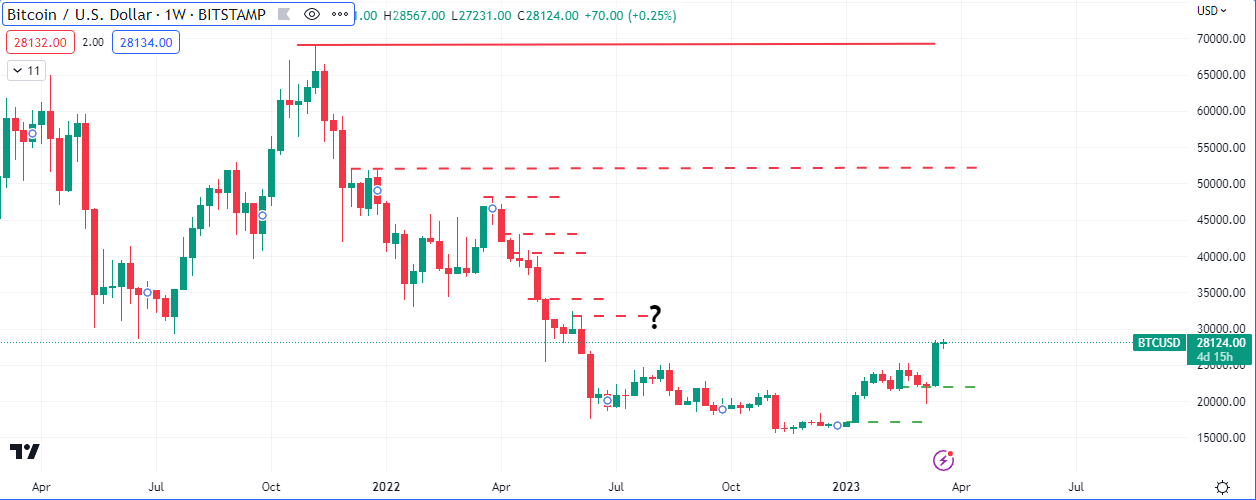

Bitcoin ($BTC) has been following risk on assets for a long time and it’s rally from $15,500 to $28,000 was in tandem with the rally seen in the equity markets. It is numerous positive correlated moves like this that has made analysts tag it as a ‘risk on’ asset.

Therefore, as a risk asset, the importance of today’s FOMC meeting cannot be overstated. Over the last few weeks the crisis in the banking sector has forced the Fed inject liquidity into the system in form of bank bailouts. Many analysts are scratching their heads as to how the apex bank can continue it’s withdrawal of liquidity since it has started loosening already, technically.

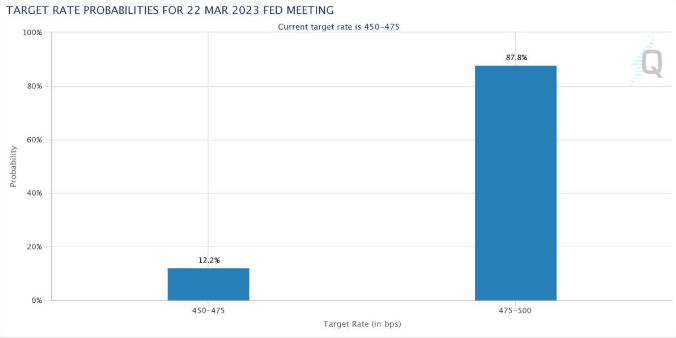

The Federal Open Market Committee (FOMC) will decide on how to tweak baseline interest rates on March 22, amid suspicions that the ongoing U.S. banking crisis has disrupted policy.

From ongoing rate hikes forecast just last month, markets are now considering the chances that the Fed will pause the cycle due to the disruption from the banking crisis.

Bitcoin currently sits at $28,164/token and some analysts have started pondering on whether investors may begin to use the asset as a risk off/safe haven instrument. This was one of it’s earlier propositions, give it’s trustless and open structure and it’s scarcity model. However it has not done so well in times of economic crises as it followed risk on assets up and down, to the whims of the almighty dollar. If the banking crises worsens and people continue to lose trust in the traditional currencies and banks, then we may see BTC take on a safe haven role.

The technical price projection for $BTC is $32,000, where the next major resistance sits.

Any surprises, dovish or hawkish will mean one thing, VOLATILITY!

Upgrade your work station with these cutting edge tools:

“