At today’s Monetary Policy Committee (MPC) meeting of the Central Bank of Nigeria (CBN), the MPC communicated its decision to keep all monetary parameters unchanged from its previous meeting.

It appears to be a tacit admission by the monetary authorities that the CBN is at its wits end and out of monetary tools to stimulate an economy which is in its second recession in 4 years, an abysmal record for the country.

In every country, monetary authorities alone are not to be held responsible for economic outcomes as there is a fiscal side to every economic equation. However, the willingness to dabble in alternate facts by the CBN lately has succeeded in eroding trust in what was otherwise one of the remaining few respected Nigerian institutions.

See Emefiele’s video:

Ah hm. pic.twitter.com/ANrBazCMt5

— Tech Bro (@OdunEweniyi) November 24, 2020

Nothing reflects that more succinctly than today’s mandatory post-MPC press conference where the CBN Governor, Godwin Emefiele mentioned that analysts who should know better are quoting 480 naira to the US dollar as the exchange rate compared to the CBN rate of 379 naira to the US dollar. The Governor went further to state that the parallel market is a shallow market and accounts for no more than 5% of the total FX demand. While the Governor might state that the parallel market consists of retail itinerant FX hawkers, the reality reflects that Bureau De Change (BDCs) have become the parallel market.

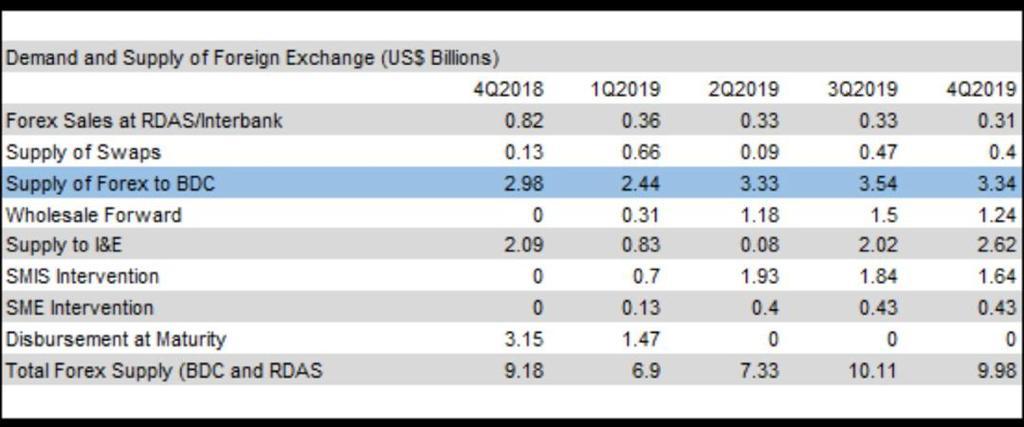

It is interesting the Governor will make such an assertion as the facts from the CBN which he heads confirms that through all of 2019, disbursements to BDCs amounted to $12.65 billion compared to $5.55 billion for the legally recognized Importers and Exporters (I&E) window.

These statistics makes it clear that more than double the amount of dollar sales by the CBN were to this parallel market and accounts for 37% of the $34.32 billion the CBN sold last year. It is clear that the CBN is challenged with meeting FX obligations as there are loud claims that there is a backlog of FX demand hovering around $2 billion (exclusive of swaps and foreign portfolio investments). The CBN is using the same playbook from 2016/2017 of denying a reality of the markets, which it will be forced to accept no matter how long it takes.

With yields low, FPIs wary amidst low oil prices and more importantly, production caps by the Organisation of Petroleum Exporting Countries (OPEC) on Nigeria, Nigeria’s FX liquidity will remain challenged and a devaluation will be inadequate to solve FX shortages. The earlier Governor Emefiele embraces the new normal of the Naira’s realities and stop living in a parallel universe, the quicker the economy might be able to begin to stutter back to life.

Read Also: “He Knows the Implication”- PDP Remains Unfazed by Abbo’s Decision to Defect to APC