03/20/2023

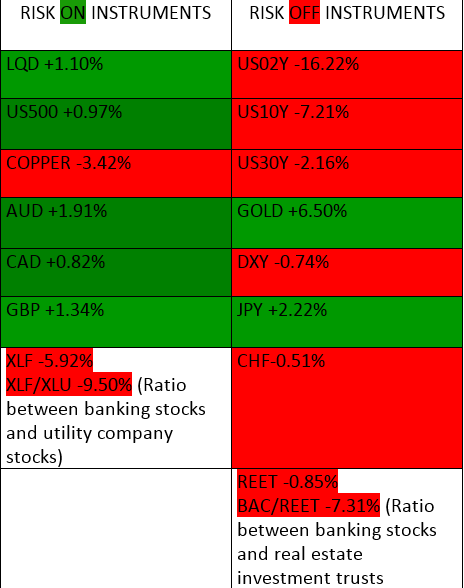

On the board today we have a mix of weekly closes from Friday’s close on the March 17th, 2023, with no clear tilt toward a Risk OFF scenario. It is important to note that the assets listed in the table are in different phases in their actual market structure, therefore some are going through pullbacks, breakouts, accumulations, distributions, mark ups and mark downs. It can get complicated when trying to view the market holistically, even when you have narrowed your focus to one key data point. However closes are important due to the fact institutions deal at the closes, so they are still worth noting despite variability in structure.

From the board we can see that the only assets that closed bearish among the risk on assets were the financial stocks and the copper. The turmoil in the banking sector took its toll on finance stocks and the XLF index dropped 5.9% and lost 9.5% relative to the utilities sector, which gained a whopping 3.9%. Banking stocks also bled over 7% relative to real estate investment trusts. These are clear risk off flows.

Copper also had a bearish close, it dropped by about 3.42%, while gold gained 6.50%. This is also another risk off flow.

Bonds yields dropped hard as well, with the 2Y treasury leading the pack. Although this looks like a parallel shift, the strength of the drop in the 2Y may have been part of the factors that slowed down the drop in equities last week, as the back end of the curve steepened.

The US Dollar continued its 3 week bearish pullback although the structure of dollar index remains bullish. This aided the rally in gold and the Japanese Yen.

The most important economic numbers to watch this week are the Fed Funds Rate, the FOMC Statement and the Flash Manufacturing and Services PMIs.

Click HERE to read up in the article with the definition of Risk ON and Risk OFF.

Upgrade your work station with these cutting edge tools;