About 15 commercial banks were on Tuesday barred from dealing in foreign exchange through the recently created small and medium enterprises, SMEs wholesale forex window.

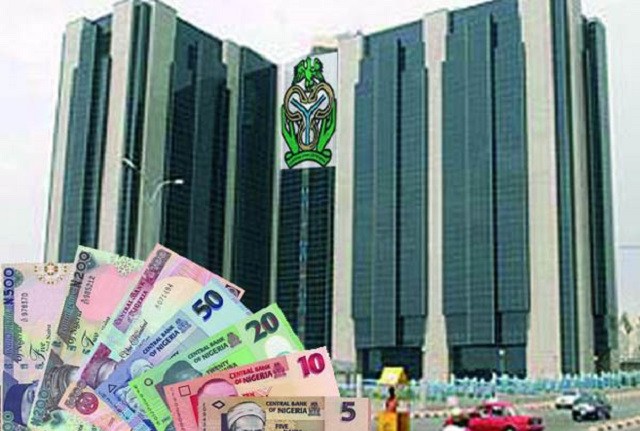

According to the Premium Times, the decision by the Central Bank of Nigeria, CBN, to wield the big stick followed persistent complaints against the erring deposit money banks, DMBs, that they were deliberately frustrating efforts by many of the SMEs to access foreign exchange through the new window.

The CBN spokesperson, Isaac Okorafor, who confirmed the action by the apex bank said the decision was based on field monitoring reports, which found eight of the banks not culpable.

Mr. Okorafor did not mention any of the banks involved.

However, a highly-placed source, who requested anonymity, identified the eight to include seven of the 22 commercial banks and one non-interest bank.

The banks found not culpable include Access Bank, Diamond Bank, Fidelity Bank, Heritage Bank, Sterling Bank, Unity Bank, Zenith Bank and Jaiz Bank.

The source said these were the banks that have been allowed to sell forex to the SMEs segment since the inception of the new window.

The 15 banks sanctioned, the source said, included Citibank, Ecobank, Enterprise Bank, First Bank, First City Monument Bank, Guaranty Trust Bank, Key Stone Bank, MainStreet Bank, Skye Bank, Stanbic IBTC Bank, Standard Chartered Bank, SunTrust Bank, Union Bank of Nigeria, United Bank for Africa, and Wema Bank.