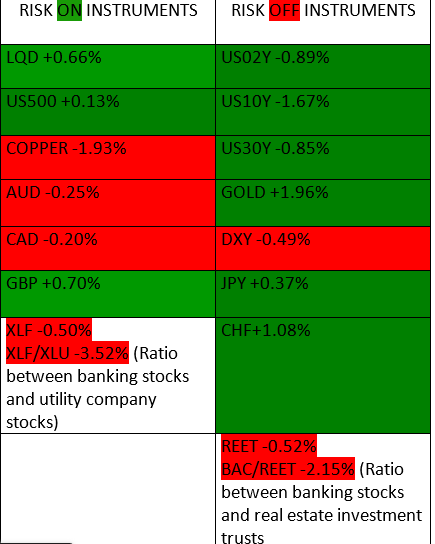

04/10/2023 (Risk on Risk Off)

On the board this week we see a tilt towards a risk off scenario, barring the US Dollar Index and Real Estate Investment Trusts which closed slightly lower at 0.49% and 0.52% respectively.

It is important to remember that US treasury bond yields are inversely correlated to the demand on them so therefore the slight decrease, 0.89%, 1.67% and 0.85%, recorded on the short term and long term debts, was an increase in demand.

The price action on the US equity markets remains bullish as volatility continues to drop although we may see a reversal of the VIX, upwards, and a reversal of the bearish momentum on the US dollar.

With the gap up on oil last week, we will be watching to see if there will be an intraday downturn on the German Spreads, the Crack Spread and the Calendar Spreads, which would increase the supply of oil and send price dropping towards $60 to fill the gap.