Black Diamond Therapeutics (NASDAQ:BDTX) stock gaining massively on Tuesday after releasing data from the dose escalation portion of a Phase 1 clinical study. $BDTX, which had lost nearly 100% of it’s share price value saw it’s share price rally nearly 300% on the day.

That trial covers the use of BDTX-1535 as a treatment for non-small cell lung cancer (NSCLC) and glioblastoma multiforme (GBM).

New data shows clinical proof of activity of BDTX-1535 in NSCLC patients “harboring both acquired resistance and intrinsic driver EGFR mutations.”

As a result of this, $BDTX is preparing for several more milestones for BDTX-1535. That includes additional clinical trial data later this year, as well as a meeting with the U.S. Food and Drug Administration (FDA) in the fourth quarter of 2023 to discuss its dosing strategy for the accelerated approval of the drug.

Sergey Yurasov, Chief Medical Officer of Black Diamond Therapeutics, said the following about the results:

“These initial safety and clinical activity data support the continued development of BDTX-1535 as a potential first and best-in-class treatment option for osimertinib-resistant NSCLC patients.”

The gap on the chart shows there is room for a fill back down to $2.

After falling from $44 to almost $0 over a period of 2 years, could $BDTX finally be on a rebound?

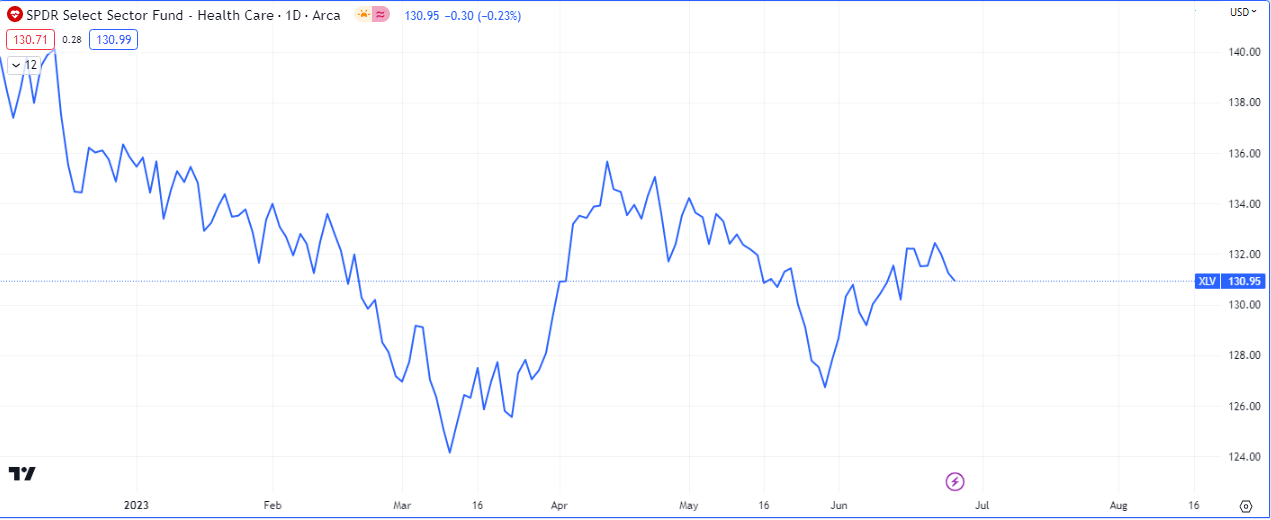

The healthcare sector index ETF, $XLV, made a recovery this year but is currently trading above the middle of the range area of the year. Usually this instrument is positive during the late growth phase of the economic cycle or during recessions.