According to Forbes, the amount of money expected to be spent on Valentine’s day this year is expected to be a record breaking $26 billion. While consumers continue to feel the pressure of inflation, the appetite for spending on Valentine’s day remains strong with a good outlook. The National Retail Federation and Prosper Insights & Analytics revealed that spending this year will be one of the highest on record, beating last years numbers by a whopping 8%.

As consumers treat each other with memorable gifts, providers of certain goods and services are set to receive a windfall this romantic season. Historically speaking, the most popular gift categories have been flowers, candy and greeting cards. In this article we take a look at some of the publicly listed companies positioned to benefit from the season.

LVMHF (OTC:LVMHF)

The world’s largest luxury goods brand is poised to gain from the season of love.

With brand like Louis Vuitton, Bvlgari, Starboard Cruise, Sephora, Fendi, Christian Dior and Celine under it’s umbrella, consumers are spoiled for choice of memorable gifts they can purchase from this brand.

The high performing stock broke it’s all time high last month and is poised to continue higher even if pullbacks occur.

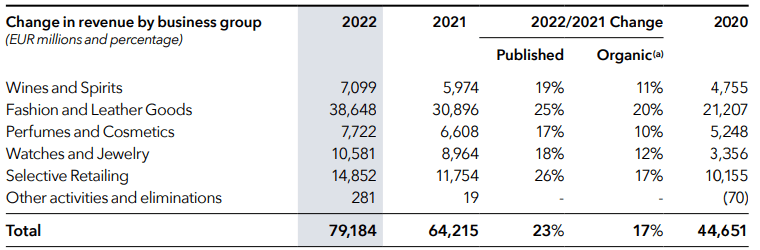

According to their 2022 financial documents, LVMH recorded €79.2 billion and €21.1 billion in profits from recurring operations. Specifically they recorded revenue of €38.648 billion from fashion and leather goods alone.

Perusing the information above, it does not come as a surprise that Bernard Jean Étienne Arnault is vying for pole position as the world’s richest man with the likes of Elon Musk and Jeff Bezos.

Mondelez International (NASDAQ:MDLZ)

What would Valentine’s day be without Chocolate! Modelez is a chocolate king indeed as it boast of brands like Cadbury, Milka Chocolates, Tobleron , Oreos Biscuits among others.

Several of these subsidiaries have offering suited to this season of love, like the ‘Pop Your Heart Out’ chocolate bars by Cadbury.

Mondelez International, Inc.’s revenue jumped 13.54% since last year same period to $8.695 billion in the Q4 2022With a healthy enough looking chart currently trading near its all-time-high at $66, this candy manufacturer looks set for more upside in the future and the revenue generated this Valentine’s will certainly not hurt their bottom-line either.

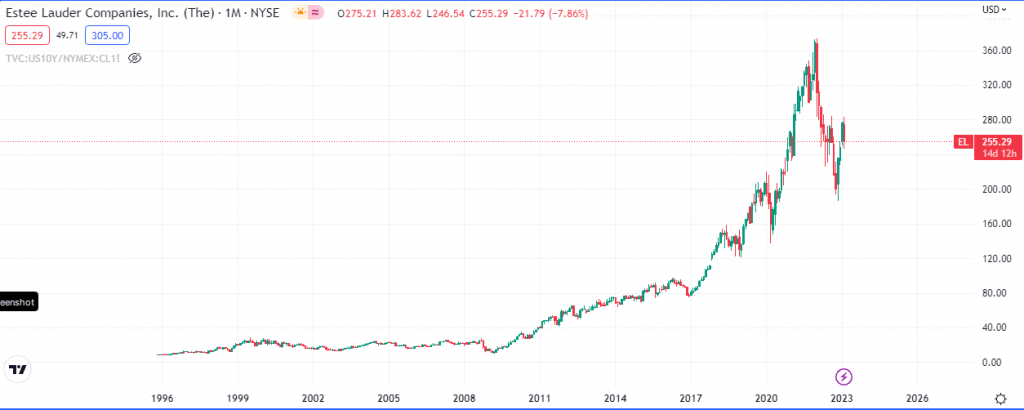

ESTEE LAUDER COMPANIES (NYSE:EL)

With brands like Tom Ford, Le Labo, MAC, Bobbi Brown and Clinique brands it not hard to see how this cosmetics giant stands to gain from the massive order flows expected this Valentine’s. They have everything from makeup, fragrance, skincare and hair care products covered.

Starting from Q4 2022, the company’s stock has been able to claw back about 30% of the value it lost over the course of last year. However the slowdown due to the Zero Covid policy in China had an adverse effect on its performance as it declared net sales of $35.6 billion a 10% decrese from $3.94 billion last year.

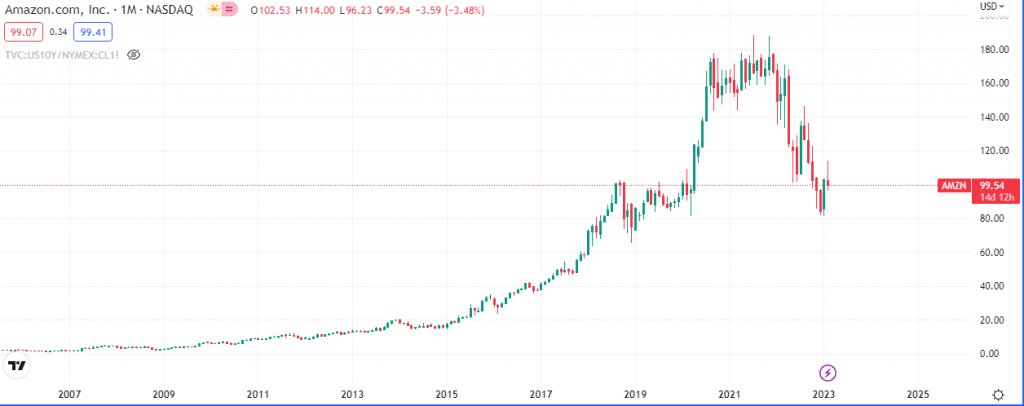

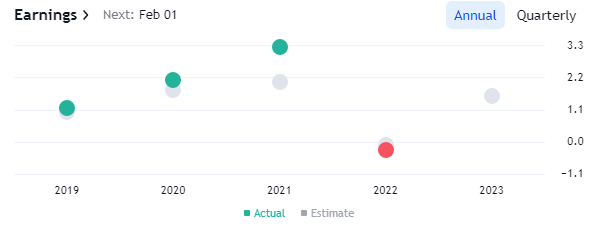

Amazon (NASDAQ:AMZN)

The retail giant recorded a 9% increase of $149.2 billion in the fourth quarter of 2022. Its pole positioning in the retail ecommerce industry makes it one of the companies to benefit the most from consumer spending on Valentine’s day.

Features such as its now popular ‘Prime Shopping’ and same day delivery may make it the retail vendor of choice for many shoppers on Valentine’s day.

Although Amazon has lost $834 billion in market capitalization since the January 2022 it remains a healthy stock, with analysts expecting an increase in earnings this year.

Premier League

Premier League