03/27/2023

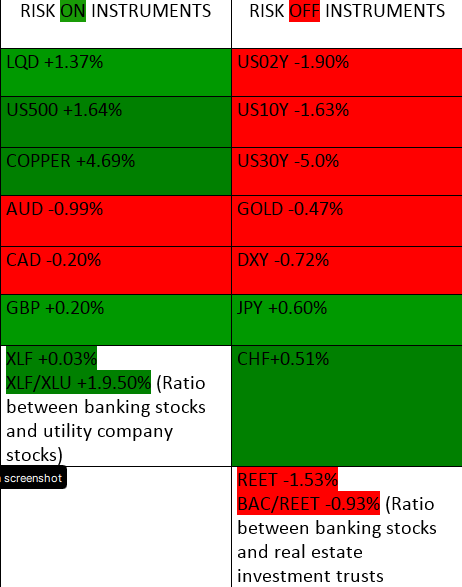

On the risk board we have an interesting mix of closes from last week Friday that will have some implications in the markets this week.

The Japanese Yen and the Swiss Franc were the only risk OFF instruments that managed to close in the green on Friday as the US Dollar, Treasuries and Real Estate Trusts all shed some points. This situation has dual implications: Gold and the US dollar moved in the same direction, with a consolidation on XAUUSD, in a strong Yen environment, this is a risk OFF flow.

The Yen 10 year treasury yield has been dropping but the US equivalent has been dropping harder, hence the yield differential has been in favor of the Yen. This demand for Japanese government debt, if accompanied by a dollar and gold resurgence will be a stronger risk OFF signal.

On the Risk ON side of the board only the Aussie and Canadian Dollar closed lower, although we saw an uptick in their yields relative the the Yen’s and the Swiss Franc’s. This uptick in demand for the government debt in the two commodity backed currencies, can help spur demand for them, leading to a possible bullish sentiment in them this week. We will keep an eye on the relevant economic news releases from both countries during the week.

XLF, the finance sector recovered a bit after a tumultuous week for banks. The debacle had investors shifting their projections of how much the Fed would hike rates in the coming months. As more information is made available this week about the evolving crises, we will be able to measure it’s effects via the movement of the dollar and subsequently bonds and equities.

Click HERE to read up in the article with the definition of Risk ON and Risk OFF.

Upgrade your work station with these cutting edge tools