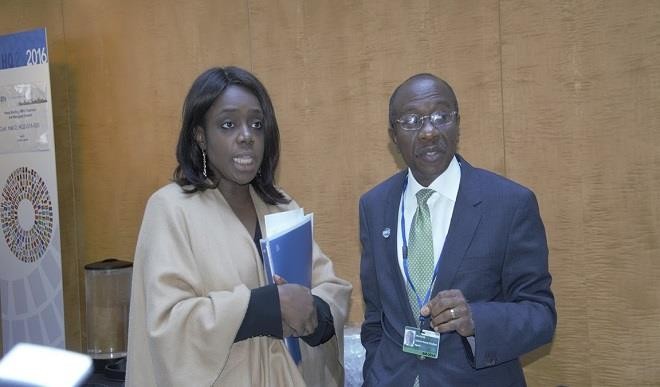

The minister of finance, Kemi Adeosun has urged the Central Bank of Nigeria (CBN) to extend bank verification number (BVN) requirement to account holders in microfinance banks which according to her would facilitate the detection of bank accounts which might have been opened and operated by ghost workers and other syndicates.

According to the director of information in the ministry of finance, Salisu Dambatta, Adeosun has written to Godwin Emefiele, CBN governor, to make her case.

She said the introduction of BVN by the CBN has contributed immensely in improving the integrity of the federal government payroll, on which more than 50,000 ghost workers were detected and removed.

She said operating bank accounts in microfinance banks without requirement for BVN has left a huge loophole which individuals intent on financial crimes could use to launder and hide proceeds of crime and successfully escape detection by law enforcement agencies.

In the letter, Adeosun reportedly told Emefiele that when a deadline for obtaining the BVN was announced, several salary accounts of federal employees were moved from commercial banks to microfinance banks.

“This is a suspicious activity and we have already commenced a review of such cases to identify and investigate cases of fraud,” he said.

“We know that extending the requirement for BVN to microfinance banks may put a huge financial strain on the smaller microfinance banks; but some such as National Police Force microfinance (NPF), have over 27,000 salary accounts.

“Our inability to perform checks on such a large number of salary earners is a key risk. I am therefore seeking your cooperation to enforce compliance with BVN on any MFB with over 200 active salary accounts or those above a certain size.

“This will support the federal government’s efforts at reducing leakages to create headroom for the capital projects that will support the growth of the economy.”

In September 2016, CBN announced its intention to extend BVN requirement to microfinance banks but the exercise has not commenced.