Over the past 7 months, the US equity market has found a ‘spring’, albeit a ‘surprising’ one. $SPX, $NQ and $DOW caught a bid, although the latter, $DOW, has floundered over the last 5 weeks. The A.I fueled boom seems to be inducing a lot of FOMO and also forcing bearish market participants to puke their positions as price keeps rallying.

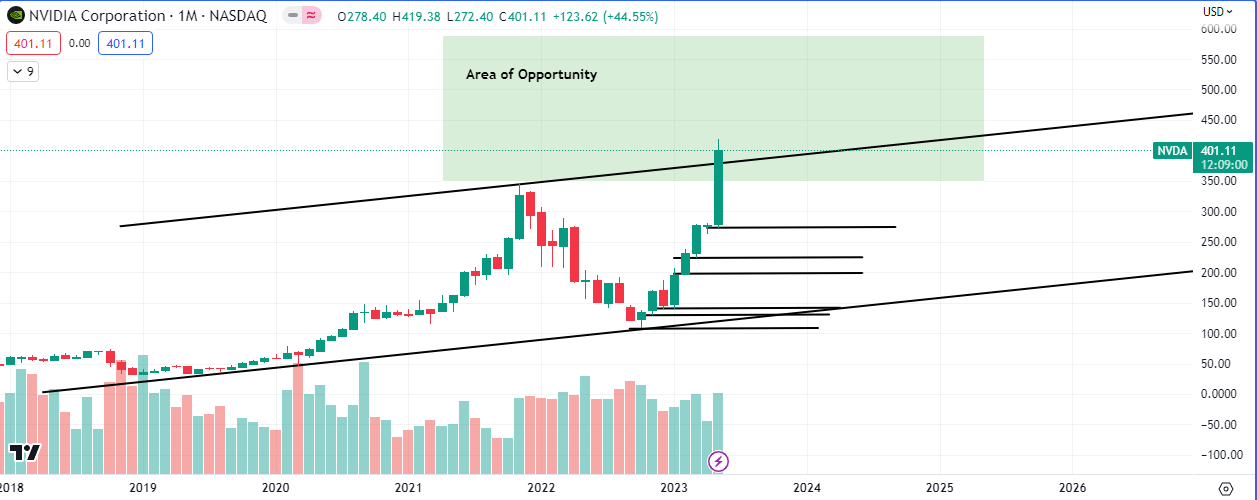

From all indications the rally has been fueled, at least to a large extent, by the boom in artificial intelligence companies. These mega cap stocks like $MSFT, $GOOG and $NVDA have all rallied strongly on news of advancements in AI technology and it’s applications. $NVDA attained a $1 trillion market capitalization a few days ago, although some analysts wonder if this is due to panic buying of chips due to the backlog from the COVID19 pandemic.

A slew of strong earning reports over the last quarter also catalyzed strong moves, however the overhanging clouds of rising interest rates, slow economic activity and the turmoil in the banking sector persists.

Given the nature of the market, we know that rallies can occur despite massive worries, if the conditions are right. That means that uncertainty and worry are part of the mix that sometimes spurs price imbalances.

There are some ‘signposts’ that show some institutional trading activities that can be used to view larger picture narratives about what is really going on in the broad market. These ‘signposts’ reveal institutional rotations spurred by cycles, fear, greed, uncertainty and other factors.

Below we take a look at some relative values as relates to some of the mega cap stocks on the $NDAQ, to get a better view of what the larger market players were up to before and during the rally. Using Alphabet ($GOOG) as a lynchpin, we compare the relative values to see how it affected the likes of $MSFT, $NVDA and $AMZN.

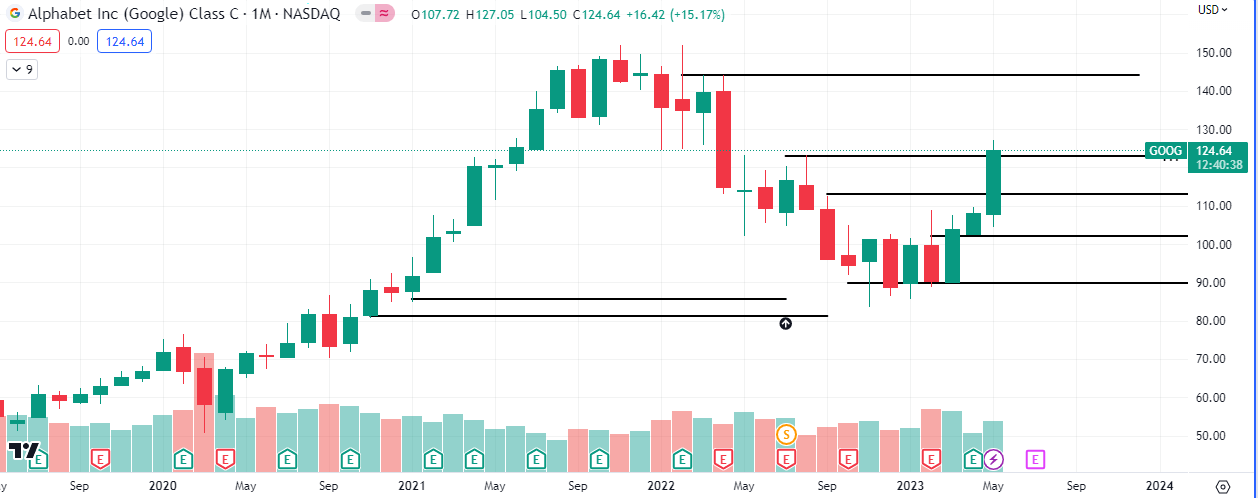

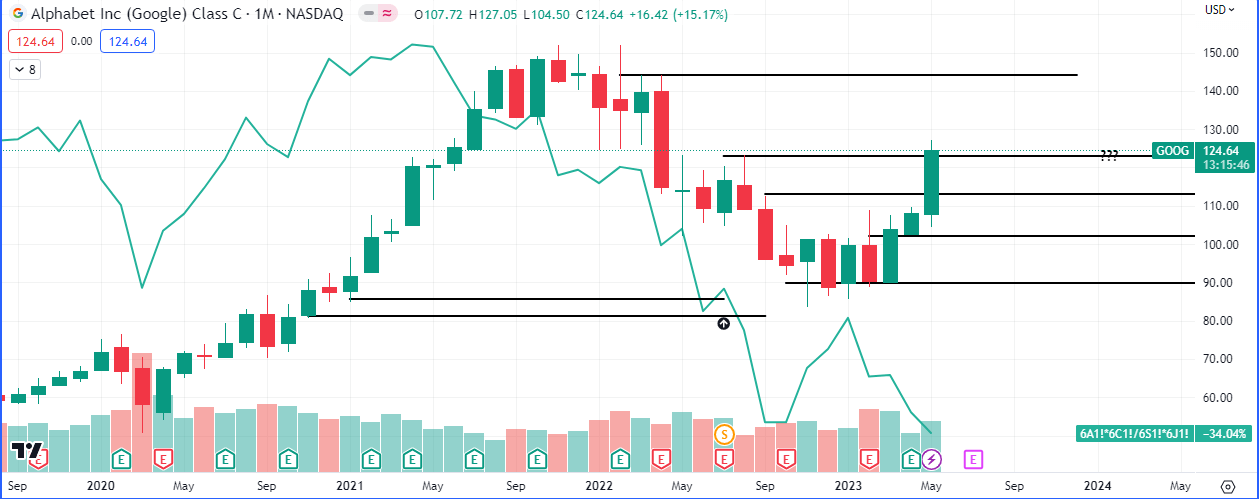

The monthly chart of $GOOG shows that today’s close (monthly close) is crucial. A close below $123.26 could spur a $24 drop in price to $100. A close above $123.26 takes price to $144/share.

It is worth noting that the last 3 months of bullish price action coincided with announcements of progress on the Google’s Bard AI project. Barring strong earning last month and stronger expected earnings later in the year, one has to wonder if this is an “A.I fuelled” rally.

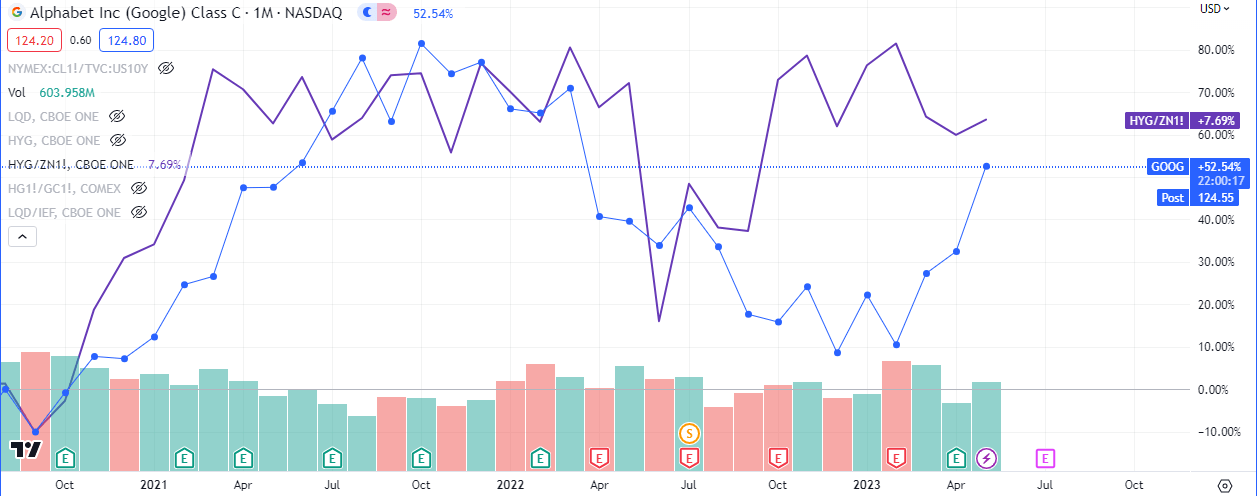

Demand in riskier high yielding corporate bonds and a converse drop in demand in 10Y treasuries, usually indicates that bond traders are keen on the stock market and less interested in holding government debt. It is a sign of increased risk appetite and probable economic expansion and growth.

In the chart above we can see that a spike in interest in High yielders started in the middle of last year, 2022. $GOOG was still tumbling when this started and a spread occurred in the positive correlation over some months. Eventually the tech giant’s share price found a bottom as institutions piling into the stock marked it up.

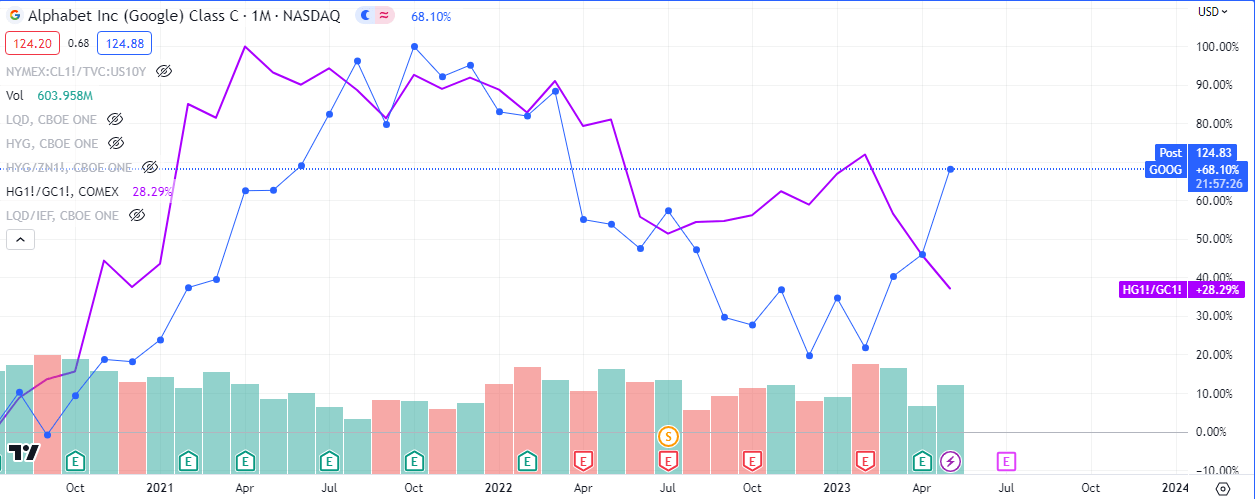

The chart above is in disagreement with the bullish narrative on $GOOG. Demand for industrial metals versus precious metals has been negative, with a drop in copper and a rise in gold prices creating a spread that can still close.

Copper may find a bid if economic activity picks up and gold could go offered simultaneously. For now the spread persists and a catalyst for this is not yet obvious. The close of the spread could also just manifest as an increase in demand for copper, economic expansion, and a pull back in stocks. This pullback may not be deep.

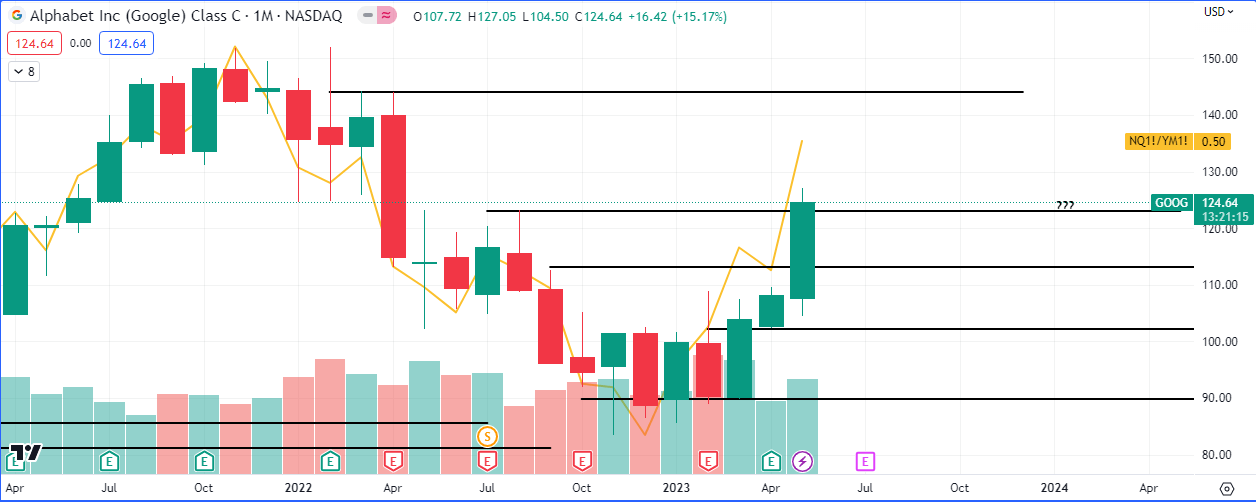

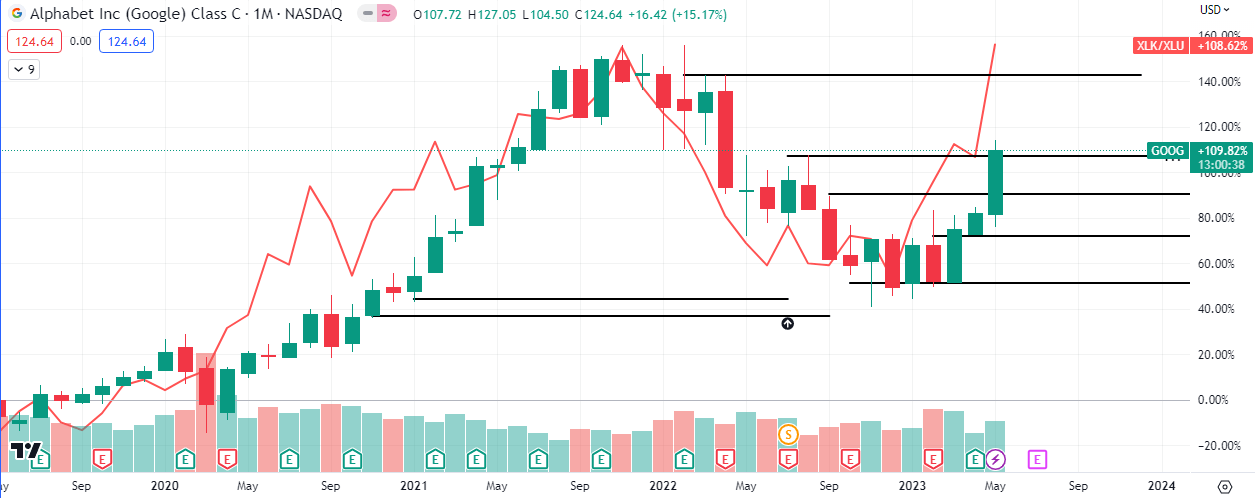

As expected the ratio between the index with a high price to earning ratio is up strongly in this environment.

The most worrying sign is the ration between high beta currencies and low beta currencies. This acts as a gauge for risk and inflations and it is not looking pretty for the Aussie and Canadian dollar, which are both high yielders and tied to commodities.

This is a worry for stocks as the spread is very likely to close, at least to the median point.

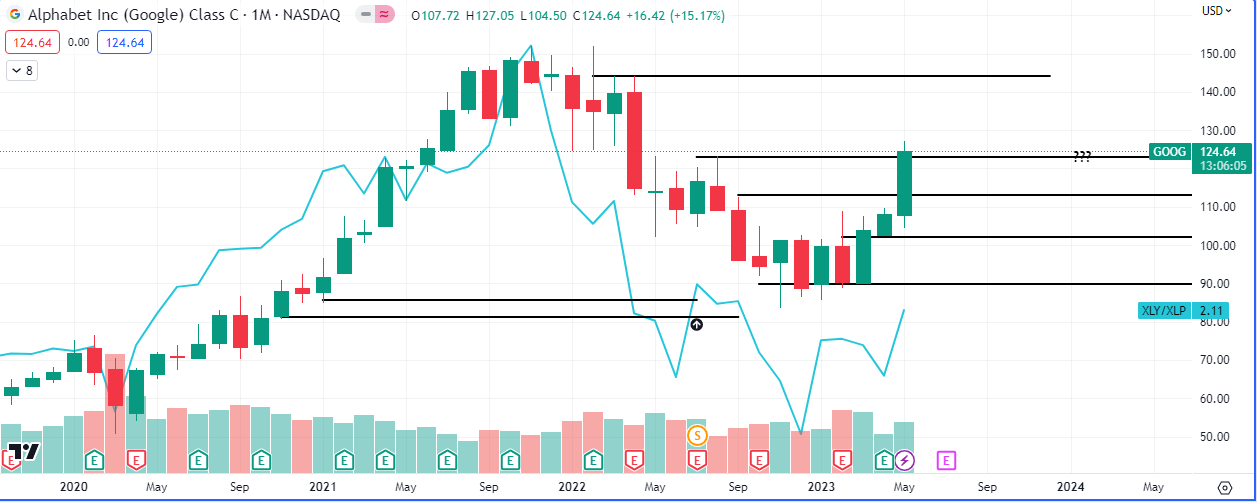

The discretionary sector caught a bid from late November and has not looked back since, while staples tanked. This was a good catalyst for a risk on sentiment and we saw $GOOG respond accordingly.

The tightest correlation can be found with XLK, the tech sector index. The strength in tech and the weakness in utilities is strongly bid and inline with the bullish narrative.

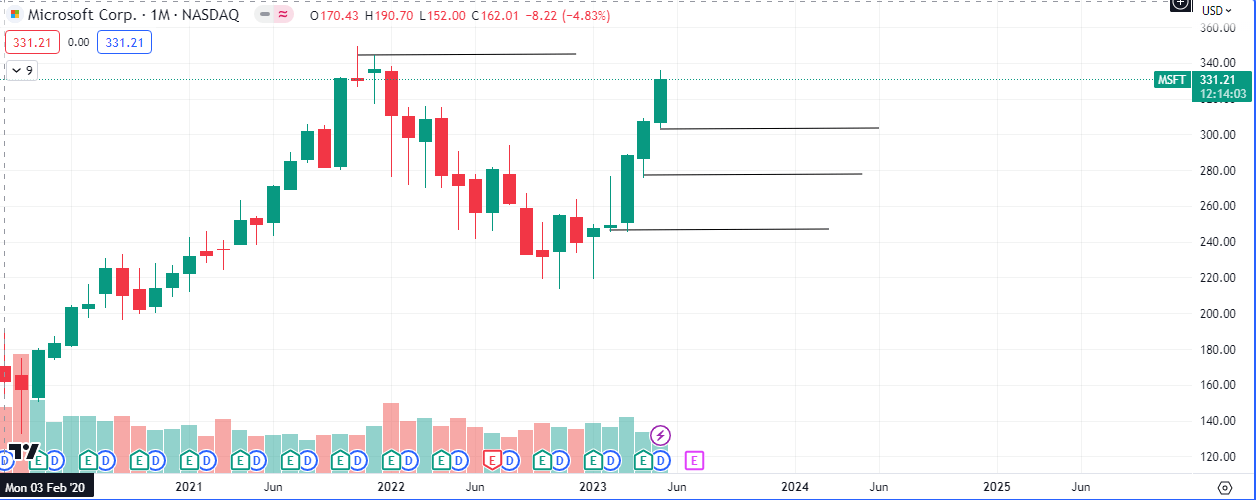

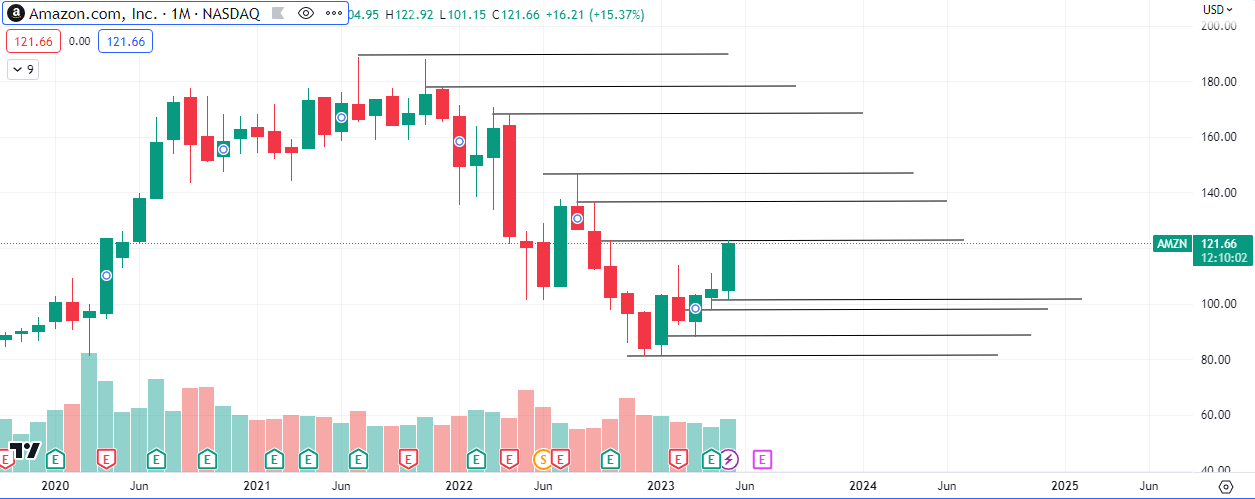

Below are the monthly charts for some of the other mega cap stocks. We can juxtapose the information above on them as well.

Now let us take a look at some other partly “A.I fuelled” rallies.

$MSFT is leading in the AI race with it’s investment in ChatGPT and it is $20 away from breaking it’s all time high. The tech giant has integrated the AI system into the latest versions of it’s Bing search engine.

$AMZN the ecommerce giant is far from it’s all time high and is just approaching the midpoint of the consolidation. Amazon’s Lex enables developers to build chatbots using conversational AI in applications. It uses automatic speech recognition to convert speech to text and natural language processing (NLP) to understand spoken instruction.

The chip maker, which recently announced that is developing an AI supercomputer, is currently leading the pack as it has broken it’s all time high. We can expect a further expansion to around $590/share.

Conclusion

The die is cast for the bulls, there are some resistances to still overcome but the supports in place also look formidable. Shorter term intraday technical analysis may serve well to structure risk taking in this environment.