Trading on May Day, Worker’s Day, was dominated by a continuation of the risk on sentiment that has been predominant for the past month.

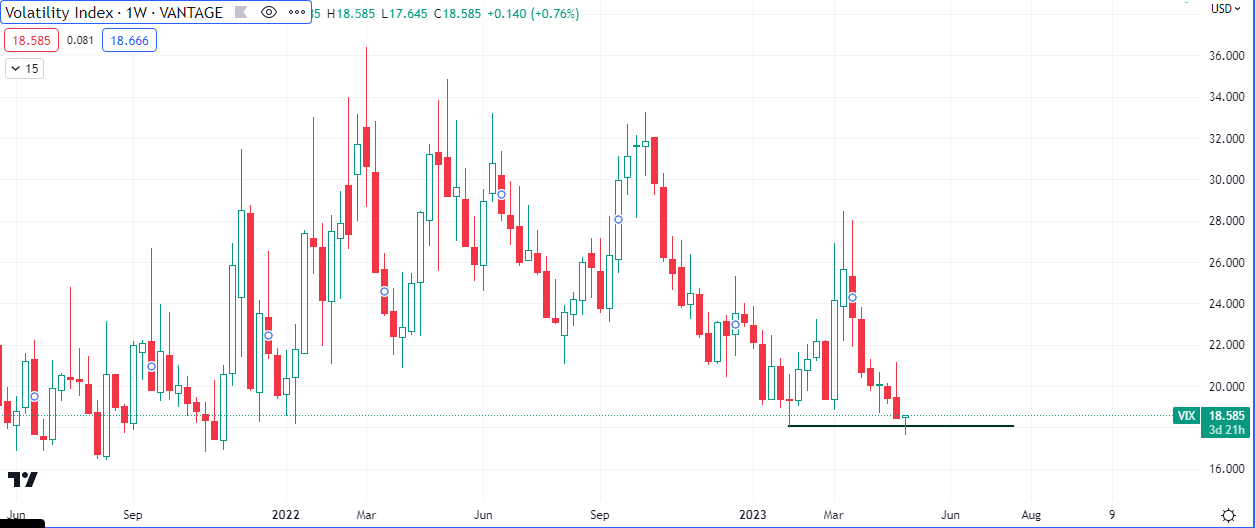

The ‘fear’ index ($VIX) finally crossed weekly lows into what should be oversold territory and the US Dollar dominated it’s peers on the day with the DXY surging by as much as 0.44% against the majors.

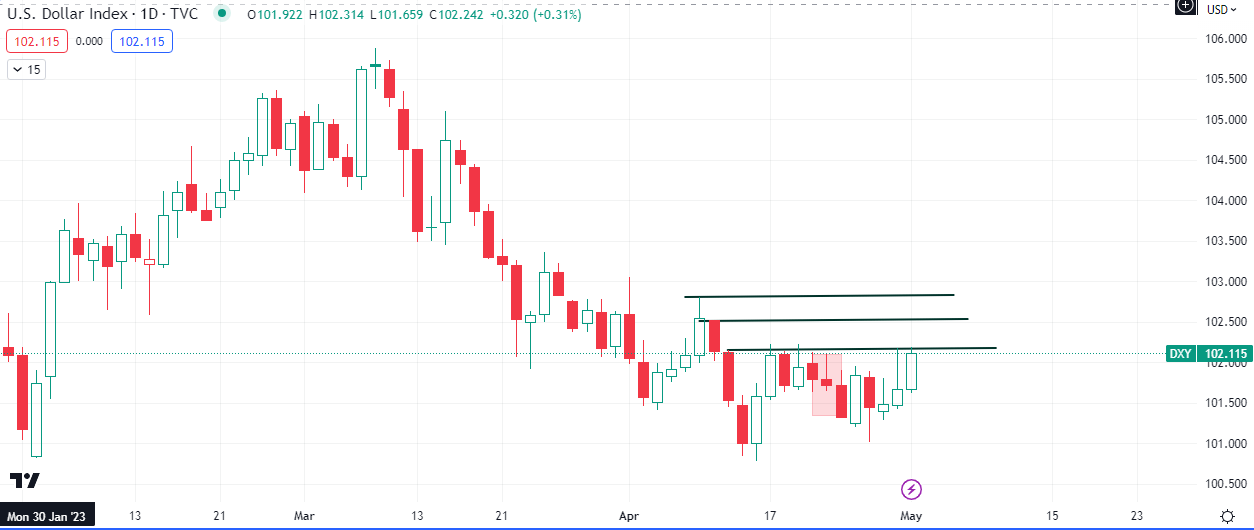

The greenback, however is still under the threat of a bearish reversal until it closes above the highs of April, as shown in the chart below.

As price advances, the closes will give clues as to the strength of the rally and how far it may go although the weekly support that commenced in mid April has a likely target of 104.000.

$VIX crossed weekly lows although it did manage to close with a minor pullback of 0.76%. A divergence in the direction of the $VIX and DXY usually leads in the close of the spread, with both instruments reverting back to the mean of the spread.

The $SPX, $NDAQ and $DOW all had minor pullbacks of 0.24%, 0.27% and 0.26% respectively.

First Republic Bank $FRC failed today, with JP Morgan swooping in to take over it’s deposits. This year, it’s share price has plummeted from around $140/share to $3.50, at the close of trading today.

According to the FDIC announcement, JPMorgan would assume all of First Republic’s $92 billion in deposits — insured and uninsured, including the $5 billion in deposits given by JPM to First Republic on March 16. It is also buying most of the bank’s assets, including about $173 billion in loans and $30 billion in securities.

Spreads to watch this week

The currency pairs EURUSD and CADJPY both closed at a premium, +0.26% and +1.61%, relative the energy market on Friday.

WTI -1.40%

BRENT -1.76%

GASOLINE FUTURES -3.56%

CRACK SPREAD -22.80%

EURUSD promptly closed the today lower by -0.44%, with more bearish pressure likely if the dollar index keeps on strengthening.