$AMD is a is a global semiconductor company. The Company operates through four segments: Data Center, Client, Gaming, and Embedded. The Data Center segment includes server central processing units (CPUs) and graphics processing units (GPUs), data processing units (DPUs), field programmable gate arrays (FPGAs) and adaptive system-on-a-chip (SoC) products for data centers.

The Client segment includes CPUs, accelerated processing units (APUs) that integrate microprocessors and GPUs (APUs), and chipsets for desktop and notebook personal computers. The Gaming segment includes discrete GPUs, semi-custom SoC products and development services.

The Embedded segment, which primarily includes embedded CPUs and GPUs, FPGAs, and adaptive SoC products. The Company’s CPUs for desktop platforms include the AMD Ryzen and AMD Athlon series processors. Its mobile APUs include AMD Ryzen and AMD Athlon mobile processors for the commercial and consumer markets

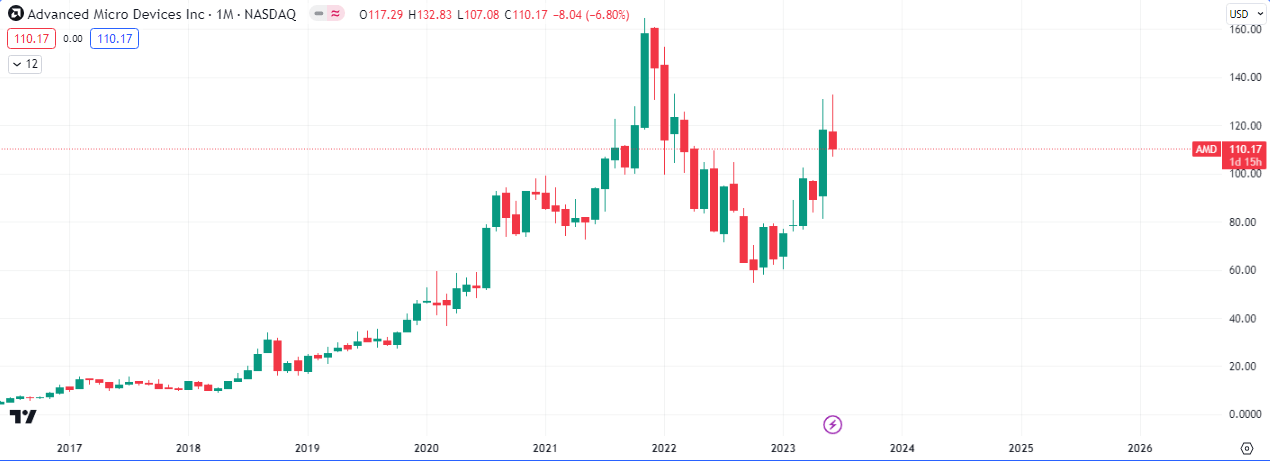

$AMD has not been left out in the recent technology rally that has led the broader equity market upwards over the last couple of quarters. The gaming chip maker has rebounded off lows established this year but the technical market structure has left some questions unanswered.

The drop in 2022 created a break of structure that they are yet to overcome, as the price is still within the bracket range of $160-$60.

The month of April, this year, could not close above a key selling imbalance that was created March 2022 and this was followed by a red close in May. This scenario has set up a possible drop to at least $70 where an unfilled gap was created in January. This drop could continue to $50 due to the break of structure created in late 2022.

This bearish narrative may be overturned by a surge in volume around the $90-$80 range, that would rally to the resistance level of $152, where the next large sell orders were.