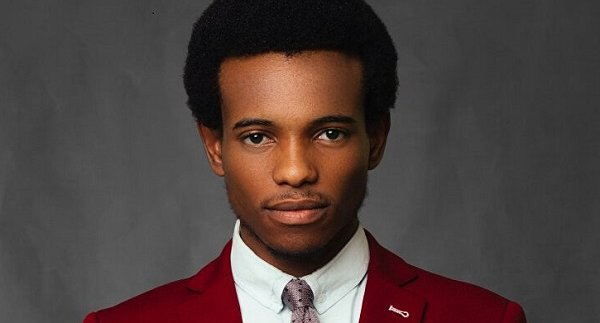

At just 22, Christopher ‘King’ Bowofade, finds himself living a life that only few can even dream of. He is the head of Better Days Investments (BTD) who buy and sells futures and options daily on behalf of 7,902 individual investors who get returns anywhere from 10% to 30% monthly.

He has 15 full-time employees and over N600 million under management in just over 2 years which is a remarkable feat by someone so young.

In an interview with Victor Bella, a social media strategist, and Coach, Christopher told his story on how he started out.

The report reads in part;

In late 2012, he was a fresh Diploma graduate, second best in his Conservation Science and Tourism class with a 4.41 GPA, but he was determined to be more than that. During the long break that preceded his direct-entry application to the Department of Economics at Obafemi Awolowo University (OAU), he stayed back in school to learn about a variety of fields over free school internet. He quickly became adept at graphic design and web development. But what really caught his eye was the financial market: forex, futures, options and binary options. These quickly became an obsession.

He would lose his first investor (his mum)’s $100 in one week, but this didn’t deter him. He found some British fund managers who became his mentors. He learnt to give one of them his money to trade for him. The fund manager returned 50% in a month. He was ecstatic. Once he was able to achieve that kind of return month after month, he felt ready to raise more money.

One of his earliest investors and evangelists was Johnson Alabi, the third best student in the Conservation Science and Tourism Diploma class. Johnson was one of those who urged him to start a company. Christopher used his PHP and CSS skills to build the company website, and they were ready for business. Their first investors would mainly be students looking to earn extra money; their first part-time staff, too.

In November 2015, BTD registered as simply a Commission Agency with CAC (neither SEC or CBN regulates speculative funds in foreign markets) and started out with N1 million from 20 investors. As returns came, word of mouth spread. Christopher and Johnson created a structure where investors signed up to be agents and earned commissions to manage other investors they brought in. At some point, they were doubling investors and asset under management every month.

They were working so hard, they forgot to go to class. This was the first year as 200 level undergraduates at the Geography department at OAU. At the end of first semester, Johnson had a GPA of 2.6, Christopher had a 1.9.

Things were going well on a business angle if not an academic one but it got worse when the MMM program went under which also affected Christopher’s business severely.

In December 2016, when majority of his investors who had thought BTD was some kind of multi-level marketing scheme started to request to withdraw all of their funds following rumours that Nigeria’s largest multi-level marketing scheme, MMM, had crashed.

“This was depleting our capital so much that it challenged the company’s sustainability.” That was Christopher putting it mildly. This was an existential crises that could have wiped out over 80% of his fund, as well as BTD itself, in under a month. He took firm action and froze the fund. He also revealed himself to many of his Lagos-based investors for the first time (some who had exposure of up to N30 million), and organised an Investor Conference in February of this year to allay their fears.

The road to startup success is dotted with what sometimes are the truest tests of skill and character. Bowofade, as he is sometimes called by friends, has had to quickly learn programming and trading in the financial markets while proving that he can make tough decisions as a leader. “Not many people can trade binary options,”He quipped at some point in our chat, “It requires that you make really important decisions in a split second.” He has been an ardent student of Trading Psychology, a term popular among traders that describes the emotional and mental make-up needed to succeed as a trader, built on the three cornerstones: stamina, patience and discipline. In addition, he has to embrace fear and take risk without flinching.

Christopher is a shining example today to a generation that sometimes struggles with achievement and success that through hard work and application one can achieve whatever he/she sets his/her mind to.