The long-awaited spinoff of Meta Materials (NASDAQ:MMAT) preference shares (OTC:MMTLP) has taken an unexpected turn. Some shareholders are outraged because trading in MMTLP stock has been suspended ahead of Meta Materials’ (MMAT) planned spinoff to Next Bridge Hydrocarbons.

Metamaterials (MMAT) is a Canadian firm that was listed on the Nasdaq in June 2021. Meta Materials merged with Torchlight Energy in order to be listed on the NASDAQ (TRCH).

The Financial Industry Regulatory Authority (FINRA) revised its notice regarding the corporate action of exchanging META’s Series A Preferred shares (OTC:MMTLP) for shares of common stock of Next Bridge Hydrocarbons, Inc.

The firm via a statement said that “Please note that this disclosure and dates from FINRA regarding the trading of MMTLP in connection with the distribution of the shares of Next Bridge Hydrocarbons, Inc. supersedes and replaces all of META’s prior disclosure regarding the logistics and timing of the trading of MMTLP in connection with the distribution.

“Please contact your broker, bank or other nominee for assistance with any questions concerning ownership or trading of META’s Series A Preferred shares.”

Reactions, petition

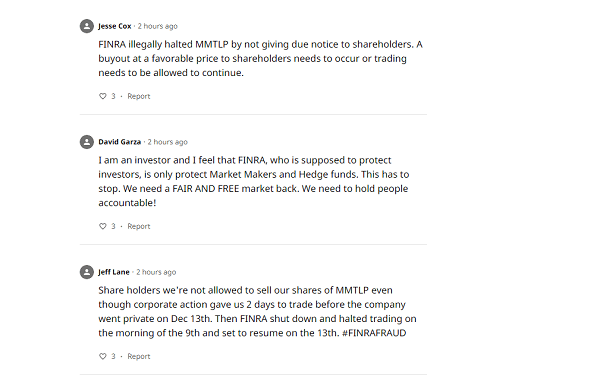

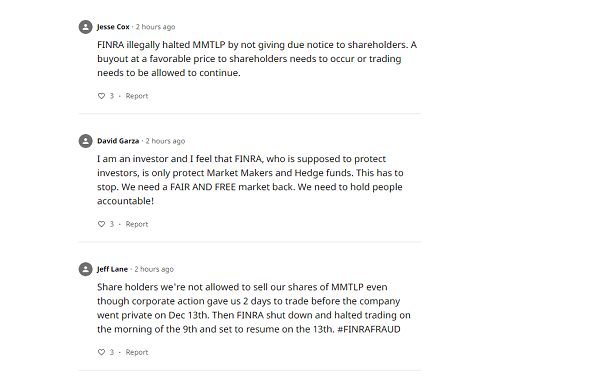

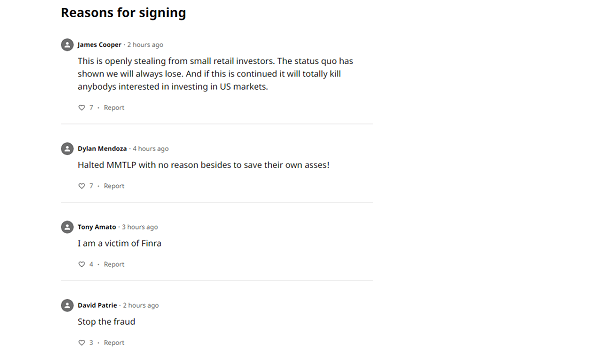

Retail investors, on the other hand, have been outraged since FINRA imposed the trading halt. Some have accused the organization of market manipulation, while others have praised the organization’s short interest levels.

Many traders have called for a lawsuit against FINRA, naming market influencers such as Elon Musk and AMC Entertainment (NYSE:AMC) CEO Adam Aron as targets. However, so far, all of the actions appear to be legal, with no illegal activities.

Over 2,000 grieved investors have signed a petition against FINRA, citing the suspension of the stocks ‘as unlawful, greedy, corrupt and thieves.

FINRA’s rule book states that “FINRA may impose a trading and quotation halt in an OTC Equity Security pursuant to Rule 6440(a)(3) where FINRA determines, in its discretion, based on the facts and circumstances of the particular event, that halting trading in the security is the appropriate mechanism to protect investors and ensure a fair and orderly marketplace.”

THIS JUST GOT CRAZY ‼️‼️

One of the Market Makers who created and had $MMTLP trading is on the Board of @FINRA

Ari Rubenstein is the Co Founder of GTS and board of FINRA

THIS IS ILLEGAL #FinraFraud pic.twitter.com/V9imet8ODw

— ShortSqueeze (@AShortSqueeze) December 10, 2022

FINRA ur breaking the law. what you have to understand you APPROVED dates.

Investors saw those date and knew they had up to the 12th to sell if they didn’t want a private company..

You BROKE THE LAW by halting and taking millions of dollars away from them #finrafraud $MMTLP RT pic.twitter.com/RCzWMHdSHM

— ShortSqueeze (@AShortSqueeze) December 10, 2022

Just filed a complaint against @FINRA with my Attorney General for what they did with $MMTLP. I hope others do the same. #finrafraud

— Machew (@MachewWV) December 10, 2022

Very true, everyone knows if you short, you take the risk to infinity 🚀🚀. Certainly @FINRA knows this and @AriGTSX should know this too. Not $MMTLP holders fault they got boxed in by their illegal activity. BE TRANSPARENT Finra, tell us what you really know! https://t.co/TF0kFOKj4q

— John Brda (@johnbrda) December 10, 2022

$mmtlp After a number of requests I am adding a sample template for you to complain at @FINRA Please edit or amend as you wish and lets keep the pressure on FINRA. We pay their wages. #finrafraudhttps://t.co/qdb9yYOCnS pic.twitter.com/j8Mjnp9qsJ

— TradingSecrets (@TradingSecrets7) December 10, 2022

$MMTLP I ask all shareholders of MMTLP to sign the petition for the trading halt from @FINRA #FINRAFRAUD

Sign here: https://t.co/WLWgb6HBIB pic.twitter.com/s0F0lnwiod

— Metamaterial News🚨 (@MMATNEWS) December 10, 2022

Should we start a protest?

[email protected]⁰1735 K Street, NW⁰Washington, DC 20006⁰301-590-6500 $MMTLP $MMAT #FINRAFRAUD pic.twitter.com/DqDl1riGBa

— ShortSqueeze (@AShortSqueeze) December 10, 2022

We know @FINRA CEO salary is 3.12 million a year…

And he wants to make retail suffer #Manipulation #FinraFraud $MMTLP pic.twitter.com/57h8fZOKkR

— ShortSqueeze (@AShortSqueeze) December 10, 2022

$MMTLP @JohnBrda here is an even more recent injunction that has no info on it yet by @AriGTSX… I bet there is a pattern here! WE SEE YOU #FinraFraud https://t.co/X0EtxPoU5J @cvpayne @MeetKevin pic.twitter.com/FwKOXZJNak

— UncleSmokeyStockTrades (@SmokeyStock) December 10, 2022

$MMTLP @JohnBrda here is an even more recent injunction that has no info on it yet by @AriGTSX… I bet there is a pattern here! WE SEE YOU #FinraFraud https://t.co/X0EtxPoU5J @cvpayne @MeetKevin pic.twitter.com/FwKOXZJNak

— UncleSmokeyStockTrades (@SmokeyStock) December 10, 2022

There! @FINRA , I fixed your background picture. According to what they did to $MMTLP investors today, they should probably update this.. pic.twitter.com/RvAm8sgLWr

— therrmann77 (@therrmann77) December 9, 2022

Even if you weren’t in this play it should scare the hell out of you. @FINRA colluded with hedgefunds and literally turned off the ticker. It’s a fucking joke and a travesty. This will happen with any ticker they want to “protect” retail (really shorts) from #MMTLP $MMTLP https://t.co/ILFnPiB3CB

— Epically Fetch (@Epically_Fetch) December 9, 2022

READ ALSO: 2023: Get your PVC, vote for me – Tinubu tells Nigerians