Two colleagues of FTX co-founder, Sam Bankman-Fried have pleaded guilty to fraud charges filed against them by the Department of Justice (DoJ).

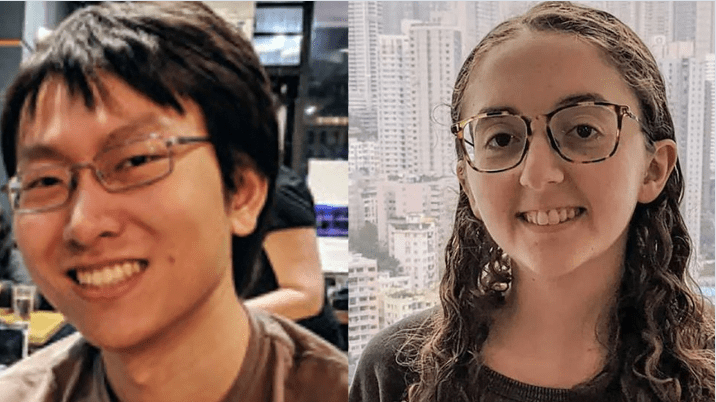

U.S. Attorney Damian Williams on Wednesday confirmed in a statement that the Southern District of New York (SDNY) of DoJ filed charges against Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang.

Williams also confirmed that the duo admitted to the charges and have agreed to cooperate with authorities in their ongoing investigations.

“Both [Ellison and Wang] have pleaded guilty to [the] charges. And they are both cooperating with the [SDNY],” the statement read in part.

Read Also: FTX Founder Sam Bankman-Fried Arrested in Bahamas

The US attorney did not specify what charges Wang and Ellison pleaded guilty to.

However, he said the announcement would not be the last his office makes concerning its investigation into FTX.

“Let me reiterate a call I made last week. If you participated in misconduct at FTX or Alameda, now is the time to get ahead of it. We are moving quickly and our patience is not eternal,” Williams said.

Williams disclosed that FTX co-founder Sam Bankman-Fried (SBF) is now in custody with the U.S. Federal Bureau of Investigation (FBI) and is on his way back to the United States.

He said that SBF would appear before a judge as soon as possible.

Meanwhile, the US Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC) also announced on Wednesday that it had filed civil charges against Ellison and Wang.

“As part of their deception, we allege that Caroline Ellison and Sam Bankman-Fried schemed to manipulate the price of FTT, an exchange crypto security token that was integral to FTX, to prop up the value of their house of cards.

“We further allege that Ms Ellison and Mr Wang played an active role in a scheme to misuse FTX customer assets to prop up Alameda and to post collateral for margin trading. When FTT and the rest of the house of cards collapsed, Mr Bankman-Fried, Ms Ellison, and Mr Wang left investors holding the bag. Until crypto platforms comply with time-tested securities laws, risks to investors will persist,” SEC’s Chairperson Gary Gensler said.

The SEC also said the duo was cooperating with its ongoing investigations.

CFTC’s charges show that Wang added special features to FTX’s code to bolster Alameda Research.

“As alleged in the amended complaint, Wang created features in the code underlying the FTX trading platform that allowed Alameda to maintain an essentially unlimited line of credit on FTX.” the agency said.

It added, “Ellison and Wang do not contest their liability on the CFTC’s claims. Both have agreed to the entry of consent orders of judgment as to their liability for engaging in fraud in violation of Section 6(c)(1) of the Commodity Exchange Act and CFTC Regulation 180.1.”

CFTC’s Chairman Rostin Behnam said the agency moved “aggressively to hold all individuals who commit fraud accountable and protect customers from additional harm and losses”.