Investors kept bidding the equity markets higher throughout last week and even in the early hours of today’s trading session, although some cracks have started emerging in this bullish narrative. The risk on sentiment, on the surface at least, seems to be spurred on by a cratering US dollar and the drop in yields in the 10Y treasury market.

At the closing bell on Friday, the dollar index ($DXY) recorded it’s biggest weekly loss since November 2022. Negative surprises from the CPI release midweek certainly helped to catalyze the sell off and this gave a lift to the equity markets as well as the majors.

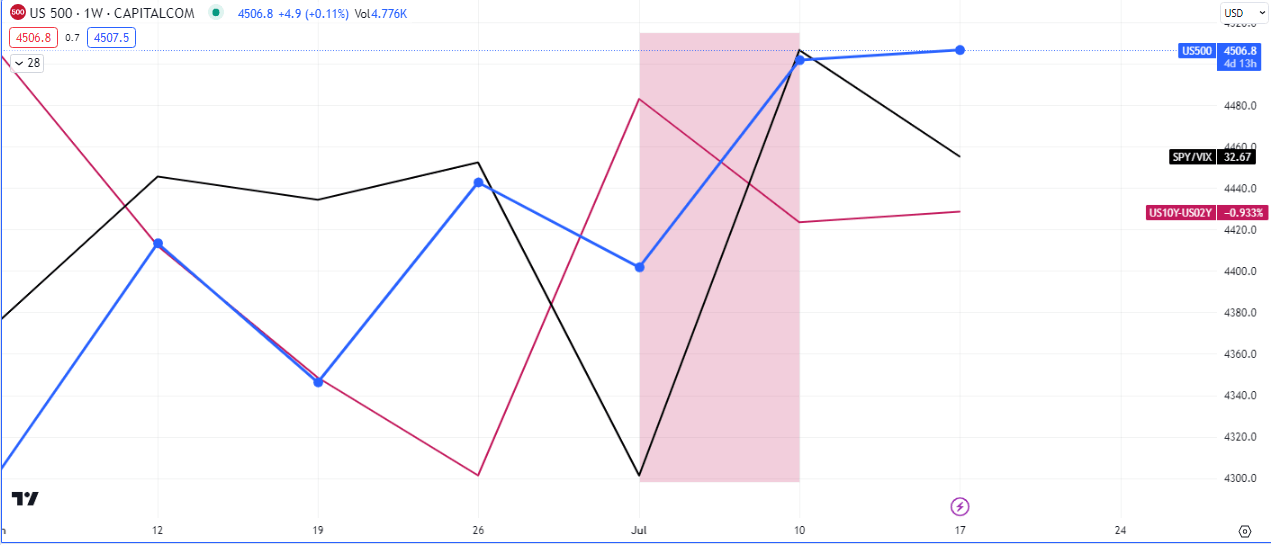

The US treasury curve US10Y-US02Y (inflation vs growth) lost some steam last week, to the tune of -6.5%, while the $VIX dropped -10.5%.

The situation on the $VIX must be watched closely as it is trading at extreme lows set during the pandemic in 2020, therefore there is a high chance of a spring occurring sooner or later. The monthly close should shed light on that situation.

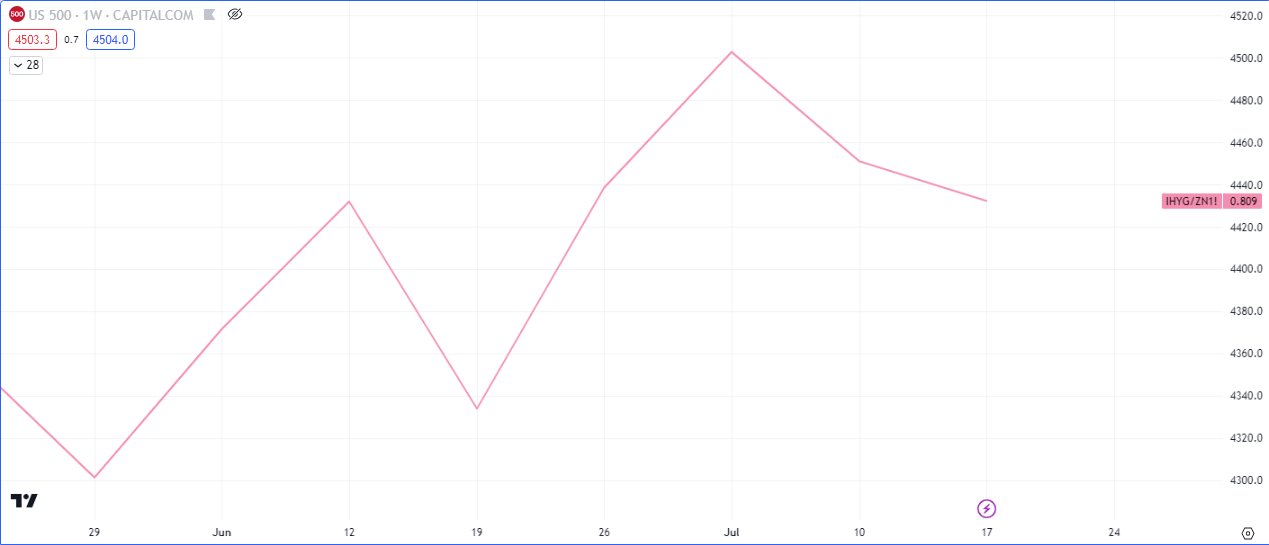

Another metric to keep an eye on the difference between high yield corporate bonds and US 10Y treasury bonds. This order flow between these two instruments can show elements of risk appetite or aversion and we have seen HYG drop relative US10Y over the last two weeks. This can be one of the components of a risk off sentiment especially when a spread develops between it and the S&P500, Nasdaq100 and Dow30.

For now the $SPX is still trading above its 20SMA and 200SMA so the trend still remains bullish however the $NDAQ and $DOW have failed to close above key resistances which leaves questions about a shallow or a deep reversal open.