The Non-Farm Payrolls release for February came out hotter than expected at 311K jobs added to the US economy, exclusing the farming sector.

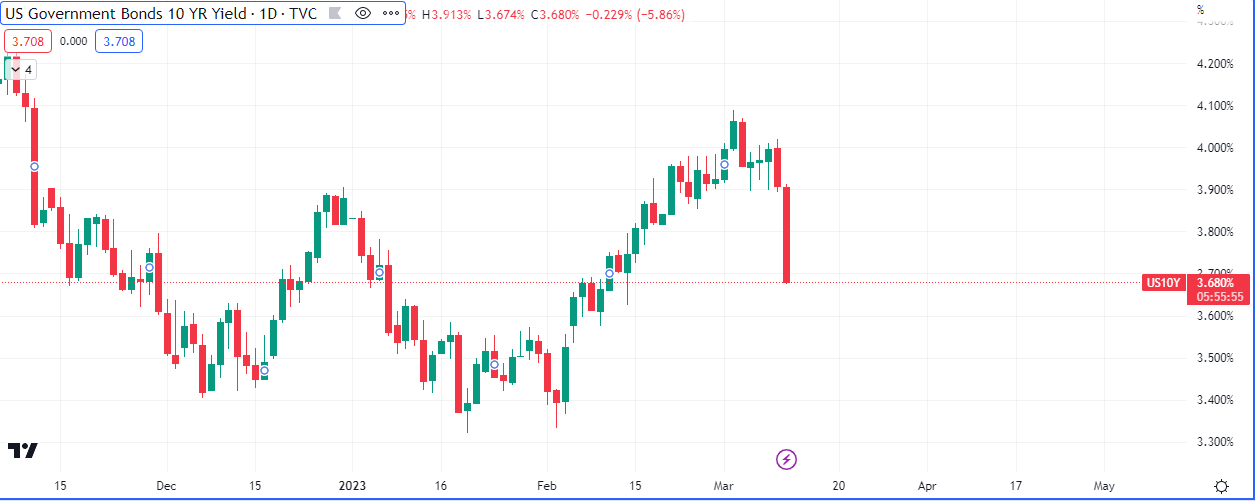

This reduces, but does not completely remove, the pressure on the FED to initiate a 5bp rate hike in March.

The US economy unexpectedly created 311K jobs in February of 2023, well above market forecasts of 205K, and following a downwardly revised 504K in January. The reading continues to point to a tight labour market, with the economy adding an average of 343K jobs per month over the prior 6 months. It is also well above 100K per month considered necessary to keep up with growth in the working-age population. Notable job gains occurred in leisure and hospitality (105K), namely food services and drinking places (70K); retail trade (50K), namely general merchandise retailers (39K); government (46K); professional and business services (45K); health care (44K); and construction (24K). On the other hand, employment declined in the information industry (-25K), namely motion picture and sound recording (-9K) and in telecommunications (-3K). Employment in information has decreased by 54K since November 2022. The transportation and warehousing also lost 22K jobs. source: U.S. Bureau of Labor Statistics

KPMG chief economist Diane Swonk said “don’t get so excited about the slowdown in earnings” as the payroll gain as more important. “This keeps a half-point hike on the table because of the sheer volume of paychecks that we’re generating, which is buoying demand. At the end of the day what the Fed is worried about is how strong demand is relative to supply. The issue is not wages; it’s aggregate demand. And this is feeding into aggregate demand, which is buoying inflation.”

TD Securities’ strategist Priya Misra, one of the reasons the market is sharply higher is because it is reacting to average hourly earnings coming in weaker than forecast:

“I guess it lowers pressure on the Fed to go 50bp but the labor market is still strong and wages are running at 4.6% (far greater than the 3.5% that the Fed needs). The Fed will not stop hiking until they see the labor market weaken so we think that the 2s10s curve should flatten. We should see the market keeping some risks of a 50bp hike in March. Not a bad report for risk assets but financials loom larger. We stay long 10s here.”

The dollar index is currently down -1.9% on the day

US treasuries are currently down on the day and week, sharply, with the 10Y having shed -4.45%.

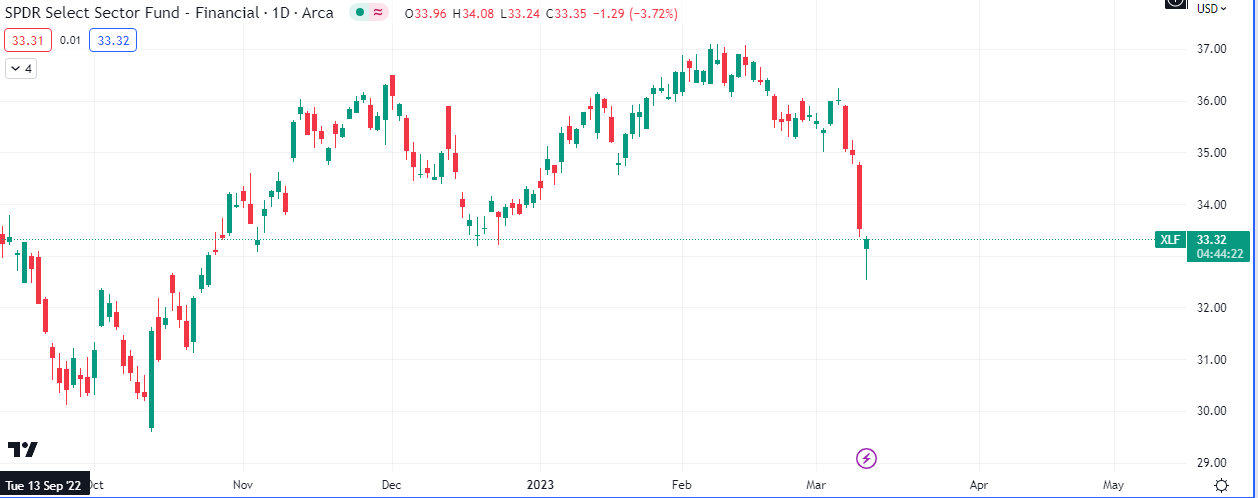

The SPDR index fund for finance stocks closed down -4.06% and has only gained back +0.66 as the time of writing this. The sector lost over $80 billion worth of market value in the stock market this week.

For details on inter-market correlations read this.

Upgrade your work station with these futuristic and ergonomic tools