Major stakeholders in banking and finance, on Monday disagreed with the Senate over its proposed amendment of laws on the regulation and supervision of Micro Finance Banks (MFBs) in the country.

They said that what the bank needed was re-modelling of its operations to function effectively and not amendment of laws regulating its operations.

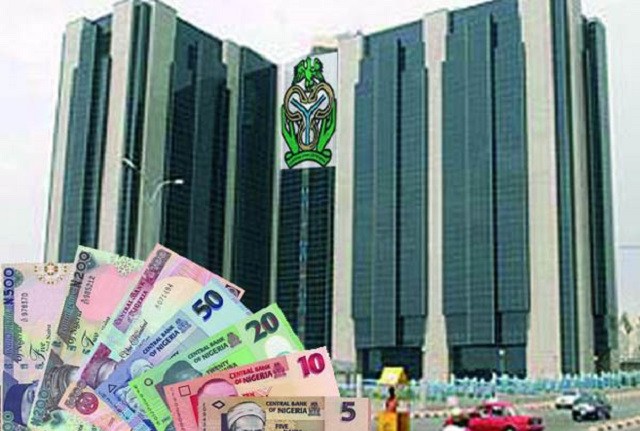

The stakeholders included the Federal Ministry of Finance, Central Bank of Nigeria (CBN), the Nigeria Deposit Insurance Corporation (NDIC), and Institute of Chartered Accountants of Nigeria (ICAN).

They made the position known at a Public Hearing organised by Senate Committee on Banking, Insurance and other Financial Institutions in Abuja.

The hearing was on three Bills one of which is “Bill for an Act to make provisions for the licensing, regulation and supervision of microfinance business in Nigeria and for related purposes, 2017.’’

It includes “Bill was a bill for an Act to amend motor vehicle third party insurance Act, 2004 to facilitate the accomplishment of the objectives of compulsory third party insurance and for related matters, 2017.’’

In his submission, CBN Governor, Mr Godwin Emefiele, argued that the Bills were unnecessary.

He said that if licensing, regulatory and supervisory roles which were traditional obligations of CBN was now given to the ministry or NDIC through planned amendment, it may cause serious conflict in the nation’s financial system operations.

Represented by the Director of Legal Services, Mr Johnson Akinkunmi, Emefiele said that the power to license banks lay with the CBN.

He added that no other government agency or ministry was empowered under the law to assume power to supervise banks, determine their licences and appoint self as liquidator.

“The Bills attempted to demarcate Micro Finance Banks into two – those that take deposit and those that do not, and hope to be regulated by the Ministry of Finance.

“This will cause conflict because the CBN has power of regulating banks.

“Another major problem that the Bill will cause is that some categories of Micro Finance Banks will be regulated by the Ministry of Finance and some by the CBN.

“This is unhealthy and very unnecessary. There is no reason to carve out deposit insurance for micro-finance outside the NDIC,” he said.

Emefiele charged the Senate to look at the challenges to assist in addressing them rather than amendment of the Act.

According to him, the policy and strategic direction is the legal framework that will make Micro-Finance Banks function effectively.

Similarly, Minister of Finance, Mrs Kemi Adeosun, agreed with the CBN Governor and said that the ministry was not asking for powers to supervise banks.

Adeosun was represented by the Permanent Secretary in the ministry, Alhaji Mahmud Dutse.

In his submission, President, Institute of Chartered Accountants of Nigeria (ICAN), Mr Ismaila Zakari, appreciated the efforts of the National Assembly toward strengthening Nigeria’s financial system.

“We also appreciate the National assembly for empowering Nigerians for economic freedom and boosting the gross domestic product of Nigeria, among other numerous laudable initiatives,” he said.

He said that the body had identified a number of gaps in the proposed Act and made recommendations.

“For instance, ICAN suggested amendment to Section 30 (a) of the proposed Act, which states that `no one shall be appointed as external auditor of an institution if such person is not qualified under the Companies and Allied Matters Act’”.

Making reference to Section 41 of the Financial Reporting Council of Nigeria Act 2011, ICAN stated that in that section, external auditors must also be appointed in line with the Act.

“Our observation is that a professional is functioning as an auditor to a micro finance institution does not imply that he or she uses fiduciary information obtained in the course of his/her audit for any other purposes,” he said. (NAN)

Premier League

Premier League