The S&P 500 $SPX fell about 0.3% Monday, while the the Dow Jones Industrial Average $DJI dipped 0.4%. The tech-heavy Nasdaq Composite $NDAQ closed 0.3% lower after setting new record closes on Friday.

The Fed helped fuel the market’s bull run last week, as the central bank reaffirmed expectations that it will cut rates three times this year while also issuing more bullish forecasts on the economy.

Meanwhile in the oil market, Russia’s government has ordered oil companies to lower their output in the second quarter so that the country can meet its OPEC+ production target of 9 million barrels per day (bpd) by the end of June.

Russia would cut oil output and exports by an extra 471,000 barrels per day (bpd) in the second quarter, in tandem with production cuts by other OPEC+ members

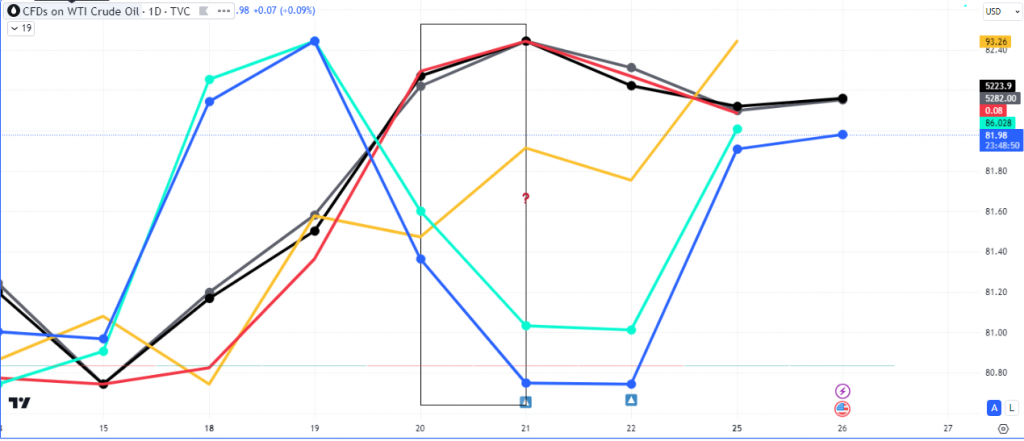

Coming into this week the spread that had emerged on the Equity-Risk-Oil basket was skewed towards a rise in the price of oil, as discussed here.

Through the Asian, European and US session, the spread closed for a ‘double alpha’ mean reversion trading opportunity.

In the chart above, the price of both oil benchmarks diverged from the rest of the markets (equities, vix, and energy stocks)

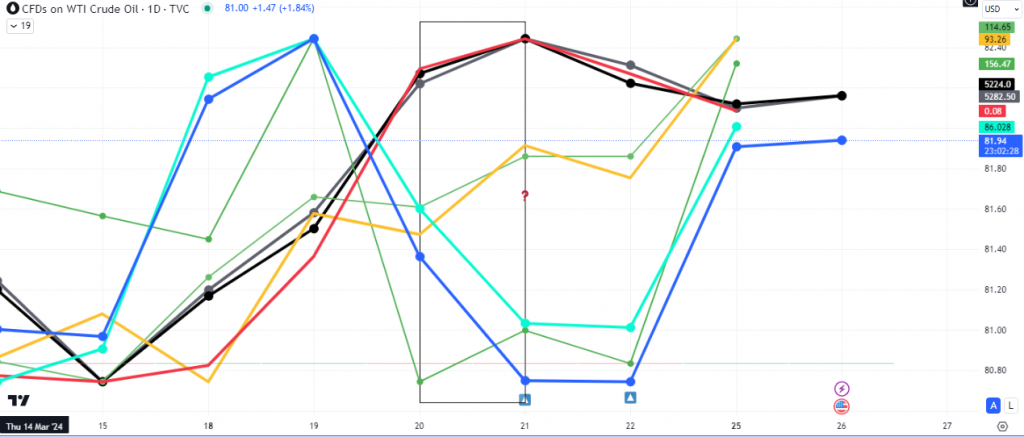

The chart above is almost the same as the previous chart except this one has oil companies ($XOM and $CVX), from $XLE, included in it (Green Lines).

Each of the Yahoo Finance’s oil stock picks have been in an uptick since their call in January and yesterday was no exception with a 1.5% gain recorded on $XOM and $CVX at the closing bell.

Turn on notifications for more interesting updates.