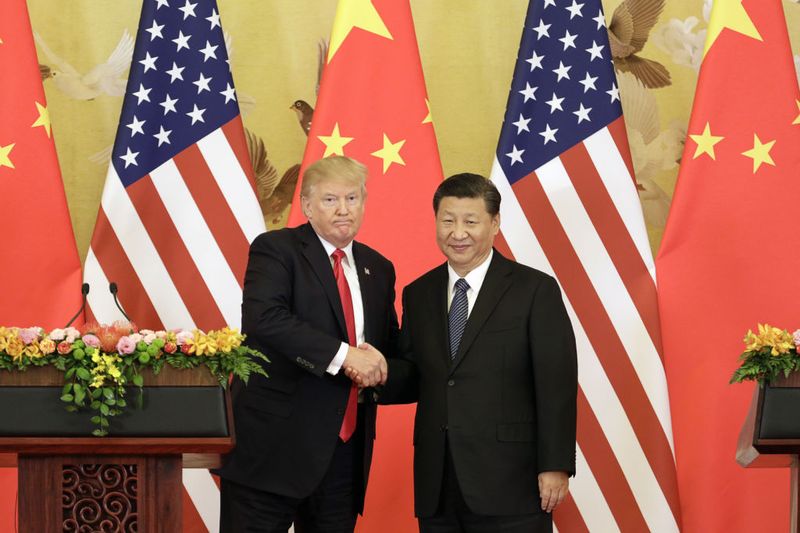

Asian shares twitched either side of flat on Friday reflecting investors’ nervousness ahead of talks between U.S. President Donald Trump and China’s President Xi Jinping that could determine whether the Sino-U.S. trade war gets any worse.

Victor Huang, head of investment strategy at Guotai Junan International in Hong Kong, said markets would be “much more volatile” next week if the two leaders failed to de-escalate their tariff war in talks due to take place on the sidelines of a G20 summit in Argentina this weekend.

By afternoon trade, MSCI’s broadest index of Asia-Pacific shares outside Japan was down 0.2 per cent as an official survey pointed to a slowdown in China’s manufacturing sector.

The index was still set for its best month since January as it bounced from a bruising October.

Shares in Europe looked set for a shaky start.

Spreadbetters CMC Markets expect the FTSE 100 to open 0.04 per cent lower at 7,035, but the DAX is seen opening 0.2 per cent higher at 11,325 and the CAC 40 up 0.3 per cent at 5,020.

In Japan, the Nikkei ended 0.4 per cent higher, while Korean shares dropped 0.8 per cent after the country’s central bank lifted its policy interest rate in a widely expected decision.

Chinese blue-chips advanced 1 per cent despite a survey showing China’s factory growth stalled for the first time in more than two years in November.

The weak manufacturing growth reinforced expectations that Beijing will roll out more economic support measures – a factor that has helped to prop up battered Chinese stocks recently.

U.S. S&P e-mini futures ticked down 0.13 per cent, pointing to a weaker Wall Street session on Friday after a mixed overnight performance.

The Dow Jones Industrial Average fell 0.11 per cent, the S&P 500 lost 0.22 per cent, and the Nasdaq Composite dropped 0.25 per cent on Thursday.

Adding to apprehension ahead of the Trump-Xi meeting , a U.S. official said White House trade adviser Peter Navarro, who has advocated a tougher trade stance with China, would attend.

The mixed signals from Washington about the prospects for a rapprochement with China on trade kept investors on the sidelines.

“Rather than jump at headlines, the market has taken a laid-back approach and prices are treading water until we see the outcome,” analysts at National Australia Bank said in a morning note.

Australian shares under performed regional peers, falling 1.6 per cent as beverage maker Coca-Cola Amatil Ltd , dropped 14.5 per cent on a weak outlook for 2019.

“They billed it as another transformational year which fund managers think means profit growth is not going to be that good,” said William O’Loughlin, investment analyst at Rivkin Securities in Sydney.

Global investors also remain hesitant to shift positions significantly as they seek clarity on Federal Reserve policy direction.

Minutes of the latest Fed policy meeting showed that almost all officials agreed another interest rate increase was “likely to be warranted fairly soon,” but opened debate on when to pause further hikes and how to relay those plans to the public.

The minutes follow comments from Fed Chairman Jerome Powell earlier this week that some took as indicating a dovish shift.

The yield on two-year U.S. Treasury notes, seen as sensitive to expectations of higher Fed fund rates, was at 2.8048 per cent on Friday, down from a U.S. close of 2.813 per cent.

Benchmark 10-year Treasury notes yielded 3.0242 per cent, compared with a U.S. close of 3.035 per cent on Thursday.

The dollar lost 0.07 per cent against the yen to 113.39 , while the euro weakened to $1.1388. The dollar index, which tracks the greenback against a basket of major rivals, was barely lower at 96.766.

In commodities markets, crude prices gave up some gains after earlier rising on news that Russia is increasingly convinced it needs to reduce oil output along with the Organization of the Petroleum Exporting Countries (OPEC).

OPEC and its allies are meeting in Vienna on Dec. 6-7.

U.S. crude was down 0.14 per cent at $51.38 a barrel and Brent crude was flat at $59.51 per barrel.

Spot gold rose 0.03 per cent to $1,223.95 per ounce. (Reuters/NAN)