Risk Gauge

02/13/2023

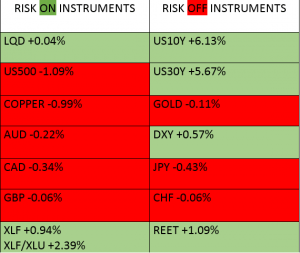

On the board today we have a mix of weekly closes from Friday’s close on February 10, 2023, with more of a tilt towards a Risk Off scenario. It is important to note that the assets listed in the table are in different phases in their actual market structure, therefore some are going through pullbacks, breakouts, accumulations, distributions, mark ups and mark downs. It can get complicated when trying to view the market holistically, even when you have narrowed your focus to one key data point. However closes are important due to the fact institutions deal at the closes, so they are still worth noting despite variability in structure.

US Dollar Factor

The recovery in the US dollar and the US treasuries market had a marked effect across board. This weakened gold, which, ironically, is also a safe haven asset, depending on what is happening with inflation. The implication of this is that in a risk off situation we should look for both Gold and the US dollar to be pointing up, hence their pairing , XAUUSD, could very well be in a consolidation phase or a slow grind up or down.

UK-Finance Correlation Factor

An interesting divergence to watch is the one between GBP and the finance stocks. With Utilities trailing Financials by 2.39% and GBP futures closing at -0.06%, we can expect a mean reversion of that spread.

CPI Inflation Outlook

The most important news release this week are the CPI numbers coming out on Tuesday. Analysts are forecasting a rise in the inflation numbers hence that could make the Federal reserve more hawkish and the rate hiking program would probably accelerate, leading to a weaker equity market. If we get a downward surprise then we could see a more dovish stance by the Federal Reserve, leading to a stronger equity market.

Click HERE to read up in the article with the definition of Risk ON and Risk OFF.