Vice President Yemi Osinbajo has described secret corporate ownership as a global problem and bane of development in resource-rich countries like Nigeria.

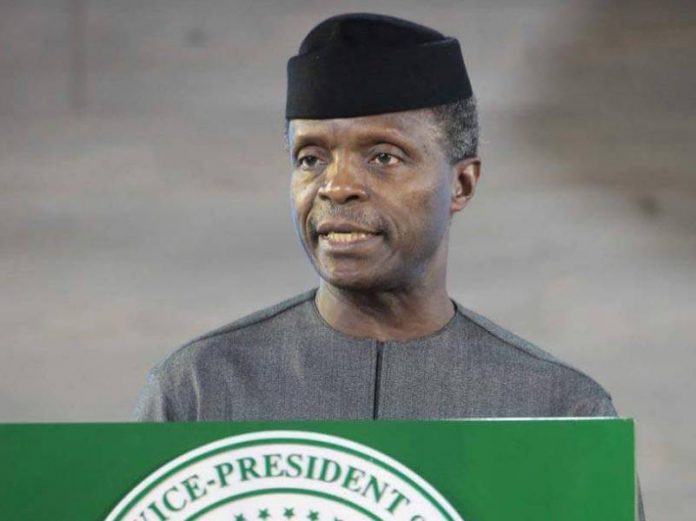

Osinbajo said this at the Beneficial Ownership Conference of the Extractive Industries Transparency Initiative (EITI) in Jakarta, Indonesia on Monday.

The vice president’s speech was made available to newsmen in Abuja.

He cited a 2014 report by the One Campaign entitled, “One Trillion Dollar Scandal’’, which showed that developing countries loose one trillion dollars annually to corporate transgressions.

According to the vice president, most of the funds are traceable to the activities of companies with secret ownership.

“Another report that may enjoy mention here is the 2015 report of the High Level Panel on Illicit Financial Flows from Africa chaired by former South African President Thabo Mbeki.

“The panel stated in its report that Africa had lost more than one trillion dollars over a 50-year period, and that Africa loses more than 50 billion dollars annually to illicit financial flows.

“Most of these illicit flows are perpetrated in the extractive sector and through companies with hidden ownerships.’’

Osinbajo said Nigeria was still struggling with the negative impact of the use of corporate ownership secrecy by senior government officials and their cronies to corner juicy contracts in the extractive industry.

He specifically mentioned the celebrated Malabu scandal of the 1990s, which he said remained the subject of criminal and civil proceedings in many parts of the world.

According to him, the court cases involved huge legal costs, while the full benefit of the natural resource remains unexploited for the benefit of the people of Nigeria to which it belongs.

“So, for us in the developing world and especially in Africa, breaking the wall of secret corporate ownership is an existential matter.

“It is for us literarily a matter of life and death. Masked or Hidden corporate ownership is deeply implicated in the sad story of our underdevelopment.

“Yes, we know that anonymous companies are not always illegal or are not always designed to harm.

“But we also know that secrecy provides a convenient cover for the criminal and the corrupt. And we are not just operating from the theoretical or hypothetical standpoint,’’ he said.

The vice president said that the problem was a global one driven by an inter-connected world where the foothold of anonymous companies does not respect the developed/developing divide.

He said although the degree of exposure may differ, everyone in today’s world was at risk of the dangers posed by anonymous corporate ownership.

“If nothing else, the Panama Papers clearly illustrated the global scale and spread of this problem.

“So, this is a global challenge and nothing less than a truly global approach will be needed to tackle it.’’

Osinbajo commended the United Kingdom, Norway, Netherlands and Denmark for setting the pace in the establishment of public registers of the real, human owners of companies in their countries.

He, therefore, called on other G8 and G20 countries to follow suit by initiating actions to end corporate secrecy at home and their dependencies.

“Open Ownership and its partners must also be commended for establishing a global register of beneficial ownership with entries on about two million companies.

“However, we must note that legislative measures in the mentioned countries may need to go farther to effectively discourage or totally prohibit non-disclosure agreements by governments with big corporate, and to re-evaluate the use of secret trusts to hide beneficial ownership from the prying eyes of the law.

“It is important to underscore the fact that opacity in one section of the globe undermines openness in the other.

“We need to break down this wall together as we are all at risk of the evil effects of opacity in business ownership.’’(NAN)

ARU/EEE