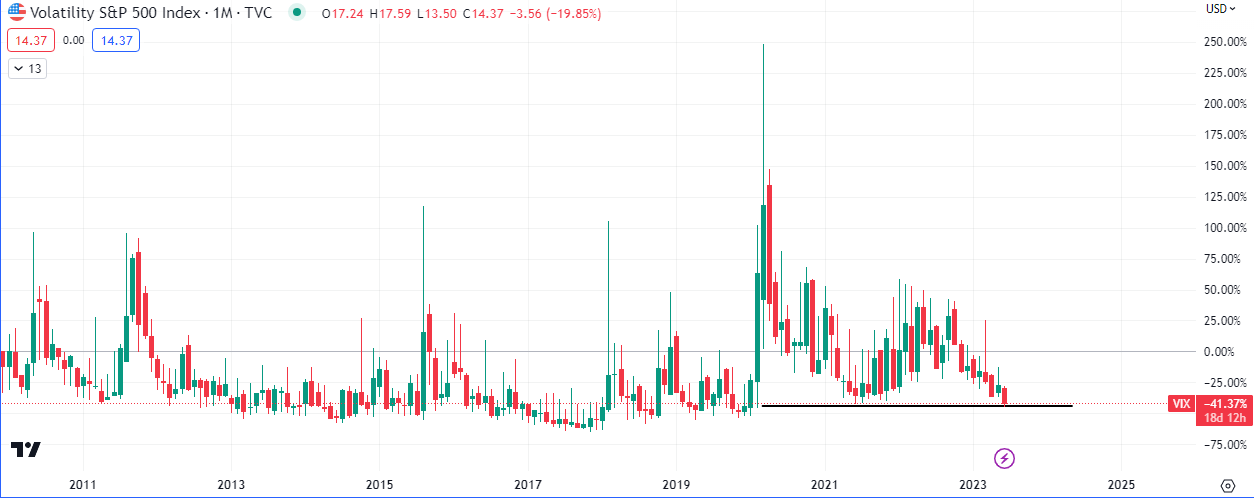

The “Fear Index” is now at the 14 year old lows of the largest percentage gains made on the $VIX in 20 years. These massive buying demand imbalances were initiated during the Covid-19 crises of 2020, the ‘lockdown’ spike as some call it.

There are billions of dollars worth of liquidity around 14.485 and the closes and volume in this area may have some strong retracements (spikes).

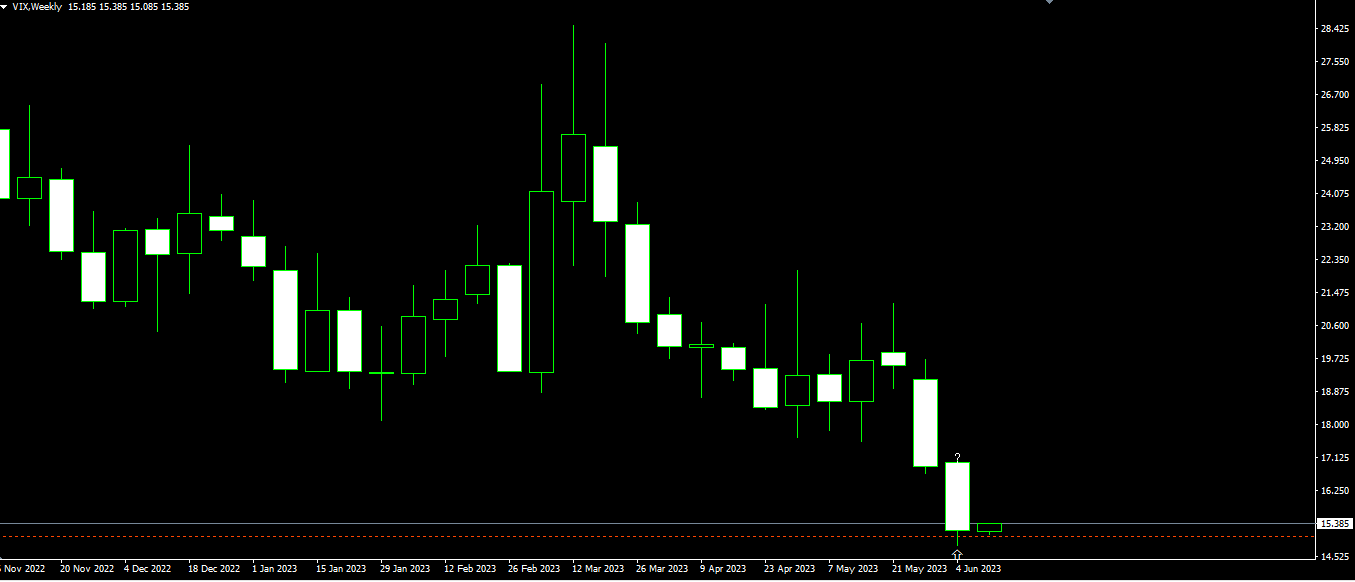

The low from 2020 is being tagged now and although it an extreme at a possibly oversold area, all the evidence still points to a move south, except on the WEEKLY chart.

The only clues price action is offering is the pullback from last week’s close. This price action opens the door to the possibility of price retesting the highs of last week and possibly the high of May itself. This depends on how price CLOSES this Friday.

A bearish close keeps this crawling down slowly but a bullish close sets up a chance for a rise to test higher resistance. The latter would be bearish for $SPX, $NDAQ, $DOW and $RUS3000, especially if it coincides with a resurgent dollar.

Read up on our call at the top of the current decline on $VIX and the bottoms of the current equities ‘AI fuelled’ rally, HERE, HERE and HERE.