Did you know that central banks set a record for the amount of gold bought in 2022? The apex banks around the world bought more gold last year than any other in the past 55 years—since 1967?

Many people talk about how Richard Nixon unpegged the US Dollar from the gold standard but they are not aware of the events, beyond inflation, that led to this decision.

The United States’ and Western Europe’s central banks made an agreement they labeled “The London Gold Pool”, to stabilize the price of gold. The goal was to maintain the price of gold at $35 per ounce by collectively buying or selling gold as needed.

However, in 1967 the London Gold Pool collapsed due to a shortage of gold and increased demand for the metal. That was because European central banks bought massive amounts of gold as they began to doubt the US government’s promise to back the dollar to gold at $35/ounce. The buying depleted the London Gold Pool’s reserves and pushed the price of gold, thereby starting a domino effect of events that eventually ended the Bretton Woods international monetary system, which had been established at the end of World War 2.

This event catalyzed the decoupling of the US dollar to gold in 1971, resulting in the fiat currency that is not backed by anything.

It is clear that a paradigm shift in the international monetary system is imminent as central banks are stampeding to buy as much gold as they possibly can.

What does all this have to do with China and the Petroyuan?

According to the Financial Times, the big buyers of gold in 2022 were China and Middle East oil producers. That’s not a coincidence, as these countries will be at the center of the changes to the international monetary system.

It is well known that China has been stashing away as much gold as possible for many years. Most observers believe that the exact amount of gold China has is many multiples of what the government declares.

China is the world’s largest producer and buyer of gold. Most of that gold finds its way into the Chinese government’s treasury.

“A new paradigm of all-dimensional energy cooperation.” These were the words of Xi Jinping at a historic visit to Saudi Arabia and other GCC states.

The GCC includes Saudi Arabia, Kuwait, Qatar, Bahrain, Oman, and the United Arab Emirates. These countries account for more than 25% of the world’s oil exports, with Saudi Arabia alone contributing around 17%. In addition, more than 25% of China’s oil imports come from Saudi Arabia.

China is the GCC’s largest trading partner.

The meetings reflect a natural—and growing—trade relationship between China, the world’s largest oil importer, and the GCC, the world’s largest oil exporters.

During Xi’s visit, he made the following crucial remarks;

“China imports large quantities of crude oil from GCC countries, expand imports of liquefied natural gas, imrovr cooperation in upstream oil and gas development, engineering services, storage, transportation and refining, and make full use of the Shanghai Petroleum and National Gas Exchange as a platform to carry out yuan settlement of oil and gas trade.”

After years of preparation, the Shanghai International Energy Exchange (INE) launched a crude oil futures contract denominated in Chinese yuan in March 2018. It’s the first oil futures contract to be traded in China. The contract is based on Brent crude oil, the global benchmark for oil prices, and is settled in cash.

Since then, any oil producer can sell its oil for something besides US dollars… in this case, the Chinese yuan.

The INE yuan oil futures contract provides a new pricing benchmark for the global oil market, which the US dollar has traditionally dominated. By trading in yuan, the contract is expected to increase the use of the Chinese currency in global trade and reduce the reliance on the US dollar.

Its significance lies in its potential to shift the balance of power in the oil market away from the US and towards China and to increase the use of the Chinese yuan in global trade.

However the problem is that most oil producers don’t want to accumulate a large yuan reserve. That’s why China has explicitly linked the crude futures contract with the ability to convert yuan into physical gold—without touching China’s official reserves—through gold exchanges in Shanghai (the world’s largest physical gold market) and Hong Kong.

PetroChina and Sinopec, two Chinese oil companies, provide liquidity to the yuan crude futures by being big buyers. So, if any oil producer wants to sell their oil in yuan (and gold indirectly), there will always be a bid.

After years of growth and ironing out the details, the INE yuan oil future contract is now ready and Xi is confident they can deliver.

Why is China purchasing oil and gas from the GCC in yuan important? Because it undercuts the petrodollar system, which has been the bedrock of the US and international financial system since the Bretton Woods system broke down in 1971.

For nearly 50 years, the Saudis had always insisted anyone wanting their oil would need to pay with US dollars, upholding their end of the petrodollar system, but that all changed recently.

After Xi’s historic visit, the Saudi government isn’t hiding its intention to sell oil in Yuan. According to a recent Bloomberg report:

“Saudi Arabia is open to discussions about trade in currencies other than the US dollar, according to the kingdom’s finance minister.”

In short, the Saudis don’t think the US is holding up its end of the petrodollar deal. So they don’t feel like they should hold up their part.

The lack of full support by the US in the war in Yemen, the shabby withdrawal from Afghanistan and nuclear negotiations with Iran were a big part of this decision.

China, which is 4 time larger than the U.S, is already the world’s largest oil importer. Moreover, the amount of oil it imports continues to grow as it fuels an economy of over 1.4 billion people.

Due to the sheer size of the Chinese market it was impossible for Saudi Arabia—and other oil exporters—to ignore China’s demands to pay in yuan forever, especially with the extra incentive of Shanghai International Energy Exchange thrown into the mix.

The Saudi move could chip away at the supremacy of the US dollar in the international financial system, which Washington has relied on for decades to print Treasury bills it uses to finance its budget deficit.

In a speech, Ron Paul, a physician and politician, who is a known critic of the current monetary system said;

“The economic law that honest exchange demands only things of real value as currency cannot be repealed. The chaos that one day will ensue from our experiment with worldwide fiat money will require a return to money of real value. We will know that day is approaching when oil-producing countries demand gold, or its equivalent, for their oil rather than dollars or euros. The sooner the better.”

The end of the petrodollar system is imminent.

The petrodollar system provides at least three immediate benefits to the United States. It increases global demand for US dollars. It also increases global demand for US debt securities and it gives the United States the ability to buy oil with a currency it can print at will.

There will be a lot of extra dollars floating around that are not needed to purchase oil. As a result, trillions of dollars of oil money that would typically flow through banks in New York in US dollars into US Treasuries will instead flow through Shanghai into Yuan and gold.

The Yuan is not freely convertible to any other currency, especially to the gold reserves of China. The capital controls that China and the US have in place are world’s apart. China will probably allow convertibility in countries like Saudi Arabia and Brazil, in the meantime.

Right now, China is the number one exporter on the globe, the largest crude oil importer and also the world’s biggest economy with a GDP of $30.0 trillion in 2022 compared to $22.9 trillion for the United States or 31% bigger based on purchasing power parity (PPP).

The petrodollar system provides at least three immediate benefits to the United States. It increases global demand for US dollars. It also increases global demand for US debt securities and it gives the United States the ability to buy oil with a currency it can print at will. In geopolitical terms, the petrodollar lends vast economic and political power to the United States. China hopes to replicate this advantageous dynamic.

During a summit meeting with heads of State of the Gulf Cooperation Council (GCC) countries in Riyadh, president Xi Jinping demanded that Arab Gulf countries should accept the petro-yuan as payment for Chinese crude imports. The GCC countries can’t refuse President Xi’s demand since 75%-80% of their oil exports go to China. Moreover, China has become the largest destination for their investments.

Sooner or later Saudi Arabia and other GCC countries will adopt the petro-yuan as a means of payment for their oil exports to China. This would reduce the petrodollar’s share in the global oil trade by 22%.

And with China paying for its estimated 12.0 million barrels a day (mbd) of crude imports in petro-yuan, Russia selling its 8.0 mbd of exports in ruble, Venezuela and Iran already accepting the petro-yuan for their exports and India paying in rupees for its 5.0 mbd of crude imports, the petrodollar will certainly lose an estimated 60% of its global oil trade.

Between them, Saudi Arabia and the other GCC countries, China, Russia, India, Venezuela and Iran account for 44.49 mbd of global oil trade or 63% leaving the remaining 25.91 mbd or 37% for the petrodollar, euro, yen, rupee and other currencies.

Moving oil trade out of the petrodollar into the petro-yuan could take away an estimated $1.62 trillion worth of transactions out of the petrodollar annually based on an average Brent crude oil price of $100.0 a barrel.

China has been accumulating an unprecedented amounts of gold in support of the petro-yuan.

The petrodollar is backed by US treasury bills so it can help fuel US deficit spending. Contrast this with a petro-yuan convertible to gold. In effect, China is offering customers oil contracts payable either in petro-yuan or gold.

By undermining the petrodollar, China will also be undermining both the US financial system and the US economy. This could probably lead to a devaluation of the dollar by one quarter to one third of its current value.

It is very likely that the Yuan will be the world’s main reserve currency and the petro-yuan will become the leading global oil currency.

Some Gold Price Action

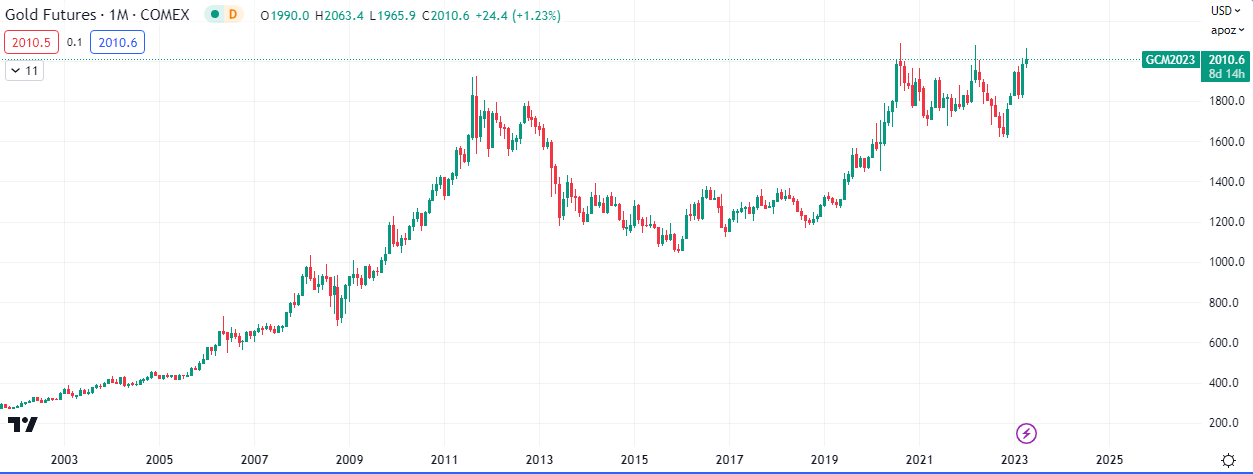

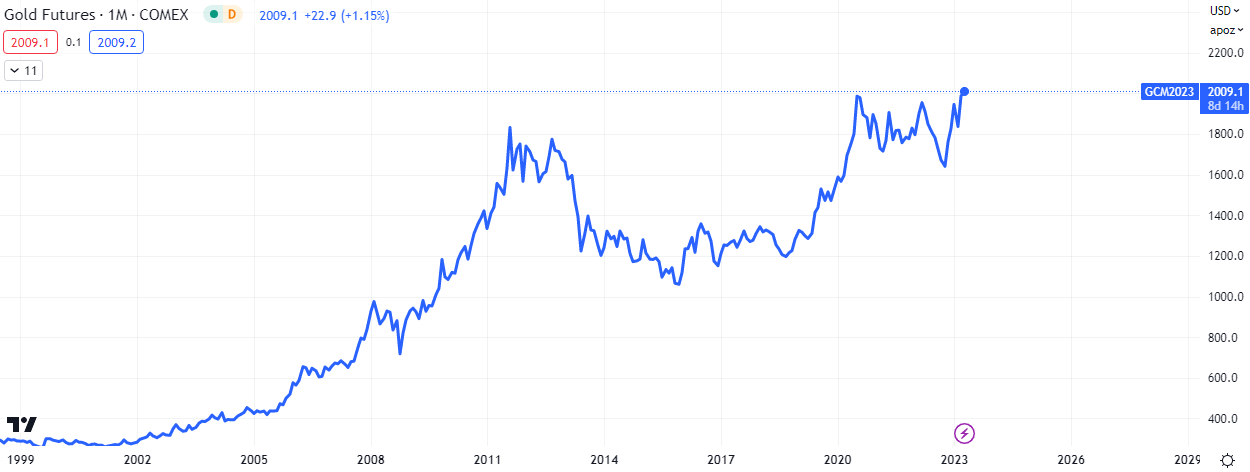

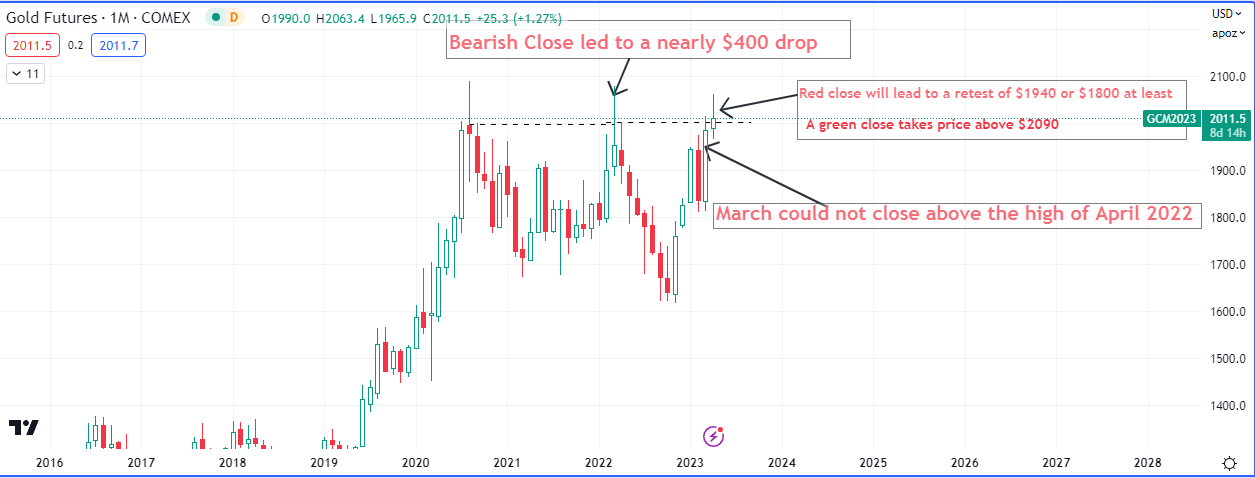

Gold is currently trading close to it’s all time high at $2010 per ounce. The all time high is $2089 per Ounce established during the pandemic on the 3rd of August, 2023.

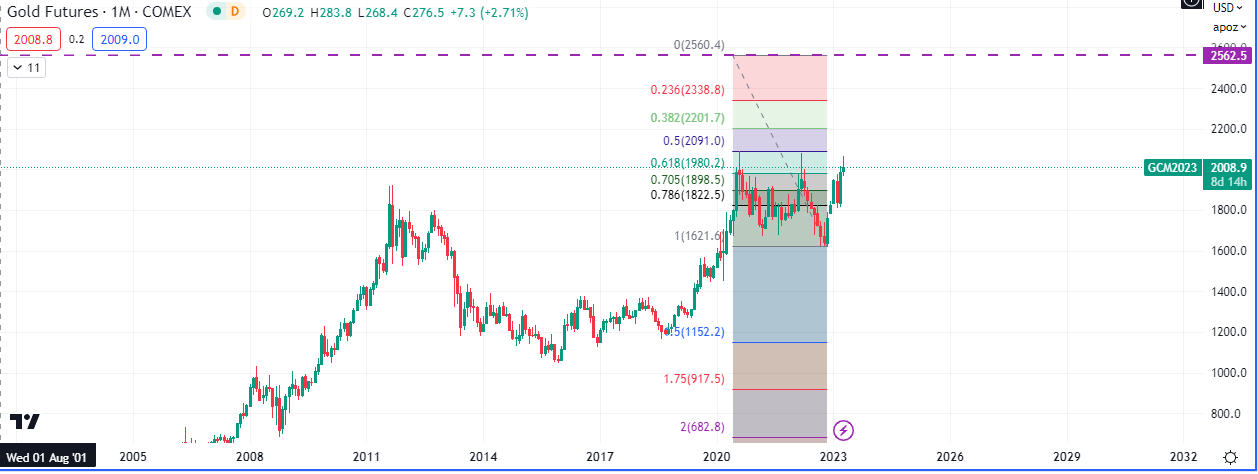

The potential break out projection for the current balance area on gold is $2562 per ounce if the breakout occurs on appropriate volume and price action.

Gold is already trading above it’s highest open and close price, the highs are a separate issue.

Considering the price action of gold we can see that a bearish close this month should mark price down to $1800 and $2090 for lower retests. A bullish close however send it higher to retest the all time high.