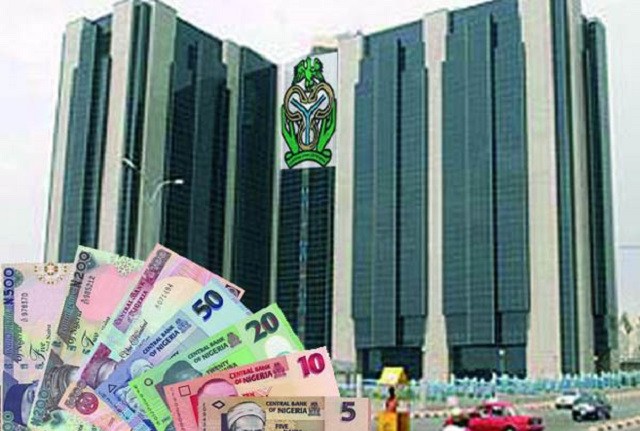

The Central Bank of Nigeria (CBN) on Monday, intervened in inter-bank Foreign Exchange Market with the supply of 195 million dollars as part of effort to stabilise the market.

The acting Director, Corporate Communications of the apex bank, Mr Isaac Okorafor, in a statement, said 100 million dollars was offered through the wholesale segment.

He said that Small and Medium Enterprises (SMEs) segment received 50 million dollars, while tuition fees, medical payments and Basic Travel Allowance (BTA), among others, got 45 million dollars.

Okorafor said that the CBN was pleased with the state of the market, and assured that the bank would continue to intervene in order to sustain liquidity in the market and guarantee international value of the naira.

He said the apex bank remained determined to achieve its objective of rates convergence, “hence the unrelenting injection of intervention funds into the foreign exchange market’’.

Okorafor expressed optimism that the naira would sustain its run against the dollar and other major currencies around the world, considering the level of transparency in the market.

He, therefore, advised stakeholders to abide by the guidelines to ensure transparency in the market.

Last week, the CBN intervened in the various segments of the foreign exchange market with the injection of 396.8 million dollars.

Meanwhile, the naira continued to maintain its stability in the market, exchanging at an average of N364 to a dollar in the Bureau de Change segment of the market. (NAN)