Some financial experts on Thursday commended the Federal Government for using a more realistic exchange rate of N305 to the earlier proposed N290 per dollar for the 2017 budget estimates.

They told the News Agency of Nigeria (NAN) in Lagos that the proposed exchange rate of N305 was more realistic given the developments at the foreign exchange market.

Dr Uche Uwaleke, Head of Banking and Finance Department, Nasarawa State University, Keffi, said the 2017 budget proposals were based on realistic assumptions.

“The government should be commended for using a more realistic exchange rate of N305 to the dollar instead of the earlier N290 to the dollar provided for in the Medium Term Expenditure Framework,’’ Uwaleke said.

He also said the oil price benchmark of $42.5 per barrel was achievable given the OPEC agreements on production cuts.

According to him, the output projection of 2.2 million barrels per day is based on the optimism that the Federal Government will address the agitations in the Niger Delta region.

“It is gratifying to note that capital expenditure is not below 30 per cent of the budget size with power, works and housing taking the largest chunk.

“Equally laudable is that more attention will be given to foreign loans this time as opposed to domestic loans which are more expensive to service. I think it is a good document,’’ he said.

Uwaleke, however, noted that implementation remained the challenge of the budget, urging the National Assembly to work on its speedy assent and implementation.

He said that the budget outcomes and level of implementation would determine its impact on the stock market and the economy in general.

Uwaleke said the country’s foreign reserve position would improve if revenue targets were met, adding that naira would appreciate.

“Inflationary pressure on high exchange rate will abate, monetary policy will ease, interest rates will come down, production by firms will pick up, leading to jobs’ creation and stock market rebound,’’ he said.

Also, Prof Sheriffadeen Tella of the Department of Economics, Olabisi Onabanjo University in Ago-Iwoye, Ogun, said the proposed oil-benchmark price was appropriate.

Tella said the exchange rate and oil output were rather too optimistic as the exchange rate would still be affected by slow growth in foreign reserves and exports, speculative attacks and capital outflows through imports of raw materials.

He stated that the oil output would be negatively affected by low demand, improved output from the Middle-East’s shale oil and activities in the Niger-Delta region.

“All these will not make forex and oil export projection realisable unless we deliberately work against them.

“It is imperative that a large proportion of borrowing for domestic production must come from within while at the same time paying off existing domestic debt so that those owed can have money for reinvestment.

“The allocations to power, road and building look huge but inadequate unless most activities on road and power are done through public private partnerships which is the way to go,” Tella said.

He also called for a speedy passage of the budget for implementation to take off on time for multiplier effects to be felt by the beginning of the third quarter.

Mr Ambrose Omordion, the Chief Operating Officer, InvestData Ltd., said the proposed N7.3 trillion budget would have impact on the economy in 2017 with a review in government policies.

Omordion said that government should invest massively to drive economic diversification and productivity to take the economy out of recession.

“The benchmark of $42.5 is okay and achievable if crude oil price remains above $50 per barrel and the Niger Delta militants are settled to allow peace in the region and meet up with proposed output,” he said.

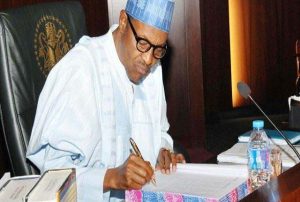

NAN reports that President Muhammadu Buhari on Dec. 14 presented a budget proposal of N7.30trillion for 2017 before a joint session of the National Assembly.

The President said N2.24 trillion, representing 30.7 per c

2017 Budget: Experts laud FG on new exchange rate benchmark